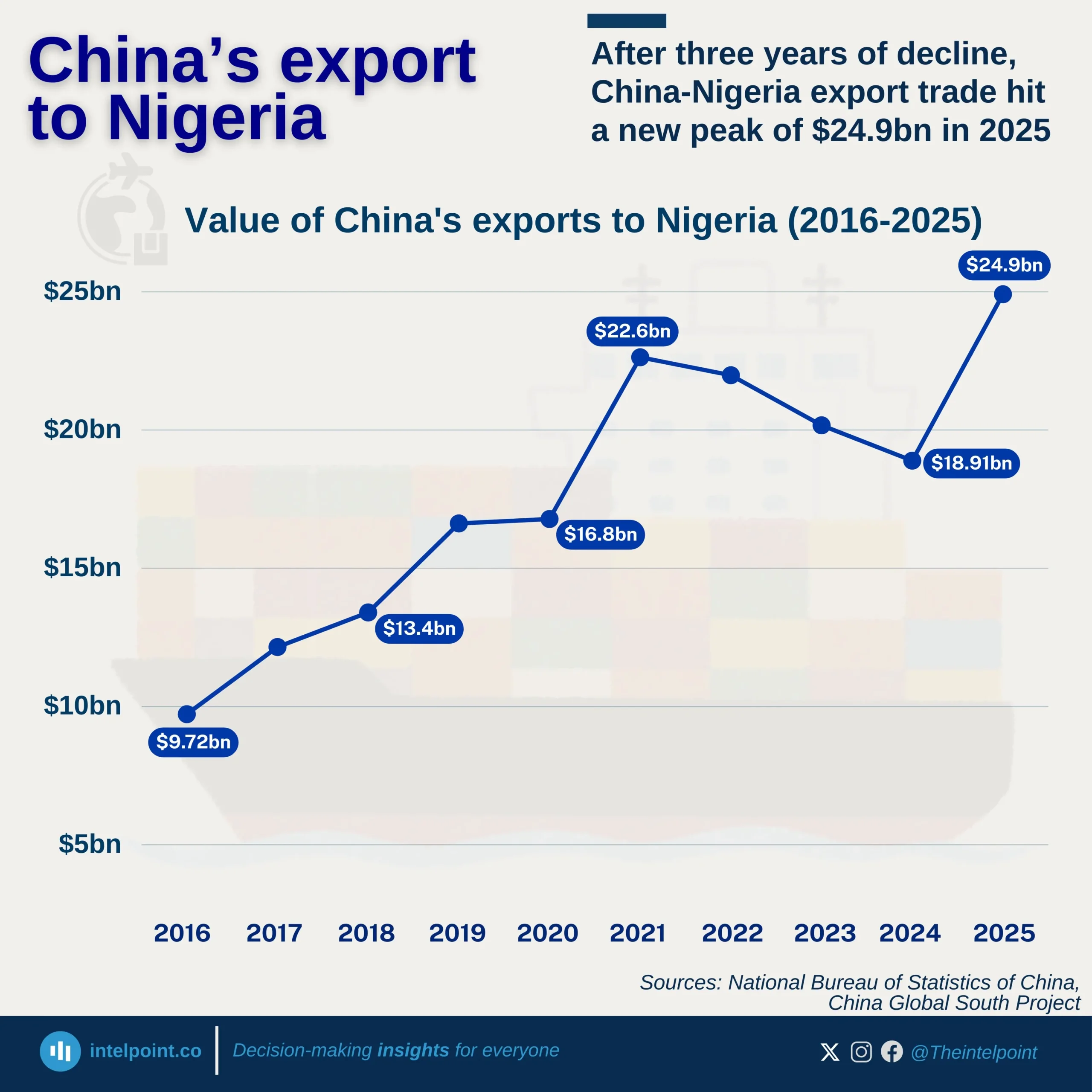

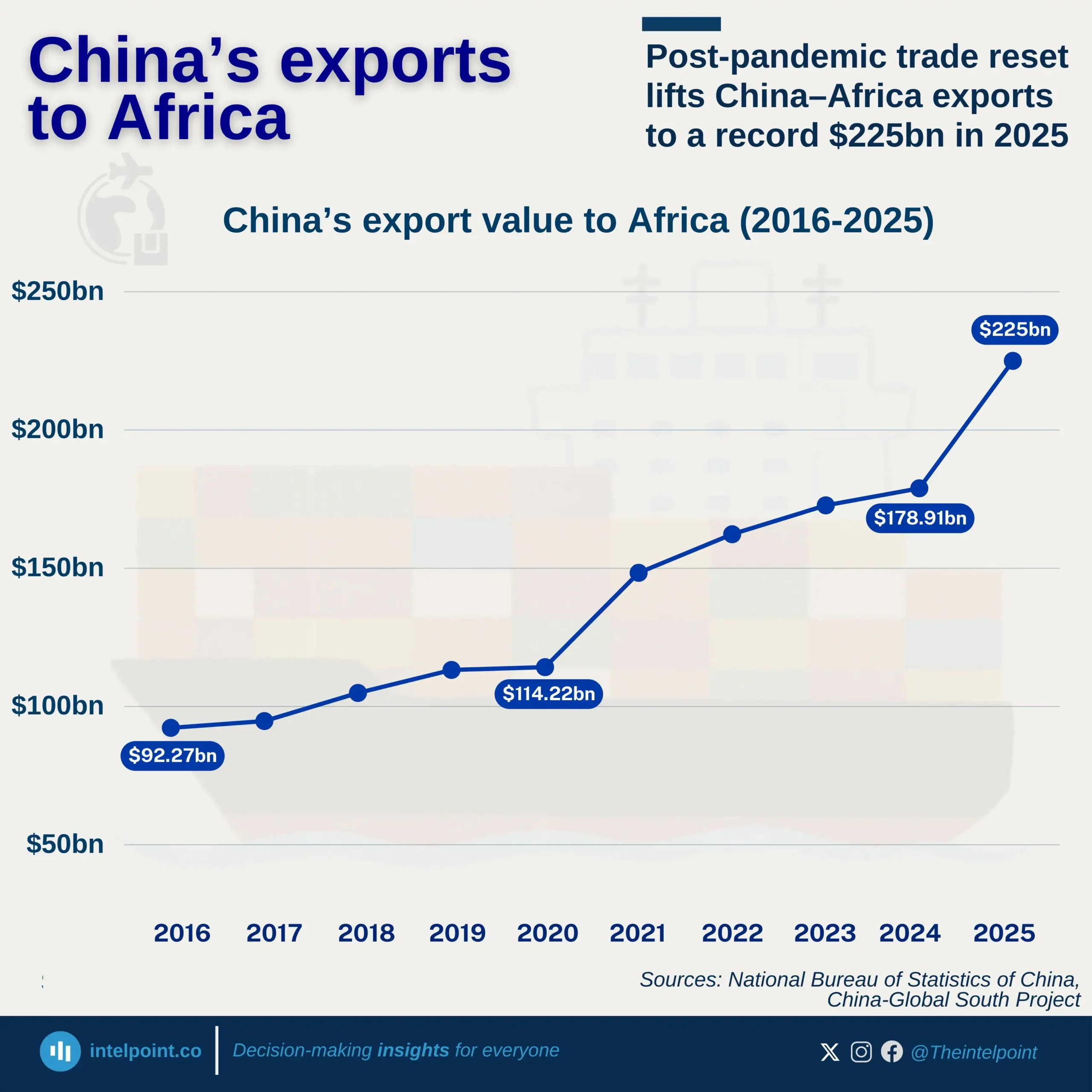

China’s export flows to Africa in 2025 exhibit a pronounced concentration among a relatively small group of countries, with the largest markets accounting for a substantial share of total trade. Nigeria ranks first, followed closely by South Africa and Egypt, reflecting the importance of market size, economic scale, and trade connectivity in shaping export distribution.

Beyond the top tier, export destinations span multiple regions and economic structures, from resource-driven economies to major regional trade hubs. This distribution highlights both concentration at the top and broad geographic reach, showing that while a few countries dominate trade volumes, China’s export network extends widely across the continent.