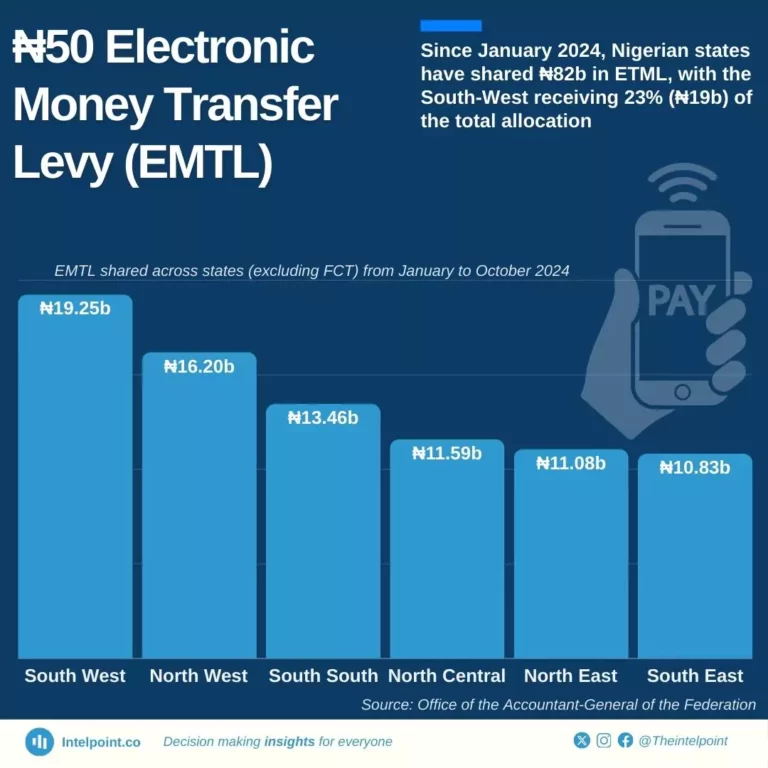

On December 1, 2024, fintech companies including OPay, PalmPay, and Moniepoint announced plans to begin implementing the Electronic Money Transfer Levy (EMTL), a ₦50 charge applied to electronic transfers of ₦10,000 and above. The announcement sparked widespread reactions from Nigerians who expressed concerns about the rising cost of living.

Since January 2024, however, Nigerian states (excluding FCT) have shared ₦82b in EMTL revenue. The South West received the highest allocation of ₦19b, while the South East received the lowest, at ₦11b.

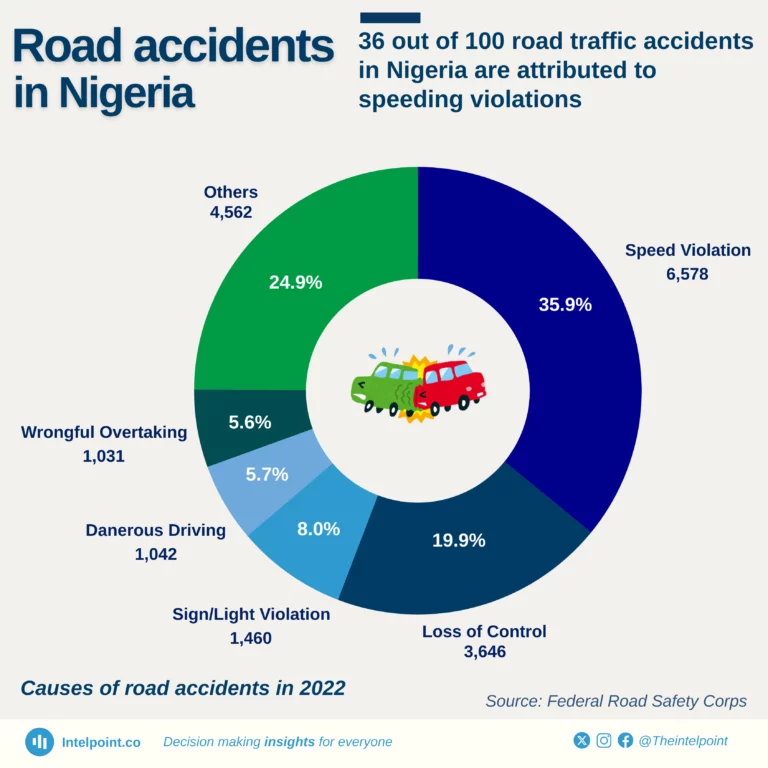

In 2022, approximately 36% of road accidents in Nigeria were caused by speeding violations, accounting for 6,578 cases. This reveals the need for drivers to prioritise safety over the rush to reach their destinations. Loss of control closely follows as another significant cause, contributing to 19.9% of accidents.

While speeding dominates, other seemingly smaller actions like wrongful overtaking (5.6%), dangerous driving (5.7%), and sign/light violations (8.0%) still add up to the dangers.

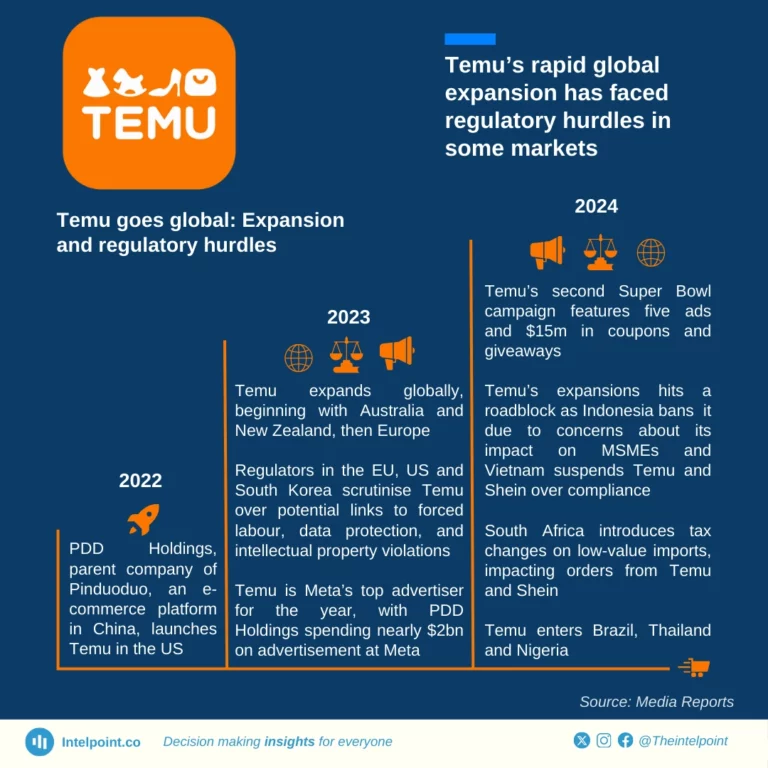

Temu has embarked on an extraordinary global expansion, cementing its place as a leading e-commerce platform across multiple markets. From its launch in the US in 2022, Temu has quickly become one of the most downloaded shopping apps in the country.

However, Temu's rapid rise has not been without its challenges. Regulators in the EU, US, and South Korea have closely scrutinised the company, examining potential links to labour issues, data protection concerns, and intellectual property violations. Despite these hurdles, Temu has continued to forge ahead, becoming Meta's top advertiser for the year and making a splash with its second Super Bowl campaign in 2024.

As Temu expands into new regions, the company must navigate an evolving regulatory landscape to maintain its momentum and solidify its position as a global e-commerce powerhouse.

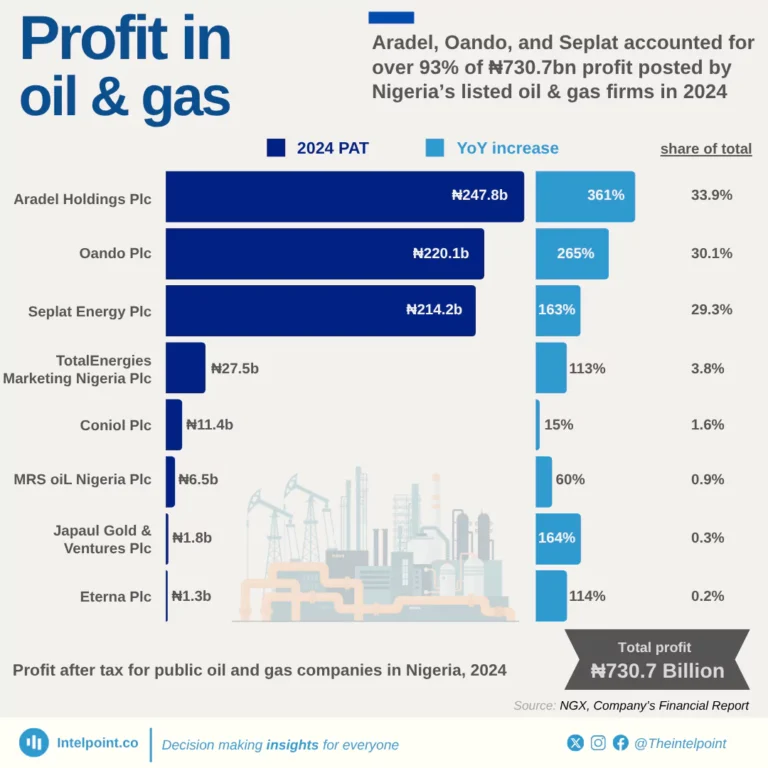

Nigeria's export value increased by 16.8% quarter-on-quarter to ₦20.49 trillion in Q3 2024. Petroleum products (oils, liquefied natural gas, and other petroleum gases) made up 85.52% of its exports, valued at ₦17.53 trillion.

This figure highlights Nigeria's heavy reliance on the oil and gas sector for revenue, emphasising the need for diversification to reduce dependence on a single industry.

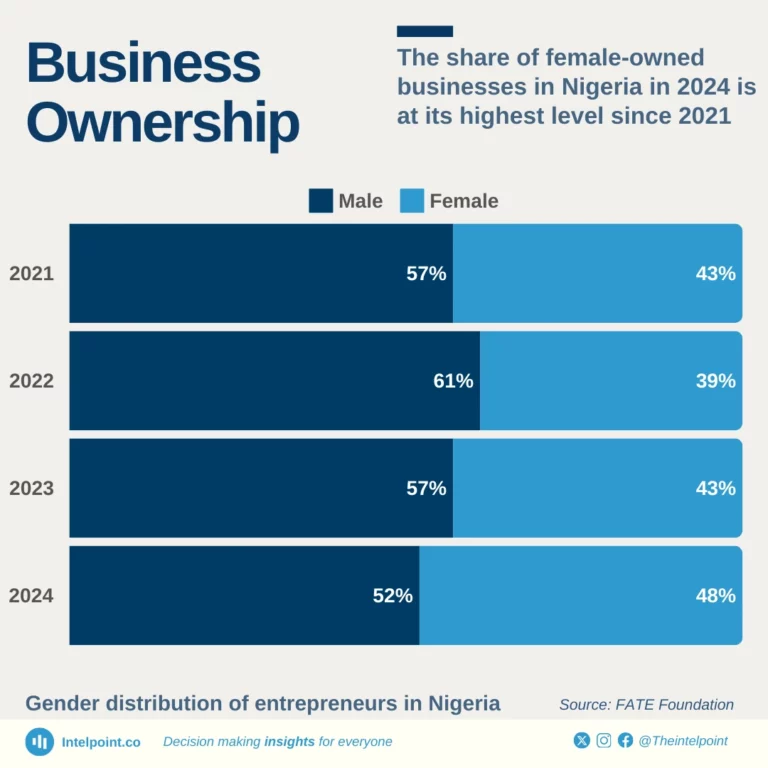

According to the latest State of Entrepreneurship Report by the FATE Foundation, the share of female-owned businesses in Nigeria in 2024 is 12% higher than in 2021. At 48%, the number of female-owned businesses is nearly equal to that of male-owned businesses.

The report highlights the disparity between male and female-owned businesses across state lines. Bauchi is the only state with over 80% female-owned businesses, while Borno, Kebbi, and Zamfara have over 80% male-owned businesses. Edo State has an equal share of both.

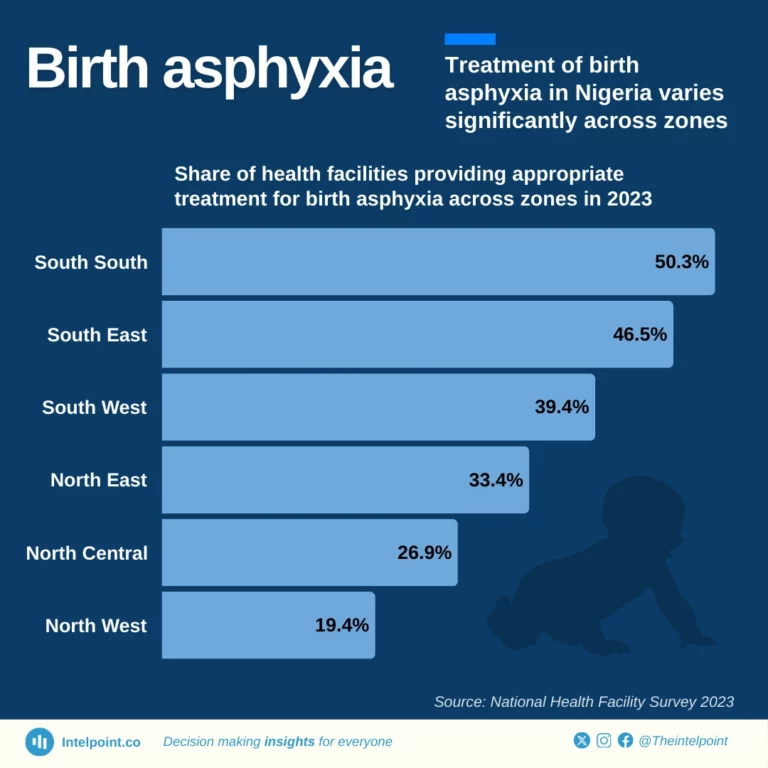

Birth asphyxia is a condition where a baby does not receive sufficient oxygen before, during, and after birth. It is a leading cause of early neonatal mortality and was selected as an indicator in the assessment of the management of maternal and neonatal complications in Nigeria.

The percentage of health facilities surveyed that provide appropriate treatment for birth asphyxia varies from as low as 19.4% in the North West to as high as 50.3% in the South-South. With no zone exceeding 50%, significant gaps remain in reducing infant mortality in Nigeria.

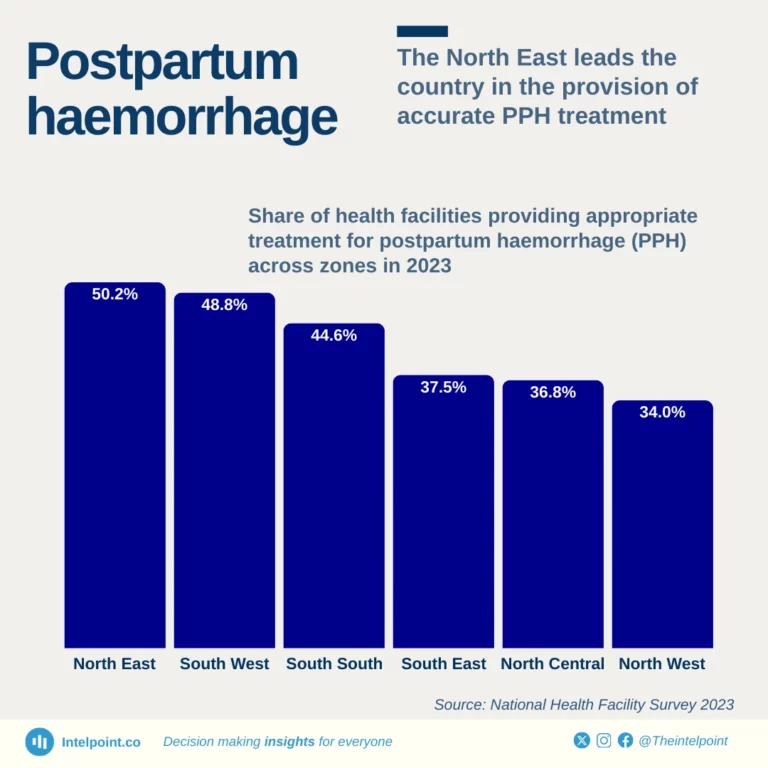

Management of maternal and neonatal health complications is crucial to reducing maternal and infant mortality rates in Nigeria. In a newly released National Health Facility Report 2023 by the Ministry of Health and Social Welfare, competence in managing postpartum haemorrhage (PPH) varies across zones and states.

PPH is a situation where a woman experiences heavy bleeding after giving birth and is the leading cause of maternal mortality. Across the health facilities surveyed, the North East has the highest percentage of facilities providing appropriate treatment for PPH at 50.2%, which reflects the generally low provision of the needed care for PPH across the country.

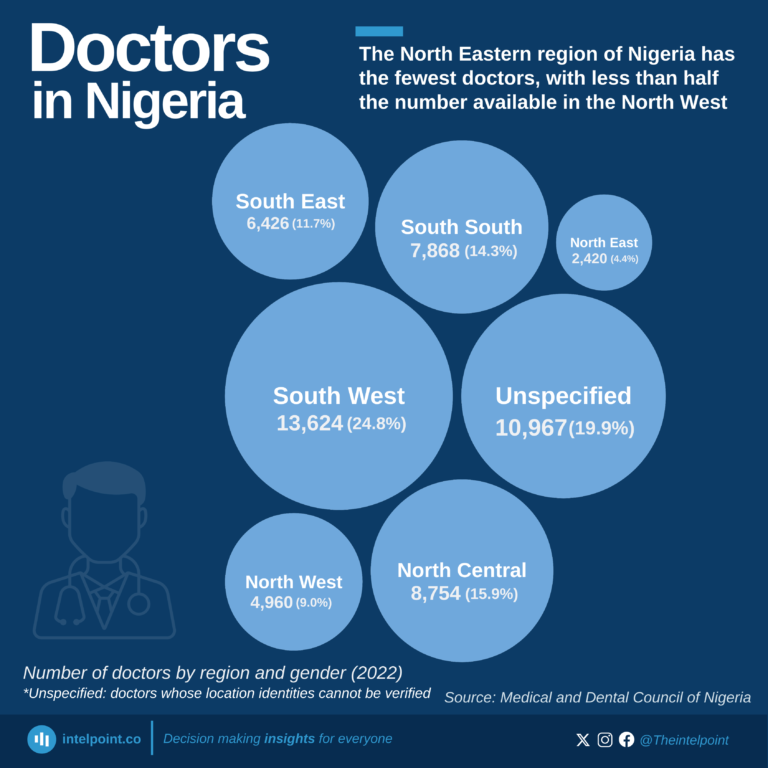

The distribution of doctors across Nigeria shows disparities, with regional inequities in healthcare professionals. The North East, with only 2,420 doctors, has the lowest number of doctors among all geopolitical zones. This is less than half of the North West's total and significantly lags behind the South West, which leads with 13,624 doctors. The gender gap is also evident, as there are more male doctors across all regions.

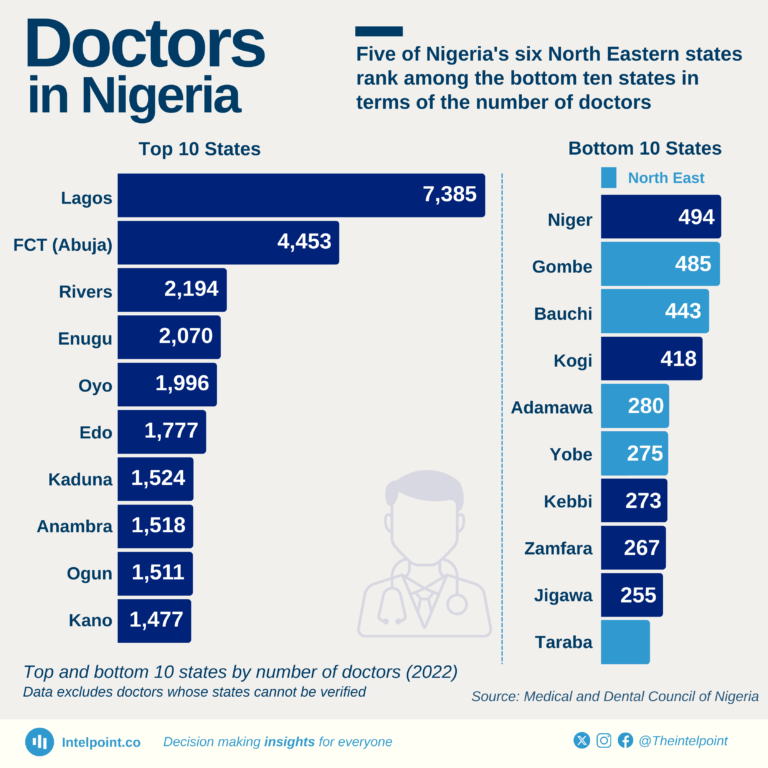

Lagos State stands out with 7,385 doctors, far surpassing the next in line, the Federal Capital Territory (FCT) Abuja. Meanwhile, five of the six states in the North East rank among the bottom ten states.

N.B. Unspecified bar represents doctors with unverifiable location identities.

The distribution of doctors across Nigeria shows disparities, with regional inequities in healthcare professionals. The North East, with only 2,420 doctors, has the lowest number of doctors among all geopolitical zones. This is less than half of the North West's total and significantly lags behind the South West, which leads with 13,624 doctors. The gender gap is also evident, as there are more male doctors across all regions.

Lagos State stands out with 7,385 doctors, far surpassing the next in line, the Federal Capital Territory (FCT) Abuja. Meanwhile, five of the six states in the North East rank among the bottom ten states.

N.B. Unspecified bar represents doctors with unverifiable location identities.