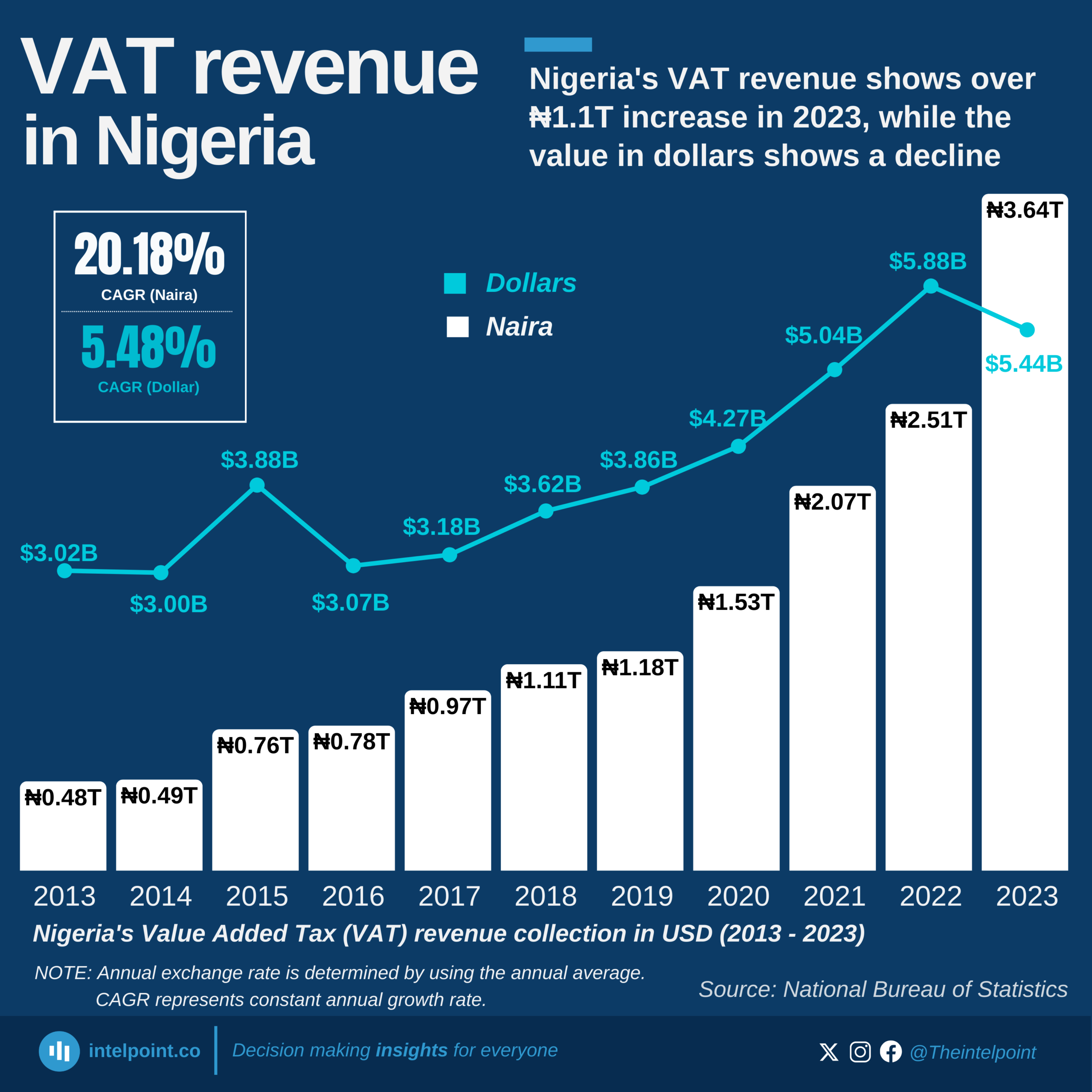

Nigeria's tax-to-GDP ratio remains significantly lower than regional averages, showing a gap in revenue mobilisation. While OECD countries reached a tax-to-GDP ratio of 34.2% in 2021, and even the African regional average stood at 18.8%, Nigeria's tax revenue represented only 6.7% of its GDP. This disparity emphasises the need for strategic tax policy reforms to strengthen Nigeria’s fiscal capacity.