Key takeaways:

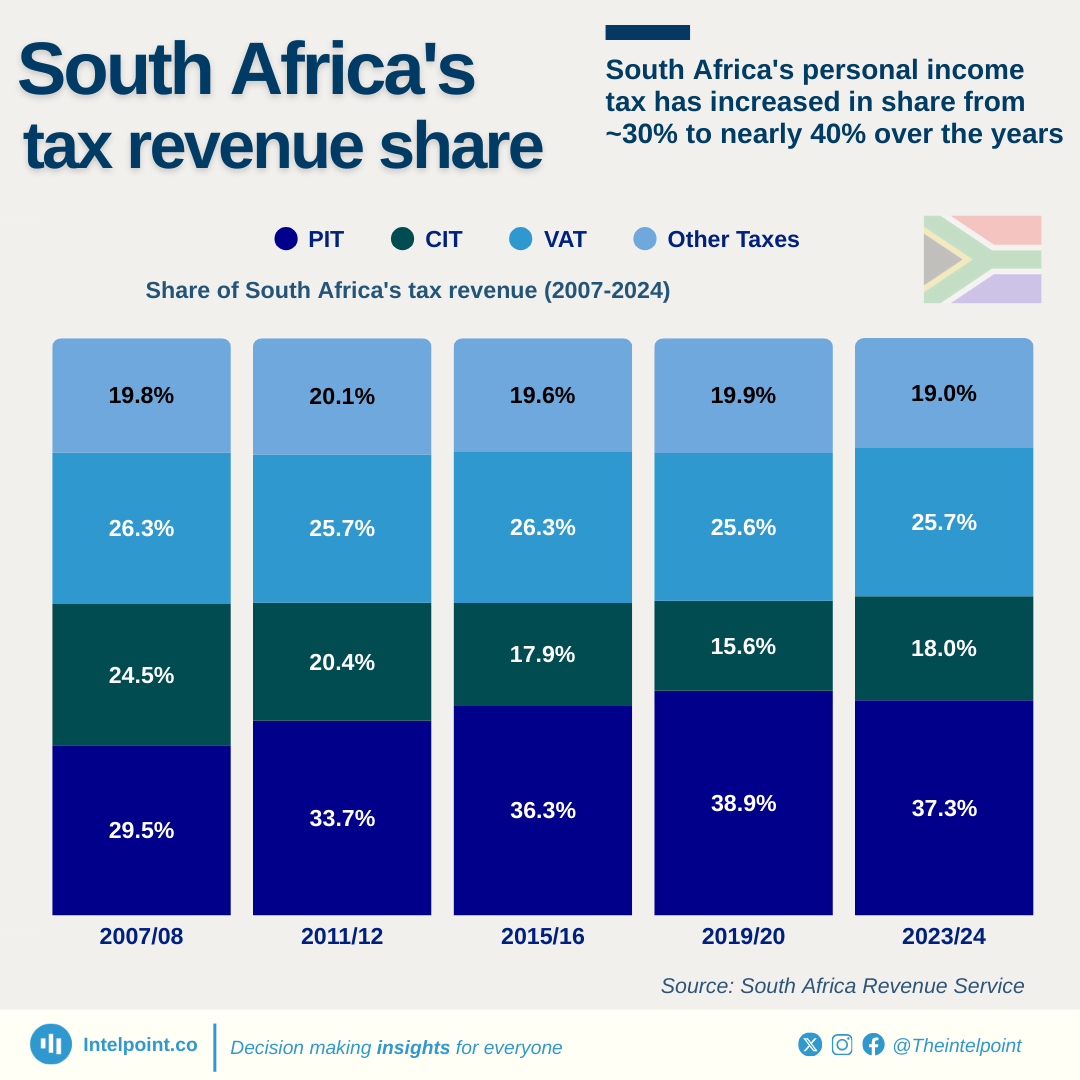

In the last twenty years, South Africa has experienced a gradual increase in tax revenue as a share of its Gross Domestic Product (GDP). During this timeframe, tax revenue rose steadily from 21% in 2004/05 to a robust 23.8% by 2007/08. However, the global financial crisis caused a sharp decline, leading to a drop to 21.1% in 2009/10.

From 2010 to 2020, tax revenue consistently remained in the range of 22-24% of the GDP, showcasing the country's remarkable capacity to sustain fiscal momentum amid economic uncertainties. The timeframe from 2016/17 to 2019/20 was particularly stable, with tax revenue consistently recorded at 23.7%.

The COVID-19 pandemic presented another obstacle, temporarily reducing tax revenue to 22.3% in 2020/21. However, South Africa's economy rebounded quickly. By 2021/22, tax revenue not only recovered but also increased to 24.7%, peaking at 24.9% in 2022/23.

The most recent figure of 24.5% for 2023/24 indicates continued strong performance, demonstrating the country’s capacity to adapt, efficiently collect revenue, and uphold fiscal stability despite global economic challenges.