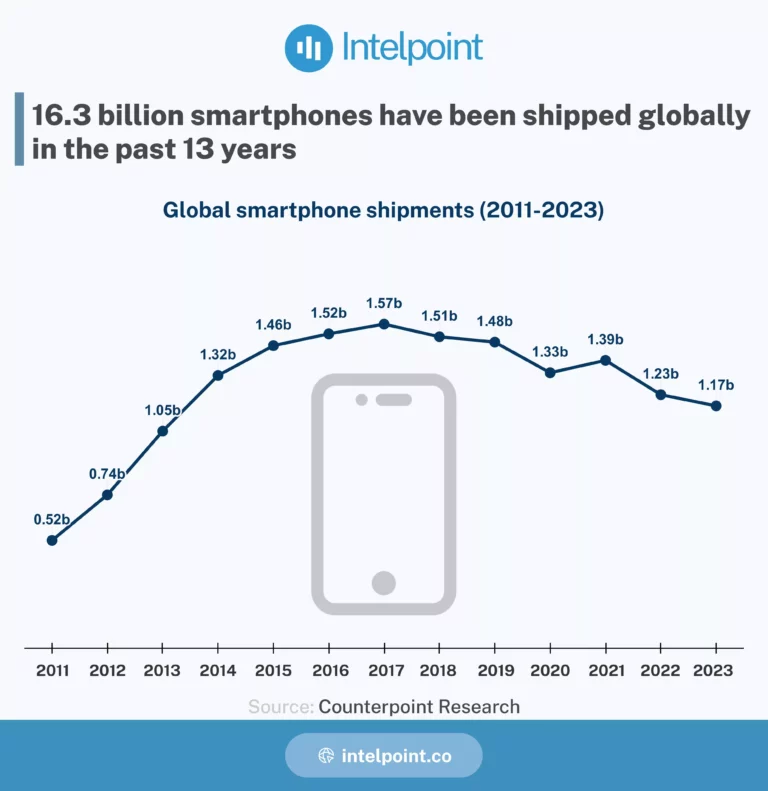

In 1994, the IBM Simon Personal Communicator, paved the way for a digital revolution. Fast forward to 2017, when smartphone shipments peaked at 1.57 billion units. However, the subsequent six-year period witnessed a 25% decline in shipments.

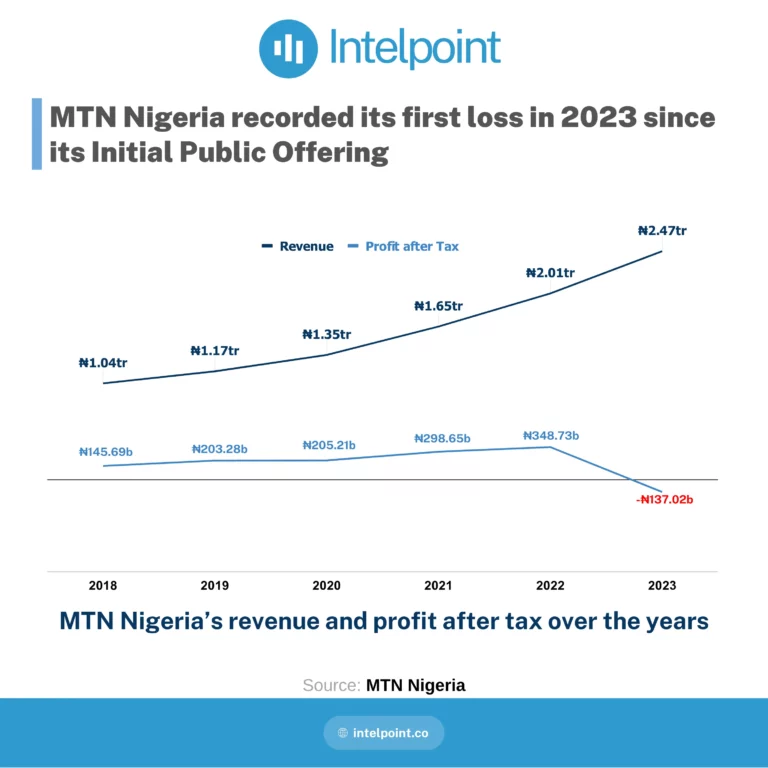

MTN Nigeria recorded its first loss in 2023 because of a loss of forex. The naira recorded a massive loss to the US dollar in the second half of 2023, with a 95% drop. The company's revenue jumped from ₦1.04 trillion in 2018 to ₦2.47 trillion. While its profit after tax grew alongside the revenue from 2018 to 2022, it dropped from ₦349b to a ₦137b loss in 2023.

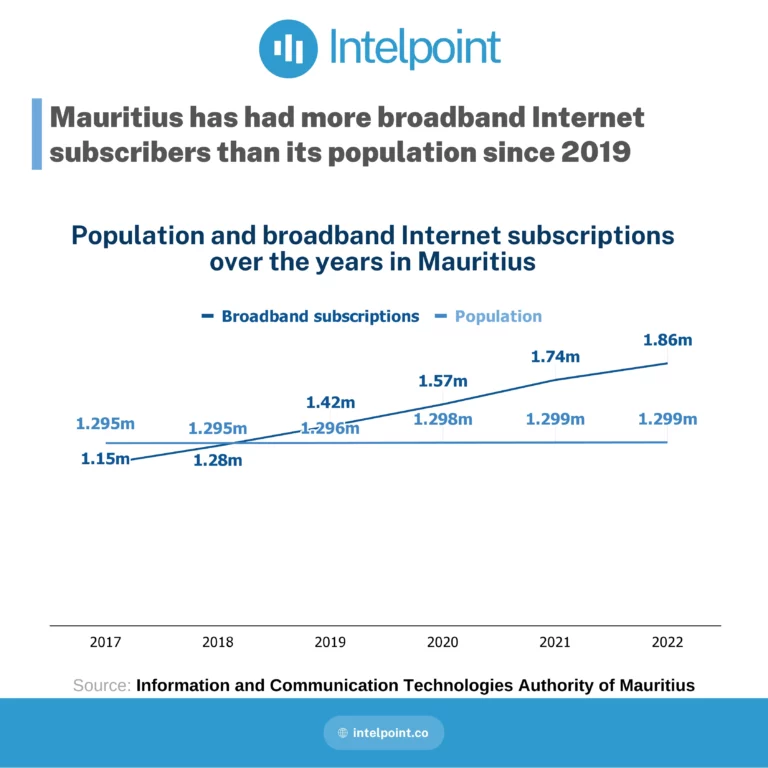

In addition to having one of the lowest populations on the continent, Mauritius boasts the greatest broadband penetration rate — 147.39% as of 2022 — of any country in Africa. The eastern African nation's broadband Internet subscribers surpassed its population in 2019.

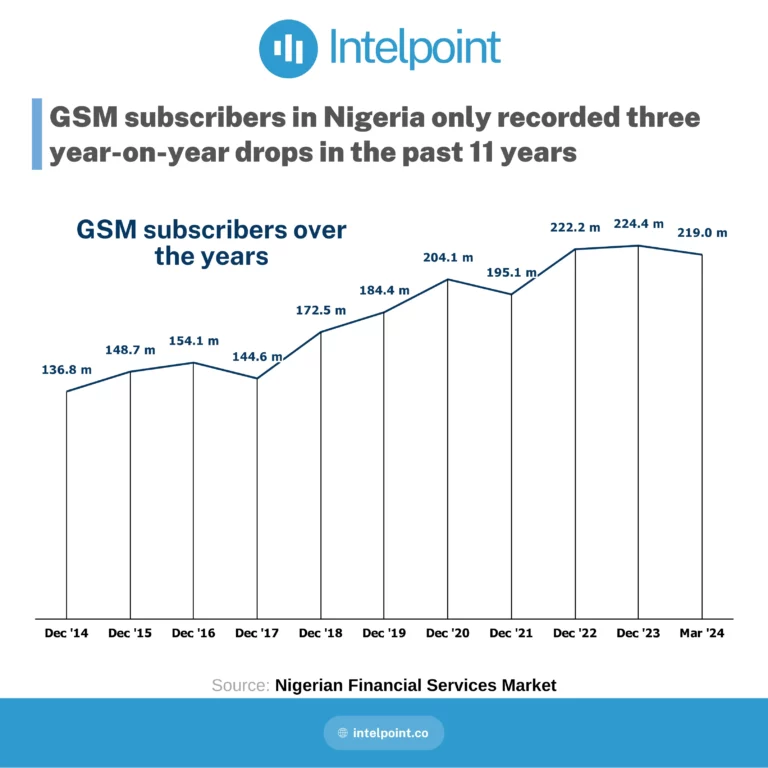

As of March 2024, there were 219m subscribers in Nigeria's GSM market which is dominated by three players each with over 20% market share. More than 40 mobile virtual network operators (MVNOs) have been licensed to date, all of whom will rely on the infrastructure of the country's four mobile network operators to offer their services.

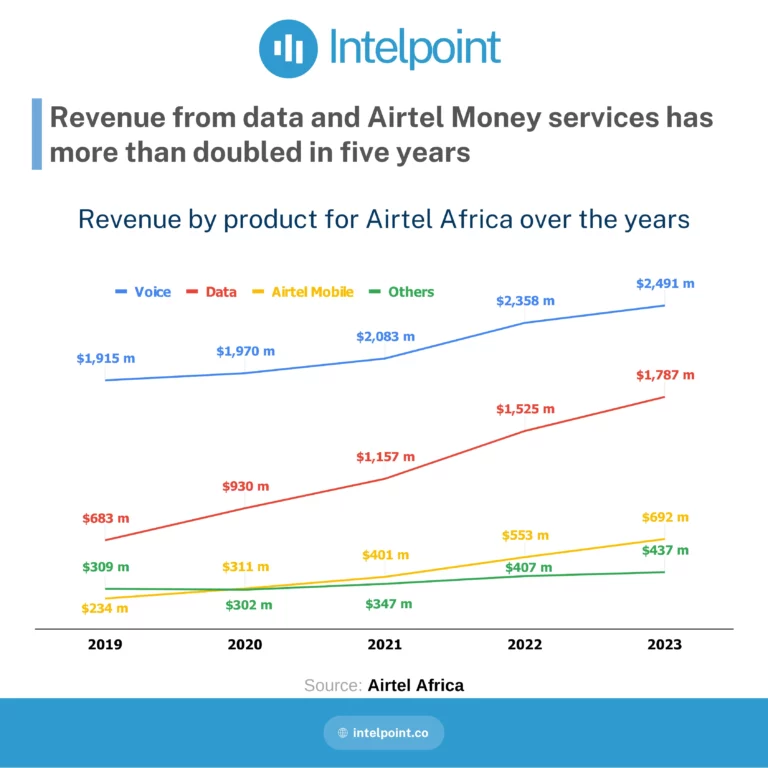

Voice is still king for Airtel Africa, accounting for the largest share of its revenue between 2019 and 2023. However, the revenue from data and Airtel Money, its mobile money services have more than doubled within this period. Revenue from voice and others didn't record a sharp increase unlike data and Airtel Money.

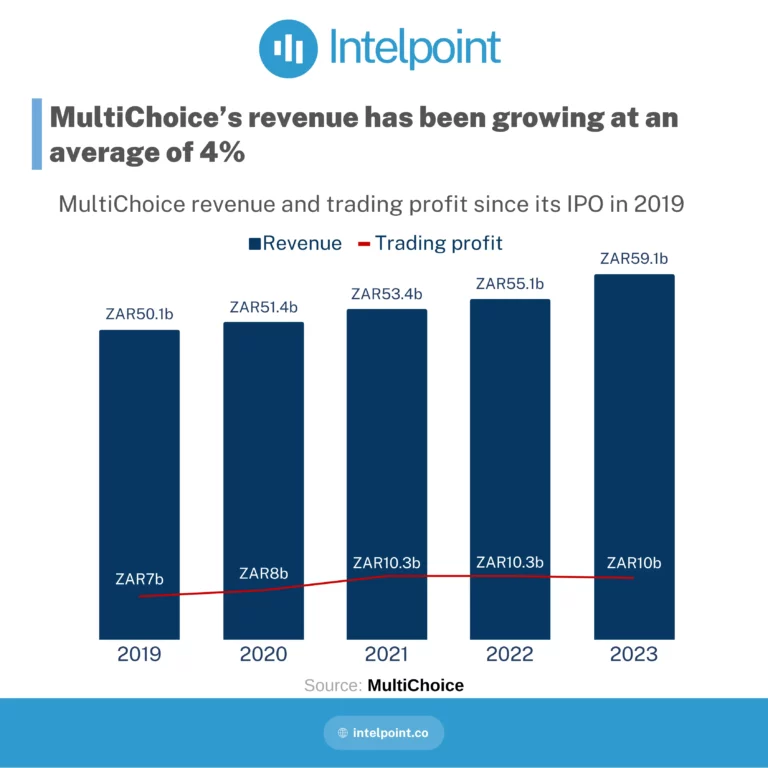

MultiChoice, owners of DStv and Showmax, among others, has been in acquisition talks with Canal+. Canal+ bought a 6.5% stake in the South African media giant four years ago, which, as of April 2024, had been increased to 40.01%. A look at MultiChoice's revenue over the years shows that it's increasing at an average rate of 4%.

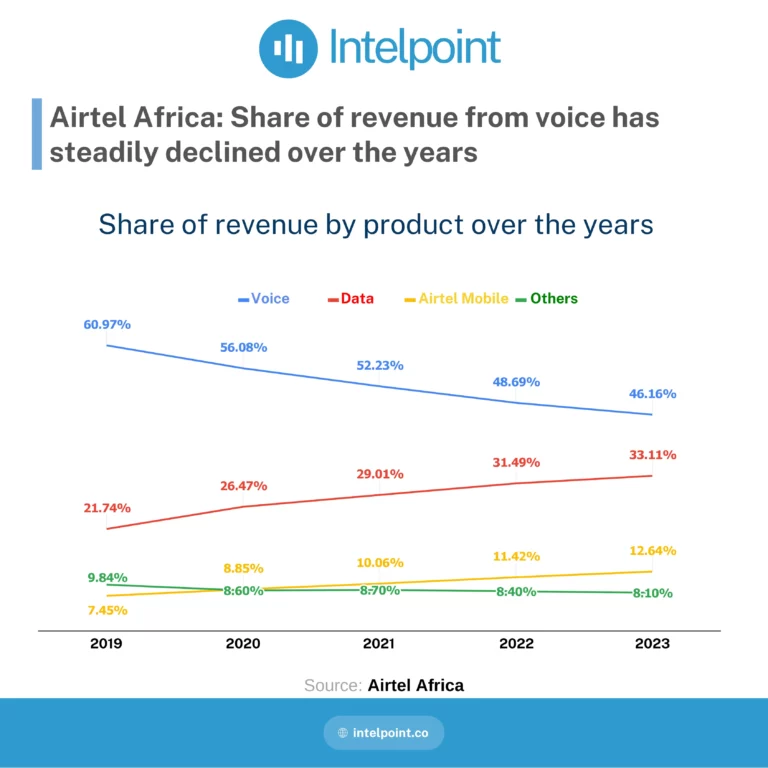

Revenue from voice is still the largest contributor to Airtel Africa's revenue between 2019 and 2023 however its share of the revenue has been on a steady decline. Voice went from accounting for 60.97% of the total revenue in 2018, to 46.16% in 2023. The share of revenue from data and Airtel Mobile have been on a steady rise since 2020.

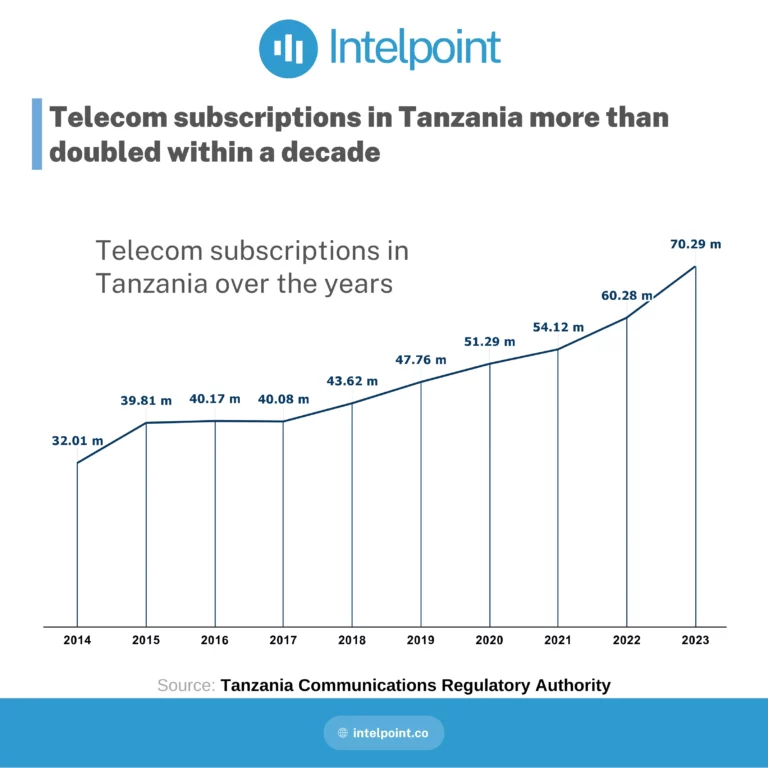

Just like Nigeria, Tanzania has more mobile subscriptions than its population. As of December 2023, Nigeria had a teledensity of 103.66%. With a population of 67.4 million as of 2023, the East African country had 70.3m telecom subscriptions, up from 32 million in 2014.

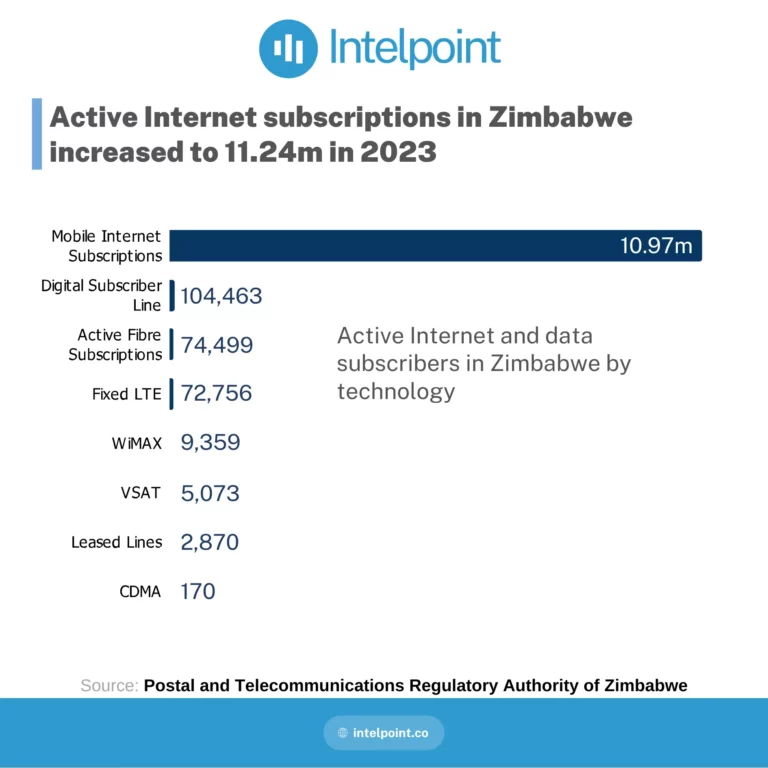

In January 2024, the communications authority in Zimbabwe warned against using Starlink Internet Services. The Southern African country has less than 100k subscribers on Fibre and Fixed LTE each. At the same time, a significant portion of its citizens rely on mobile Internet, with 10.97 million subscriptions as of 2023 in a country with 16.67 million people.