The global data centre landscape is led overwhelmingly by the United States, which hosts over 3,700 data centres, more than eight times that of its nearest competitor, Germany. This sheer volume reflects America's dominant digital infrastructure and underscores its role as a global data powerhouse.

Meanwhile, countries like the U.K., China, and Canada also feature high on the list, highlighting their investment in scalable tech ecosystems. However, the top 10 is notably absent of any African country, pointing to a regional gap in large-scale digital infrastructure.

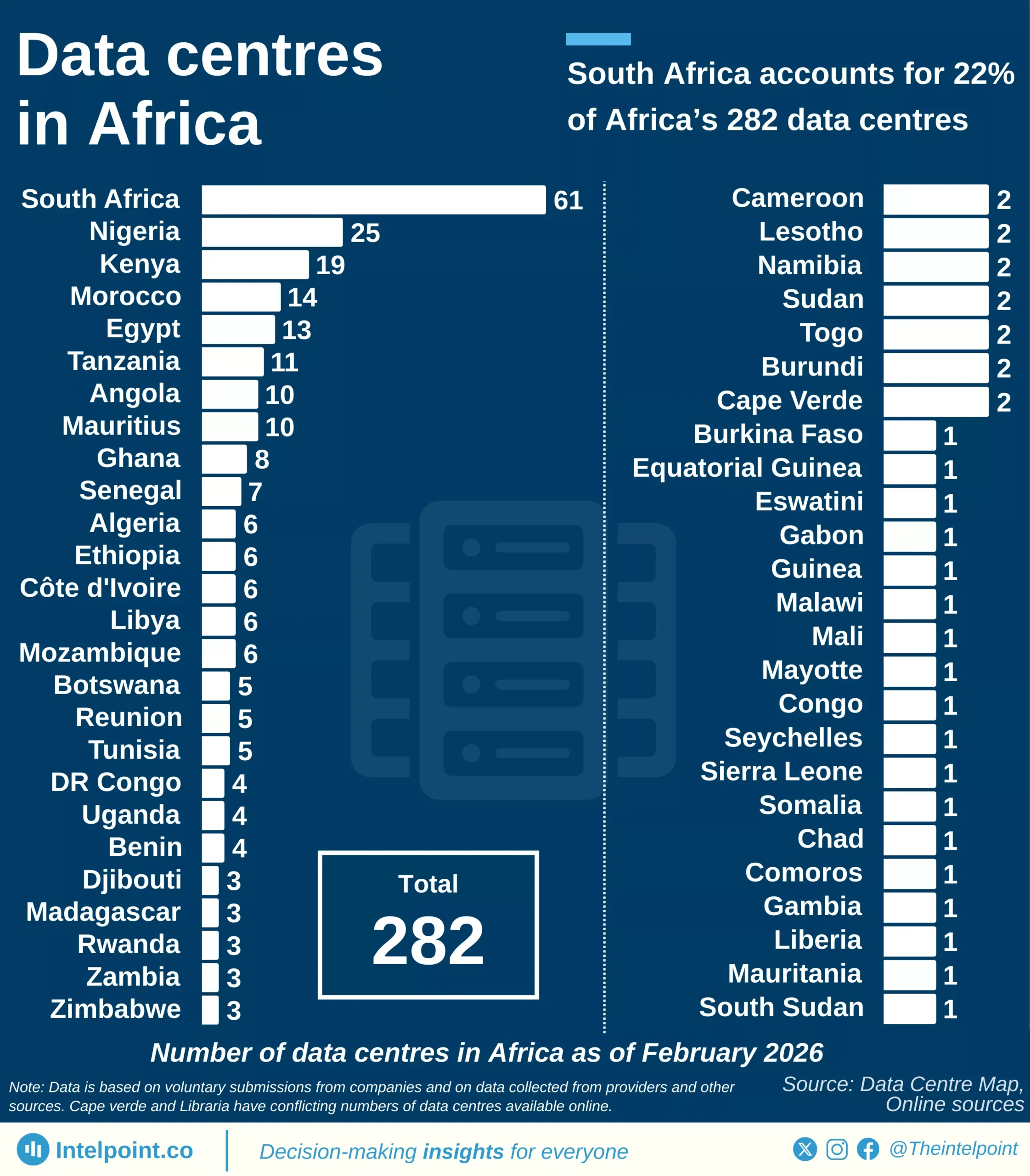

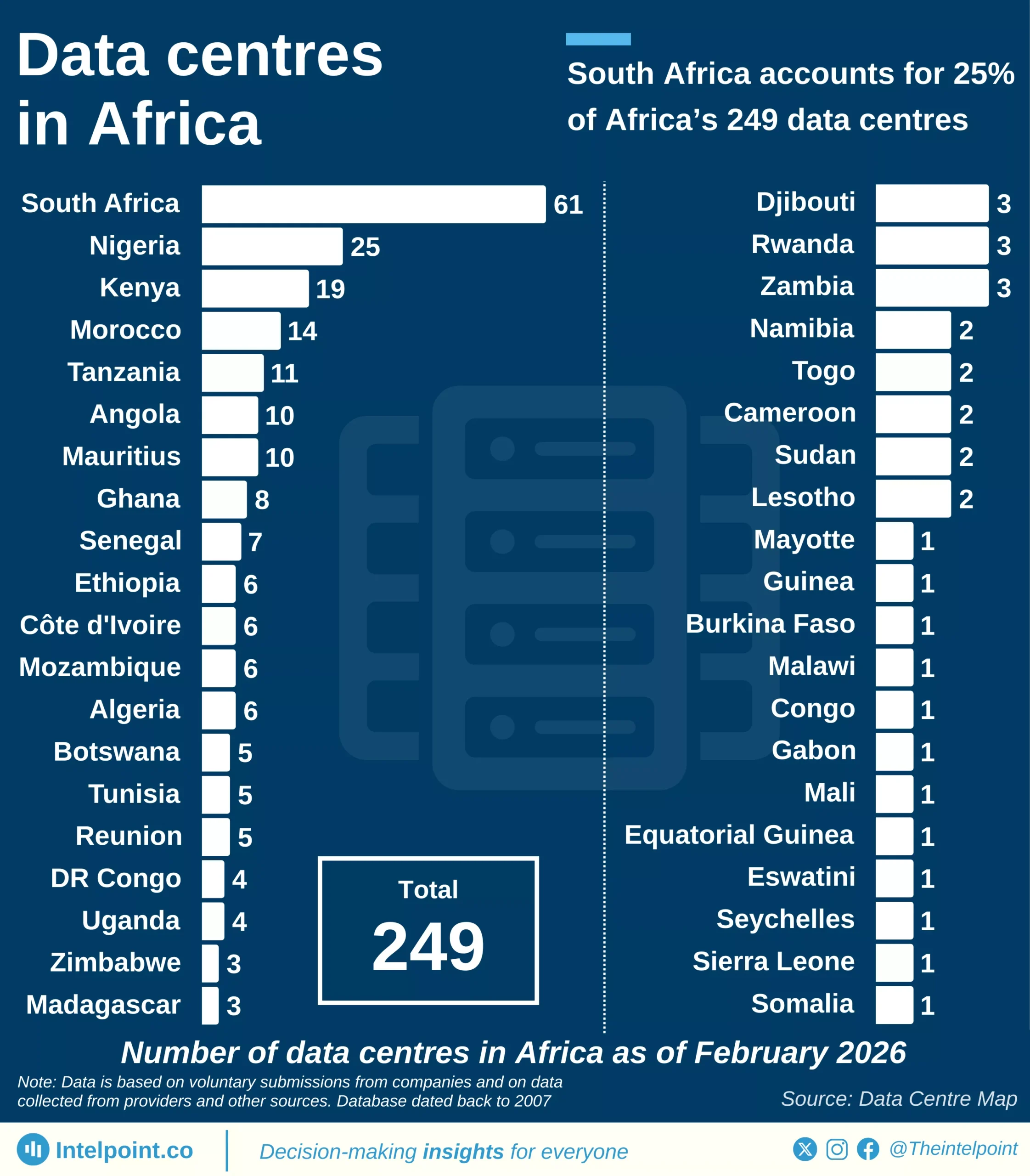

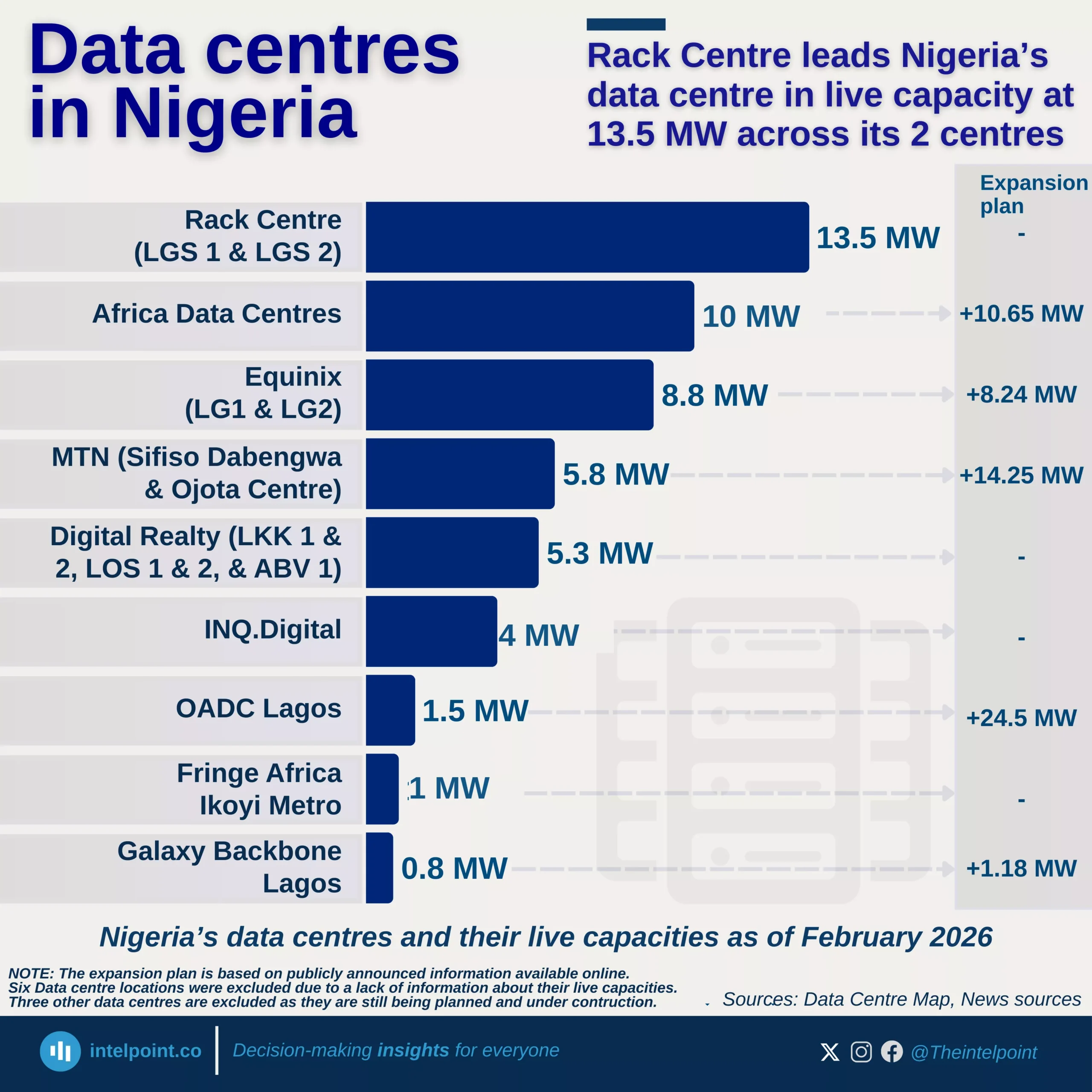

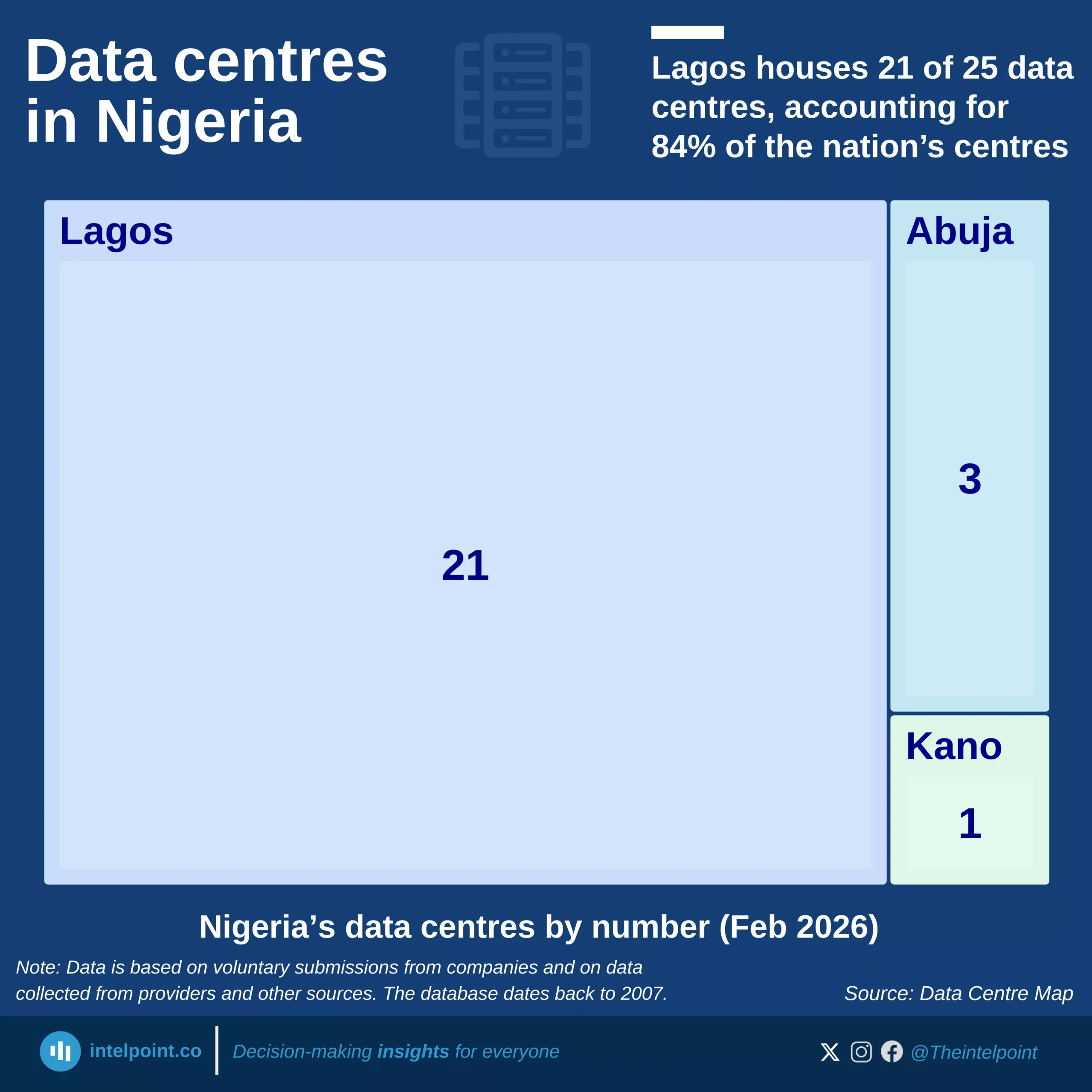

Still, Africa's footprint is beginning to emerge. South Africa, ranking 36th with 49 data centres, leads the continent, followed by Kenya (54th) and Nigeria (56th). While these figures are modest, they signal a growing digital awakening across the region, laying the groundwork for future growth in data and cloud services.