South Africa is rising on the global stage, showcasing its growing influence as it secures its spot as the only African country among the world's top 23 superpowers.

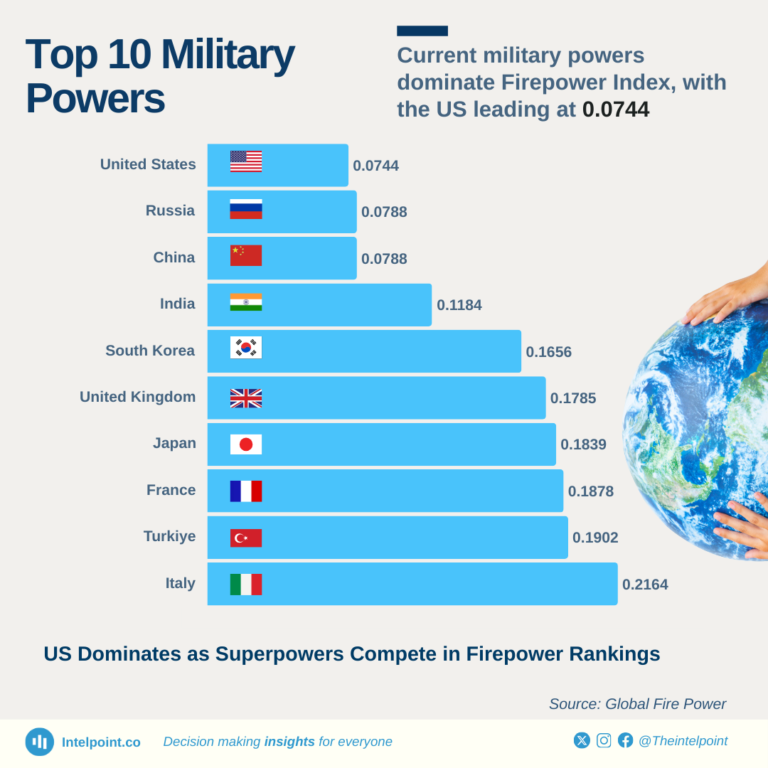

The United States leads with a strength index of 0.89, followed closely by China at 0.80. While traditional powers like Germany and Japan hold their ground, South Africa proudly stands among the top 23 superpowers with a strength index of 0.1. This is the only African country that made the top 23, coming 22nd on the list.

The ranking is based on analysis from Ray Dalio's Great Powers Index 2024. Dalio assessed each nation's strength based on a wide range of metrics, including education, innovation and technology, cost competitiveness, economic output, and military strength.

Note: The Eurozone, ranked third on the list, was removed as it cannot be considered a single country.