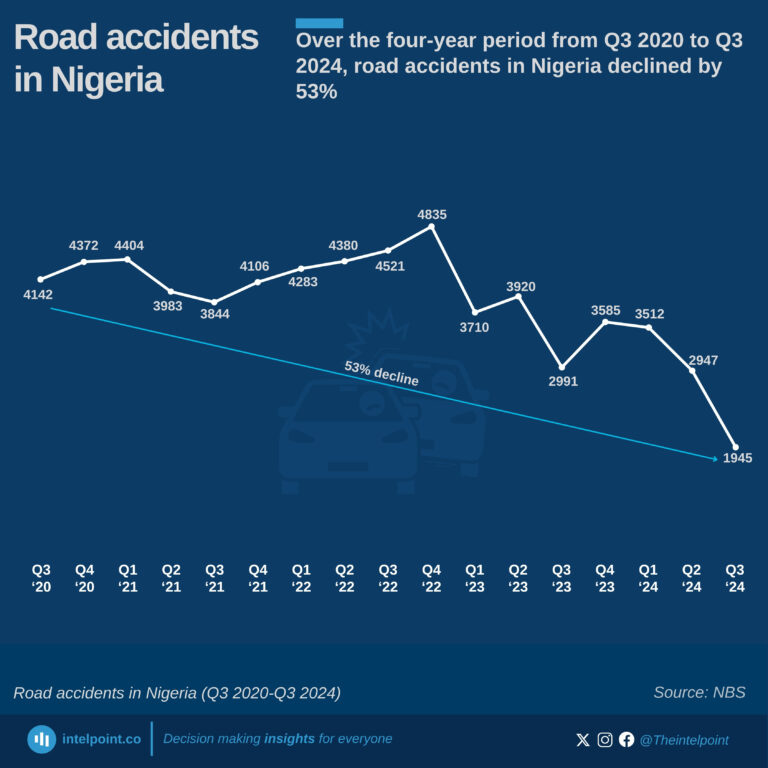

FCT, Ogun, and Nasarawa consistently rank as the top three states with the highest number of road accidents.

The FCT recorded its peak accident figures in 2022, particularly in Q2 (842 cases) and Q4 (864 cases).

In Q2 and Q3 of 2024, Ogun State surpassed the FCT in the number of reported accidents.

Across these three states, there has been a notable decline in accident numbers, with an average decrease of approximately 37.6% between Q2 and Q3 2024.