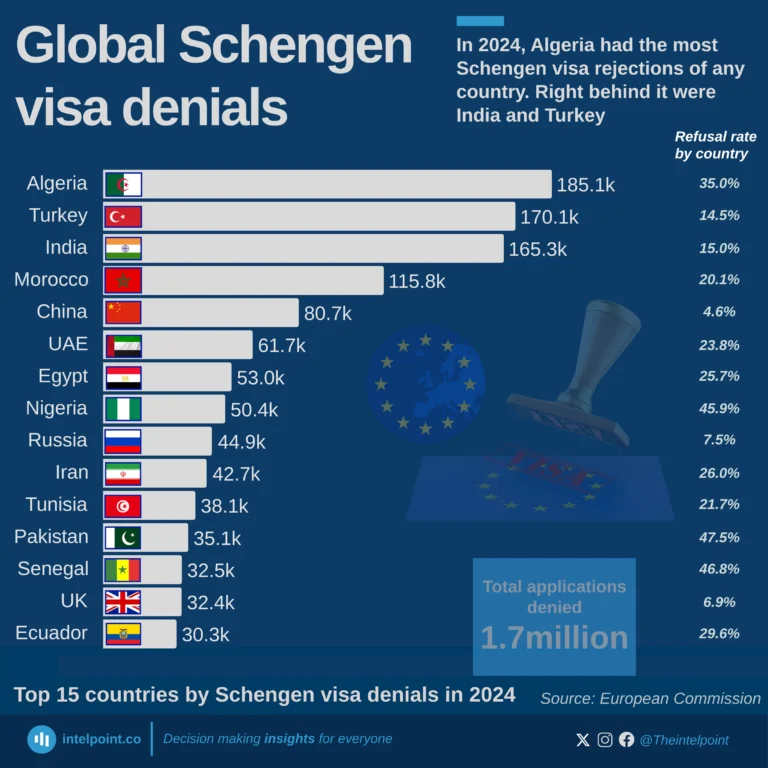

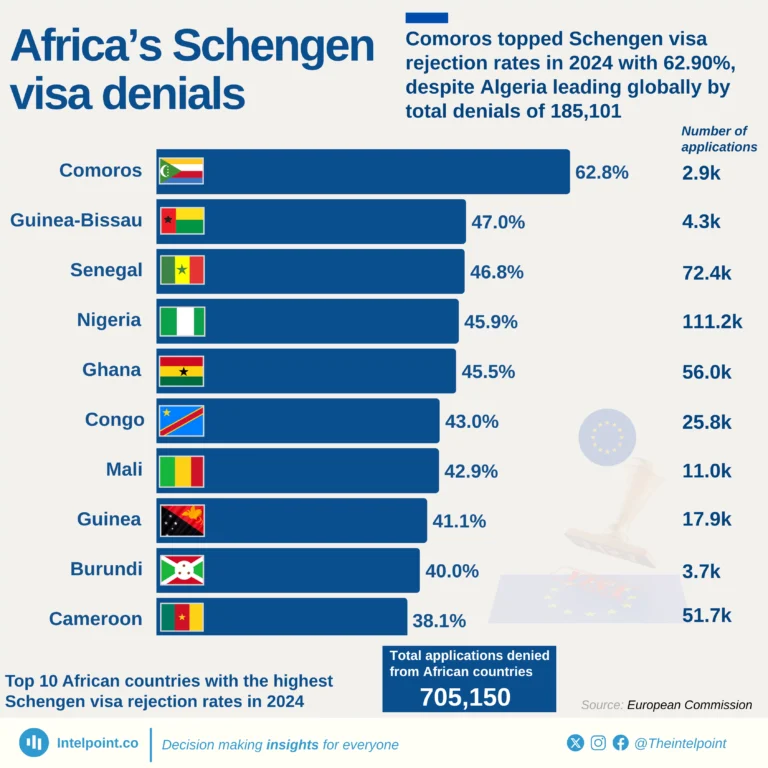

Comoros leads with a striking 62.8% rejection rate, the highest not just among African consulates, but also the global consulate countries

Guinea-Bissau, Senegal, and Nigeria follow with rejection shares between 45% and 47%.

Despite having one of the highest total visa rejections globally, Algeria does not appear in this chart, as its rejection share is comparatively lower.

Countries with smaller applicant pools tend to have higher rejection rates, shedding light on access disparities and approval scrutiny in consulate processes.