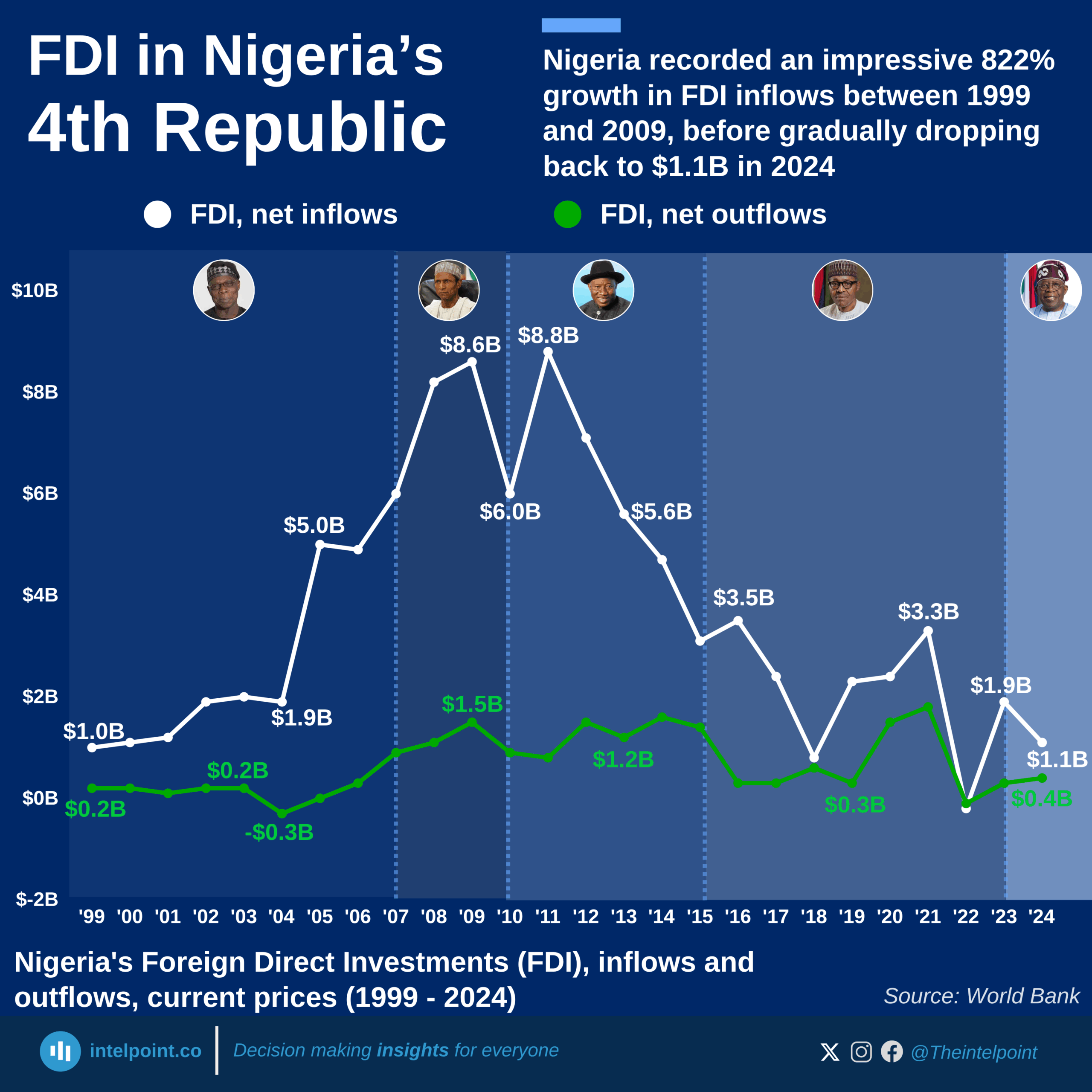

Over the past 35 years, Nigeria's share of Africa's Foreign Direct Investment (FDI) has experienced a significant decline, from 35.2% in 1990 to a mere 1.1% in 2024.

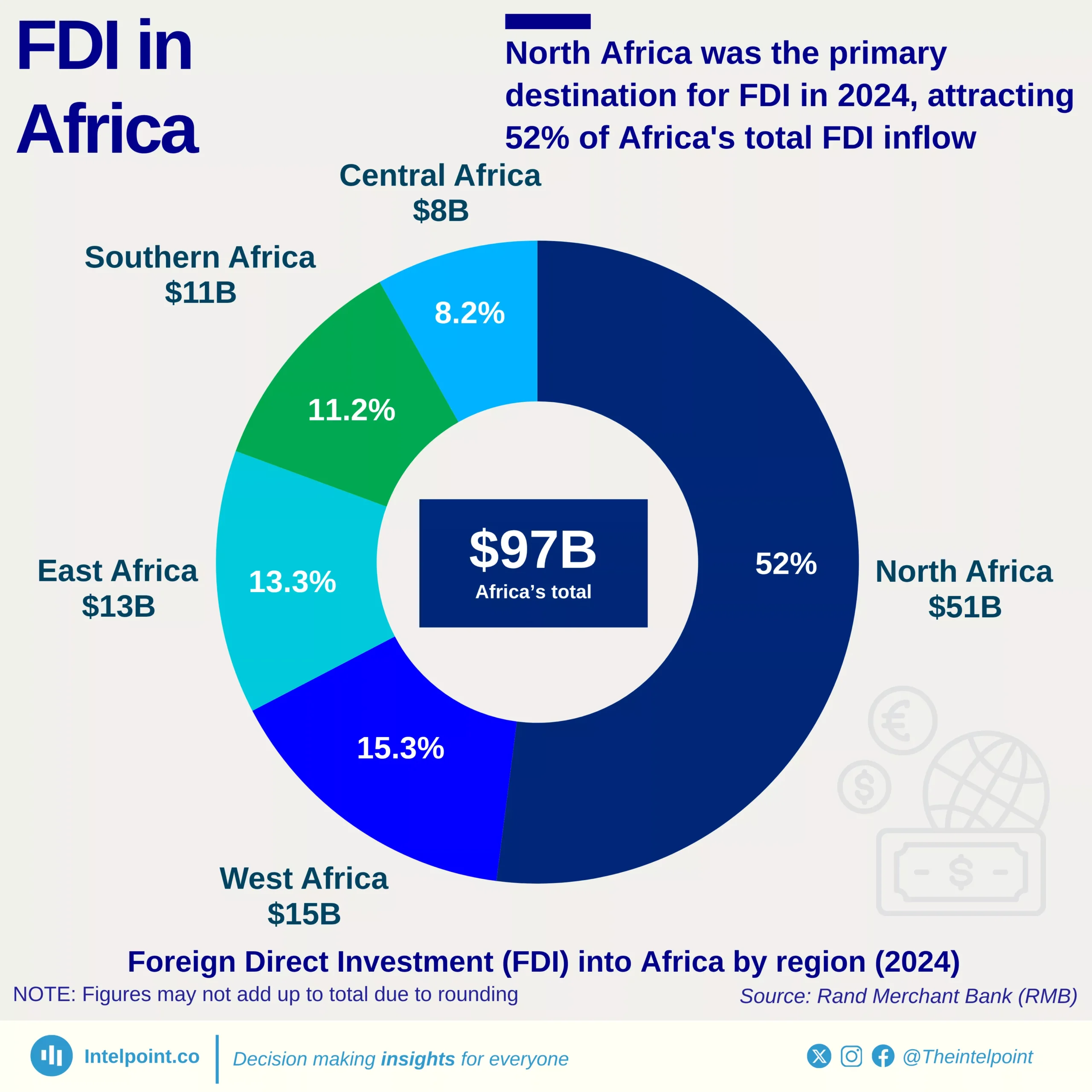

This trend is particularly striking given that Africa's total FDI inflows have increased substantially during the same period, rising from $2.85 billion in 1990 to $97.03 billion in 2024. Despite this overall growth, Nigeria's FDI has not kept pace, peaking at $8.91 billion in 2011 before entering a persistent downward trajectory. This decline underscores a shift in investor confidence and highlights the need for Nigeria to reassess its investment climate, especially in light of the continent's evolving economic landscape.

So far in 2025, Nigeria’s FDI performance has remained subdued, with official data showing inflows of just $126.3 million in Q1 2025, a 70% drop from the previous quarter. However, there are renewed signs of investor attention: the Nigerian Investment Promotion Commission reported nearly $20 billion in new investment signals across energy, manufacturing, and infrastructure during mid-2025, while global firms like Shell and Siemens reaffirmed long-term project commitments.

These developments, though mostly in the announcement stage, hint at a potential rebound if macroeconomic stability and policy reforms gain traction.

The question now is — will 2025 mark the turning point in Nigeria’s declining FDI story, or will investor caution continue to define the years ahead?