Between 2000 and 2023, Africa received $182 billion in Chinese loans, primarily for energy and transportation development.

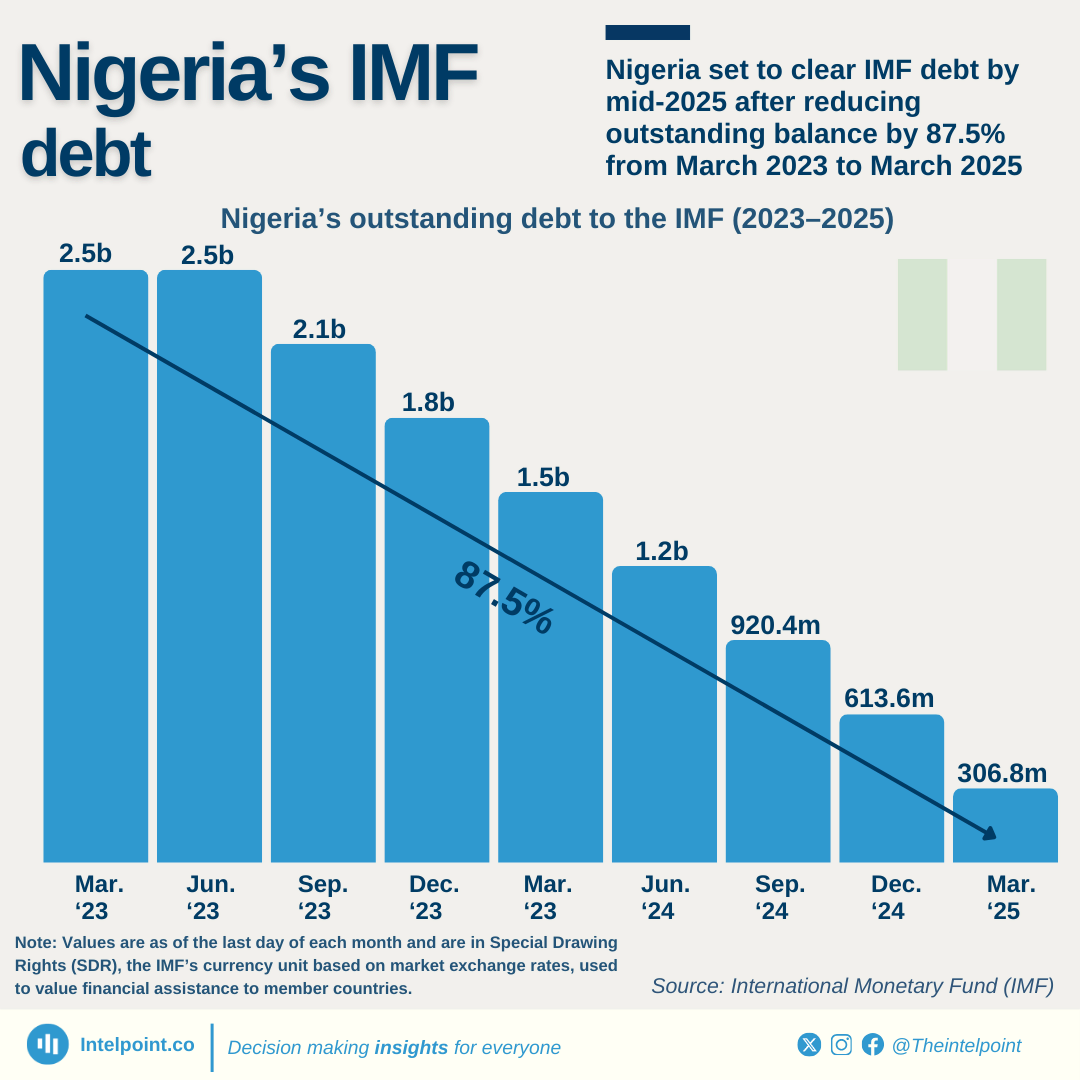

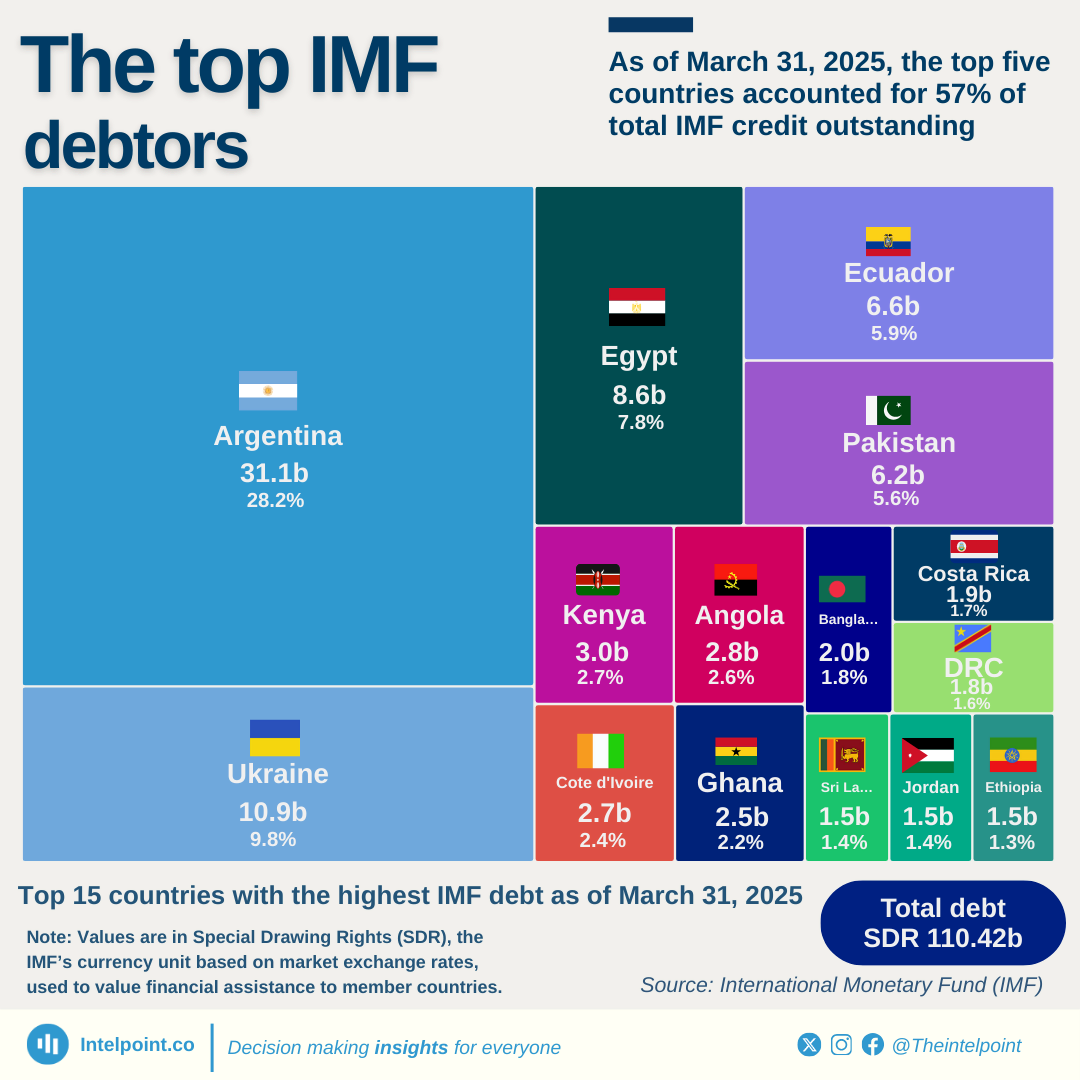

Angola, with 25%, was the largest recipient; Ethiopia, Egypt, Nigeria, and Kenya followed.

While 49 countries benefited, experts warn of increasing debt risks.