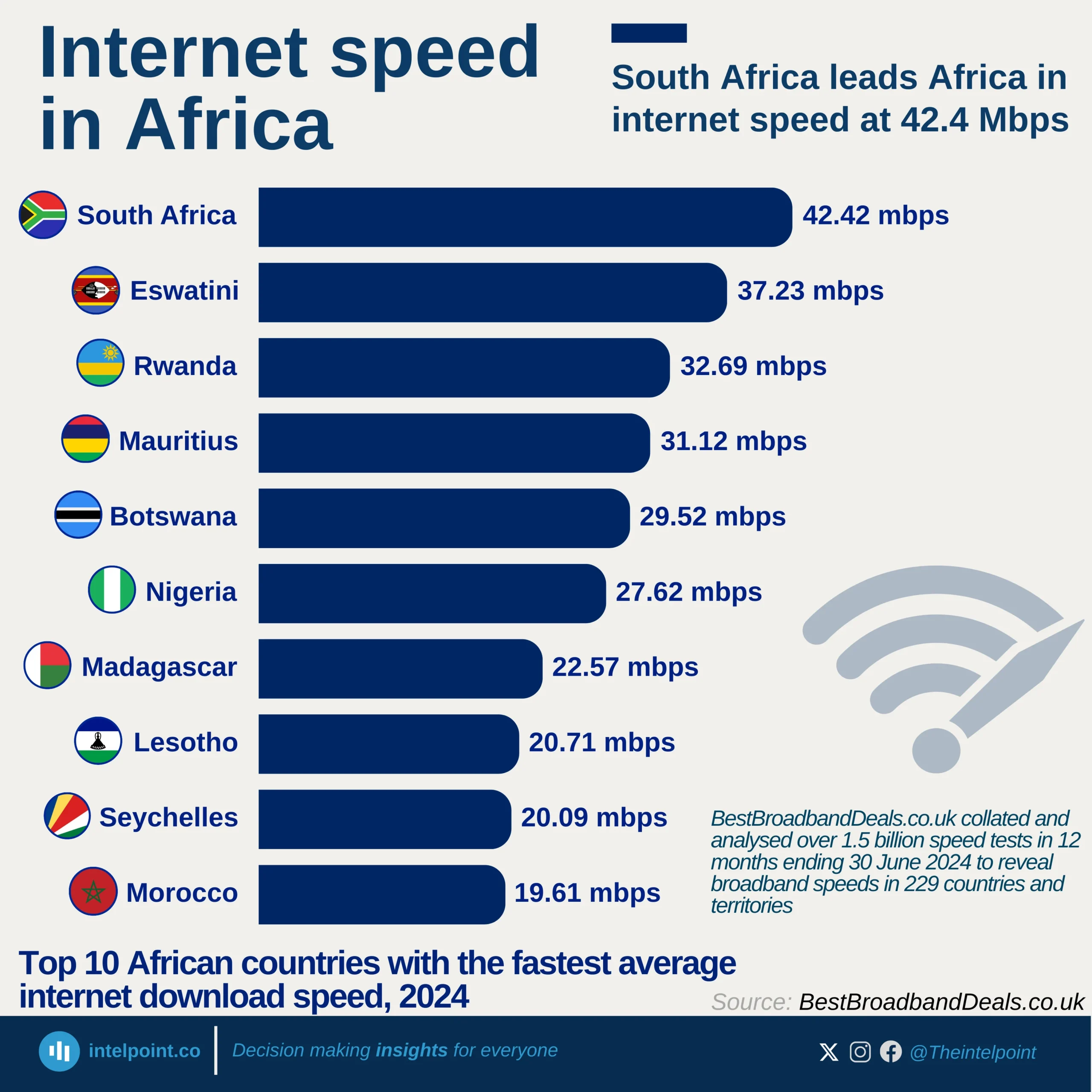

Across Africa, the cost of mobile data can vary sharply from one country to the next, even among those with the cheapest rates. At the very top of the list are Uganda and Mauritius, where 1GB of data costs just $0.02. Close behind are Comoros ($0.07), Ghana ($0.08), and South Africa ($0.10).

Nigeria, Africa’s largest economy and most populous country, also makes the top 10, with 1GB costing $0.13. Others on the list include Angola, Gambia, and Zambia, showing that affordable data spans both West and Southern Africa. The 20th spot—Madagascar—closes out the list with a still-low price of $0.30 per GB.

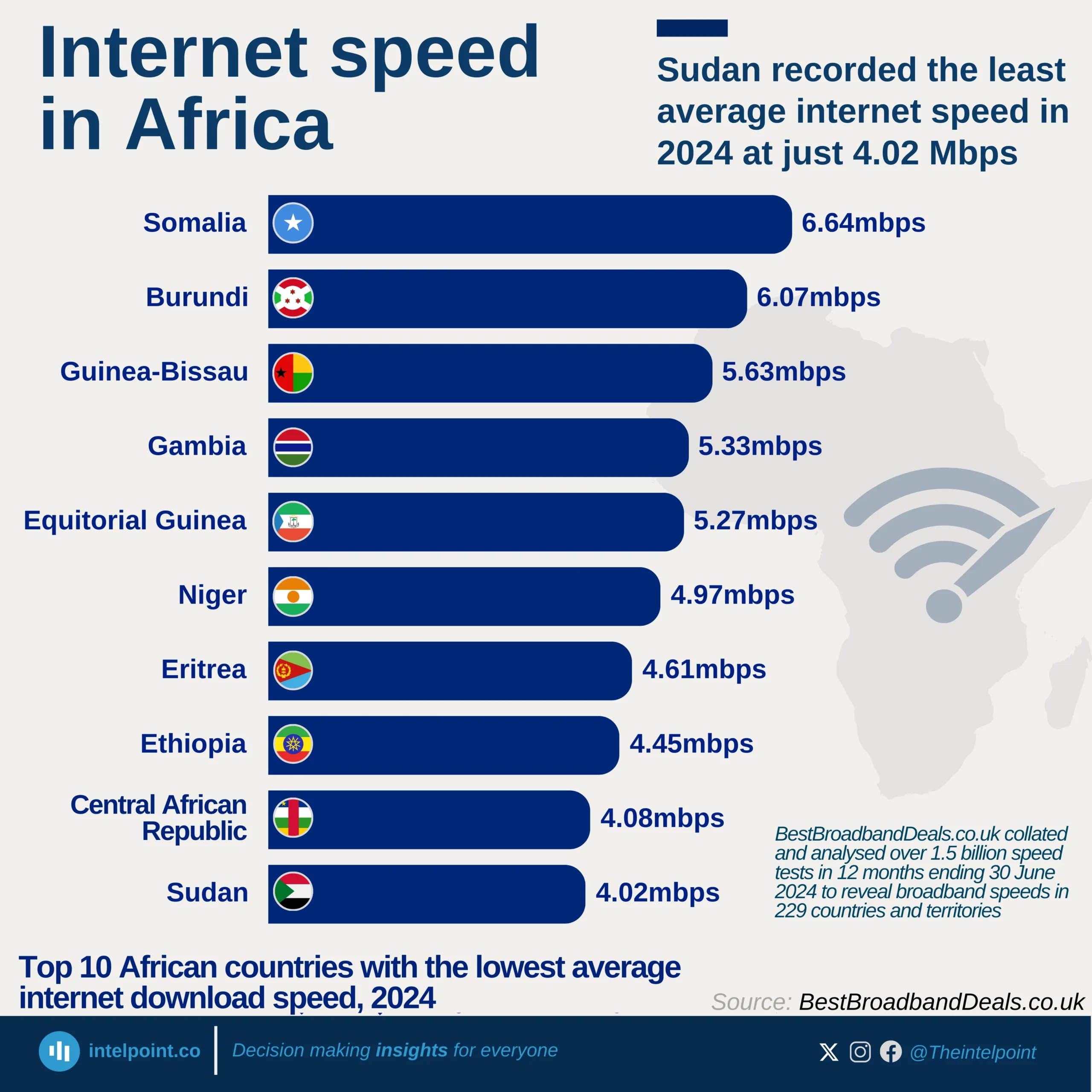

But even at these prices, the lived experience of affordability differs. In a country like Mauritius, where incomes are relatively higher and the cost of living is more stable, $0.02 may feel truly negligible. In Uganda or Comoros, that same $0.02 may carry more weight when stacked against food, transport, or housing costs.

While all 20 countries on this list boast low data prices, the real affordability of internet access still depends on local wages, living costs, and daily priorities.