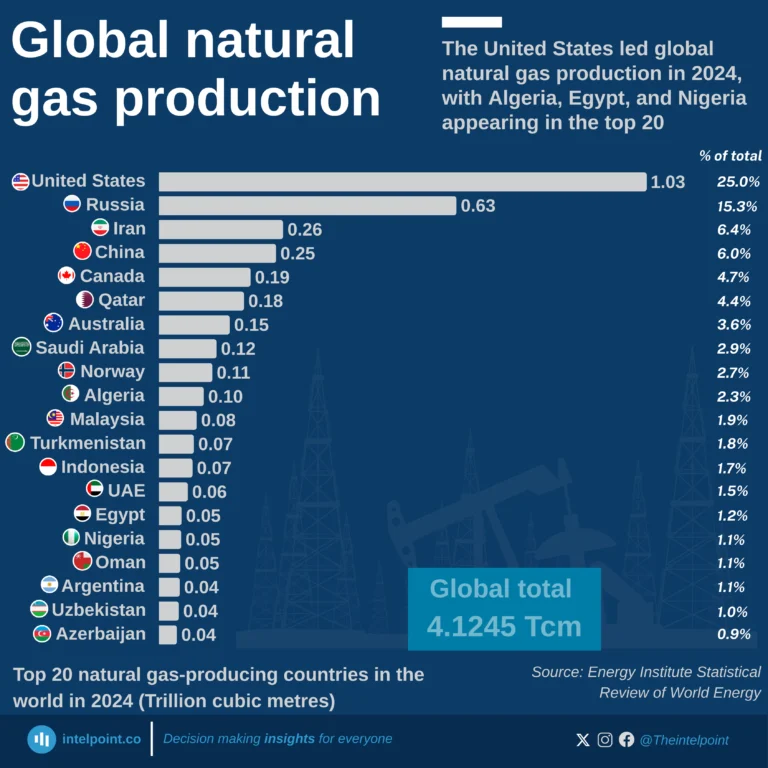

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.

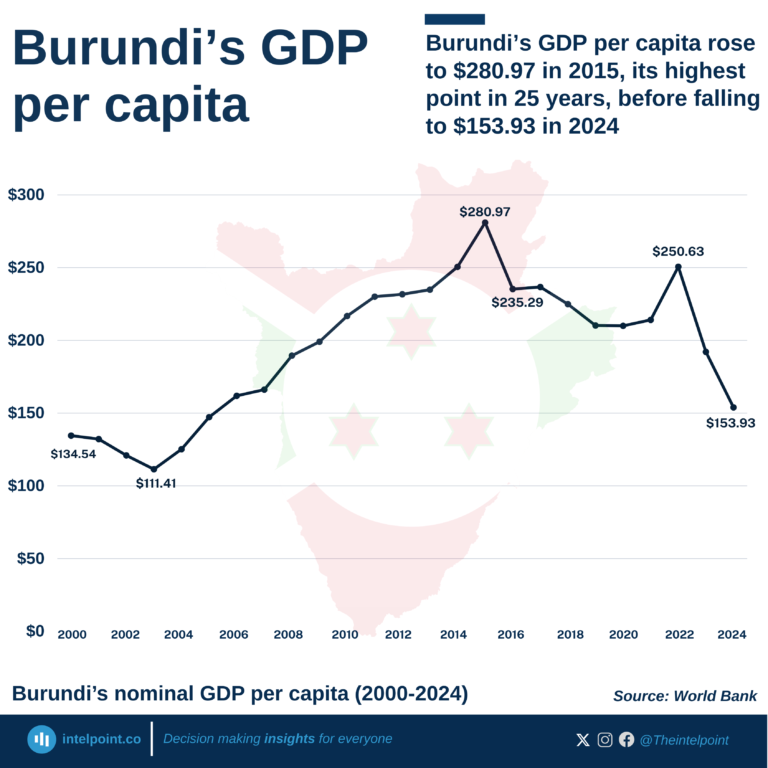

Burundi recorded its highest GDP per capita in 2015 ($280.97).

By 2024, GDP per capita dropped to $153.93, a decline of nearly 45% from its peak.

Burundi’s population exceeds 13 million (2024), which dilutes income per person even when overall GDP grows.

Structural challenges like limited industrialization, reliance on subsistence farming, and political instability contribute to stagnation.

Since 2015, Burundi has held the lowest GDP per capita in Africa—and at $153.9 in 2024, it is the poorest country in the world by GDP per capita.