Key Takeaways:

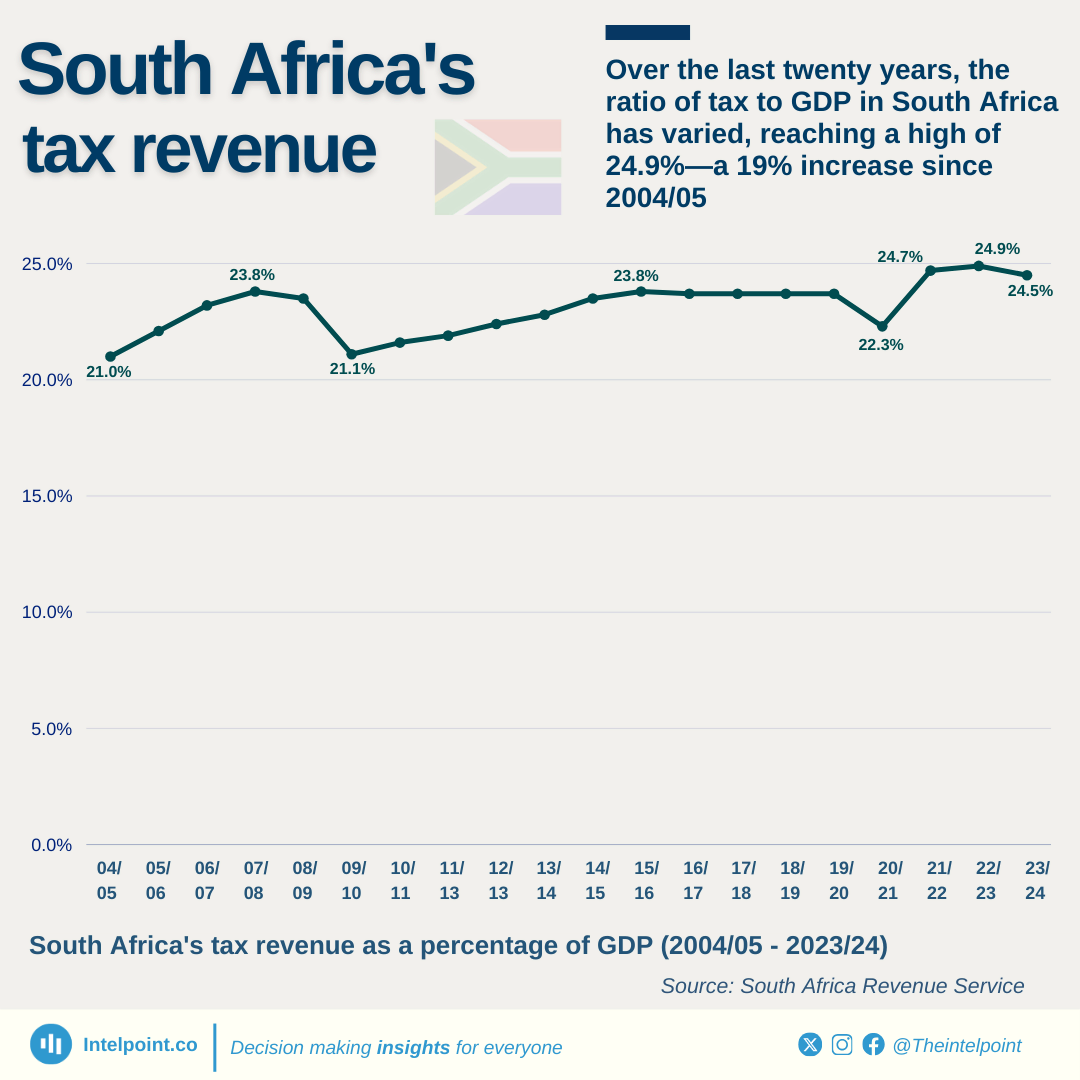

In the fiscal years spanning 2007/08 to 2023/24, the composition of South Africa's tax revenue has experienced notable shifts, mirroring broader economic transitions. Personal income tax (PIT) has established itself as the primary source of revenue, climbing from 29.46% in 2007/08 to 37.28% by 2023/24 and peaking at 38.92% in 2019/20. This trend reflects an increasing dependence on individual taxpayers.

In contrast, the Corporate Income Tax (CIT) witnessed a decrease from 24.46% in 2007/08 to 17.99% in 2023/24, including a significant reduction to 15.60% in 2019/20. This pattern aligns with analyses indicating a reduction in CIT contributions linked to factors like a contracting tax base and difficulties faced by key industries.

Meanwhile, VAT contributions remained relatively consistent throughout the examined years, oscillating between 25.58% and 26.27%. Other taxes displayed slight variances, averaging around 19% of the overall tax revenue.

In conclusion, the increasing significance of personal income tax points to a growing burden on individual taxpayers, while the gradual decline in CIT may suggest attempts to foster a more favourable business climate or reflect wider economic challenges.