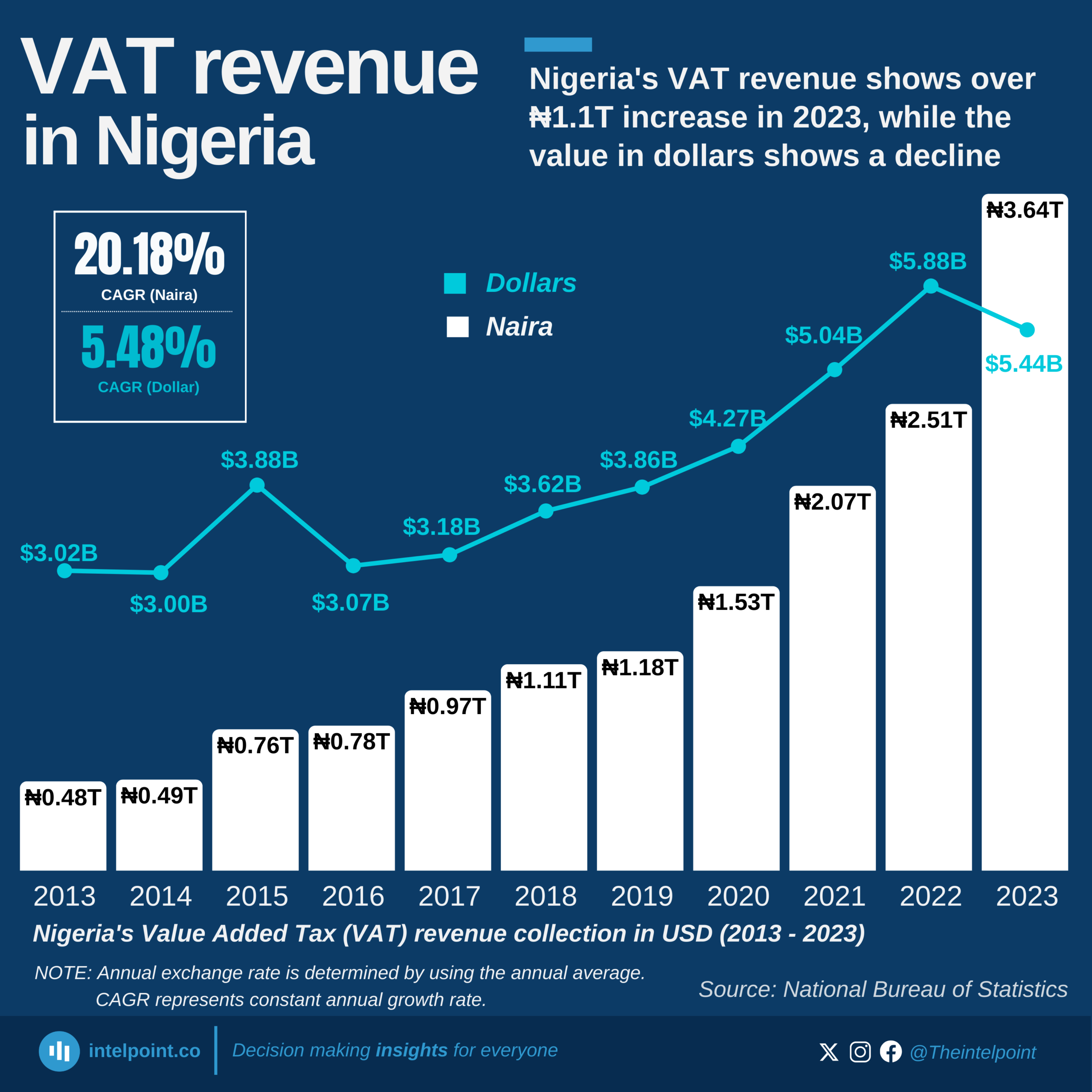

In the first half of 2024, Nigeria’s Value-Added Tax (VAT) collection was heavily concentrated in three key sectors - Manufacturing, Information & Communication, and Mining & Quarrying. These sectors collectively contributed 58.8% of total VAT revenue, demonstrating their strong economic impact. Manufacturing alone accounted for nearly a quarter of total VAT collection (24.8%), showing its dominance in Nigeria’s tax structure.

While VAT is generated across 21 different sectors, the data reveals a sharp concentration of tax revenue in a few industries. The Manufacturing sector’s dominance reflects Nigeria’s reliance on industrial production, while ICT’s 17.6% share highlights the country’s booming digital economy. Meanwhile, the Mining & Quarrying sector’s 16.4% contribution reinforces Nigeria’s strong dependence on extractive industries.