Key Takeaways:

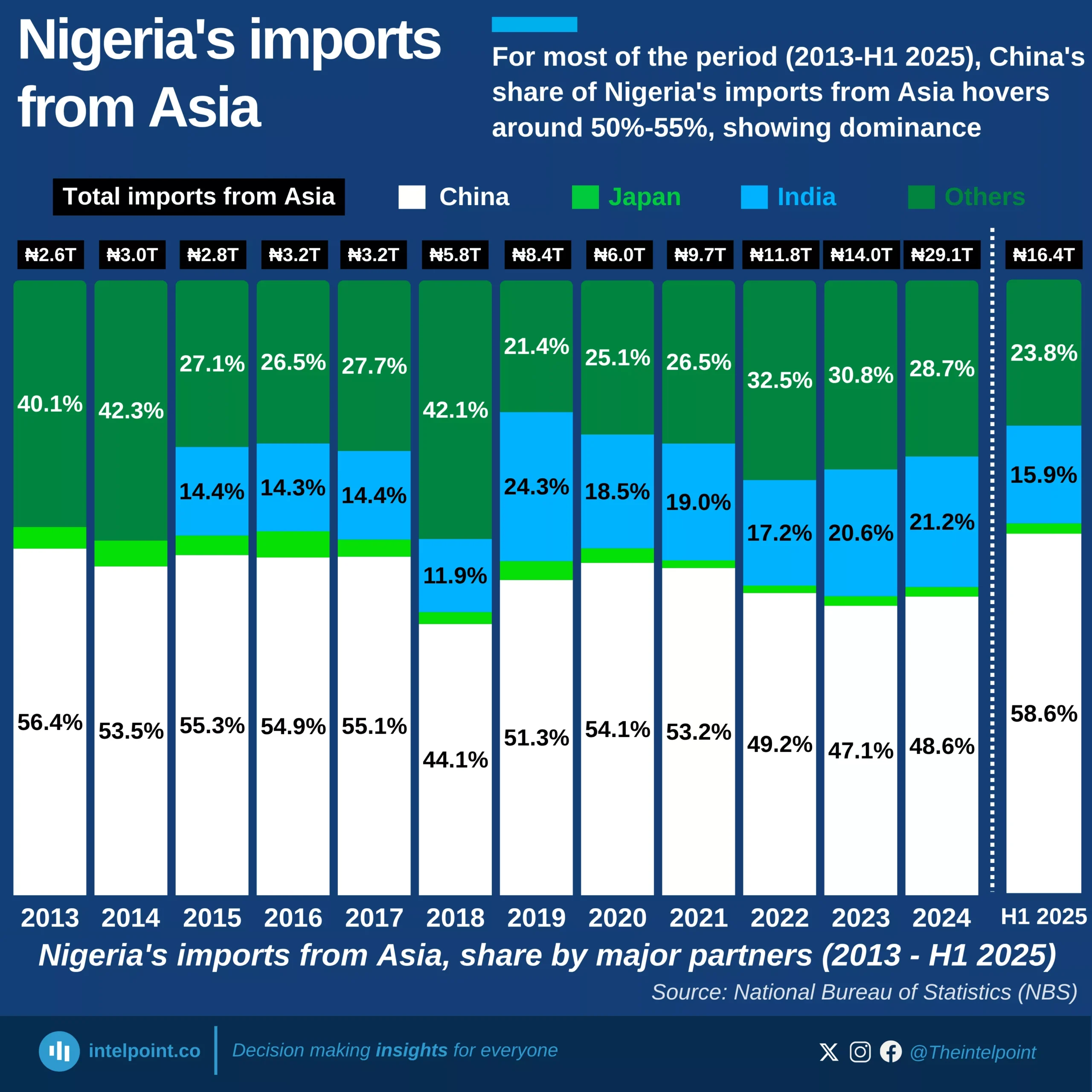

The 2023 trade dynamic between China and Nigeria revealed a significant imbalance in favour of China. China exported $20.18 billion in goods to Nigeria, representing 89.5% of the total trade volume. In contrast, Nigeria exported only $2.37 billion to China, just 10.5% of the total.

This resulted in a substantial trade surplus of nearly $17.8 billion for China. The disparity highlights Nigeria’s reliance on Chinese-manufactured products, machinery, and consumer goods, while primarily supplying raw materials in return.