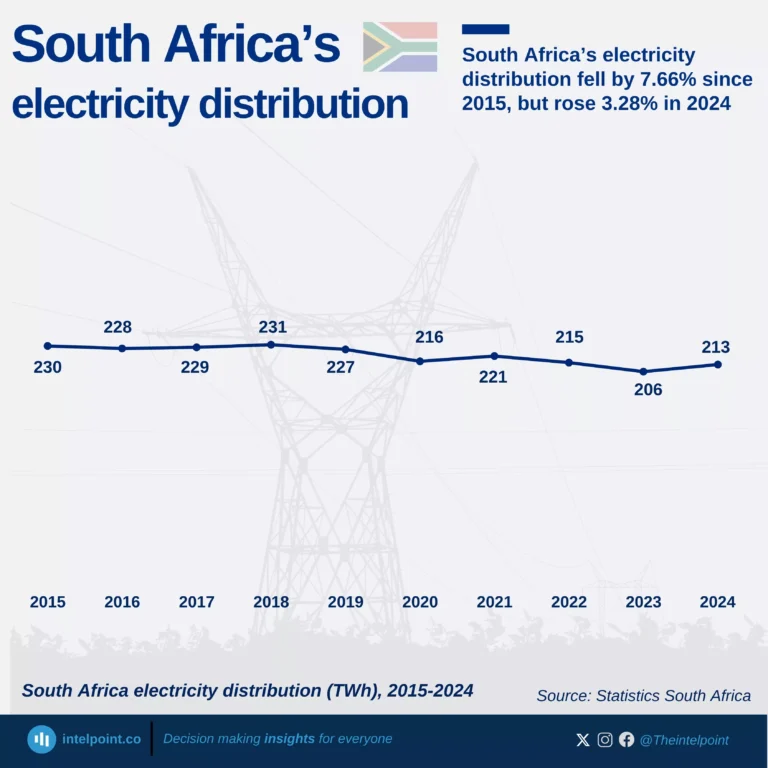

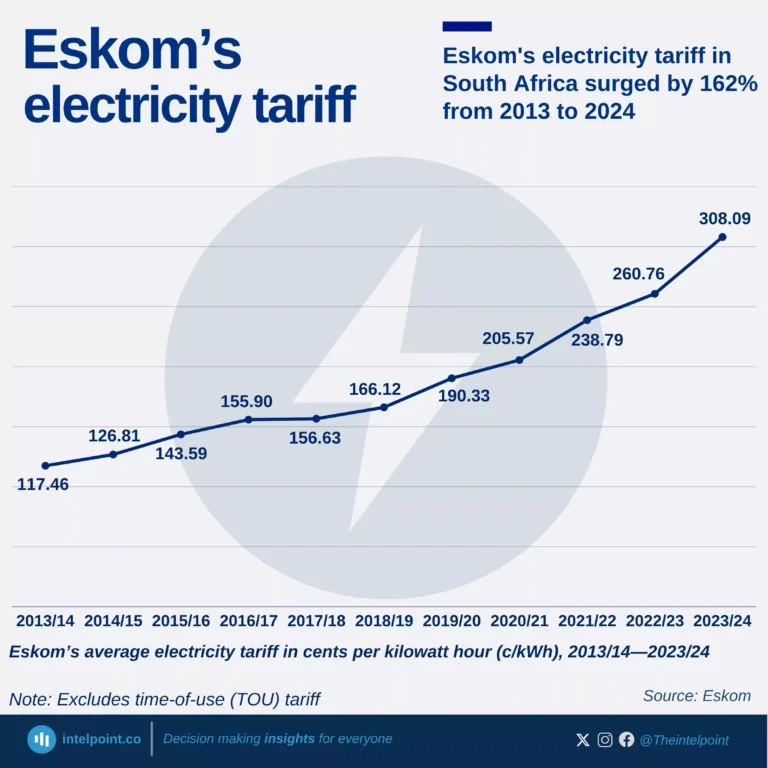

Electricity distribution in South Africa reached its peak in 2018, a record high of 231 TWh.

The lowest electricity distribution was recorded in 2023, dropping to 206 TWh.

Load shedding has become a persistent challenge, with 2023 experiencing the highest number of load shedding days — 332 days in total.

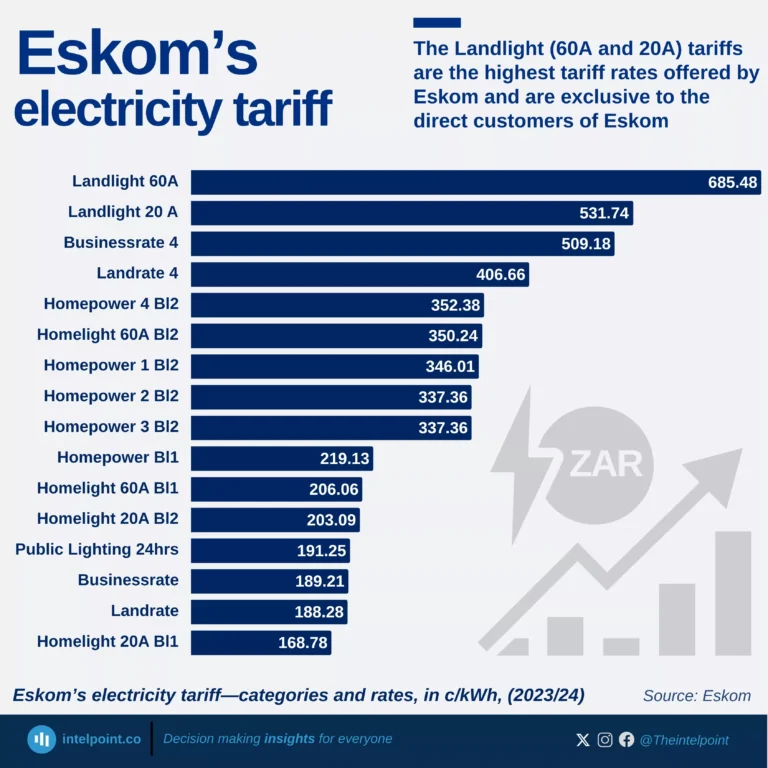

Eskom applies Time-of-Use (ToU) pricing, where tariffs vary by Time of day (peak, standard, off-peak periods) and Demand season (high-demand season: June to August and Low-demand season: September to May)