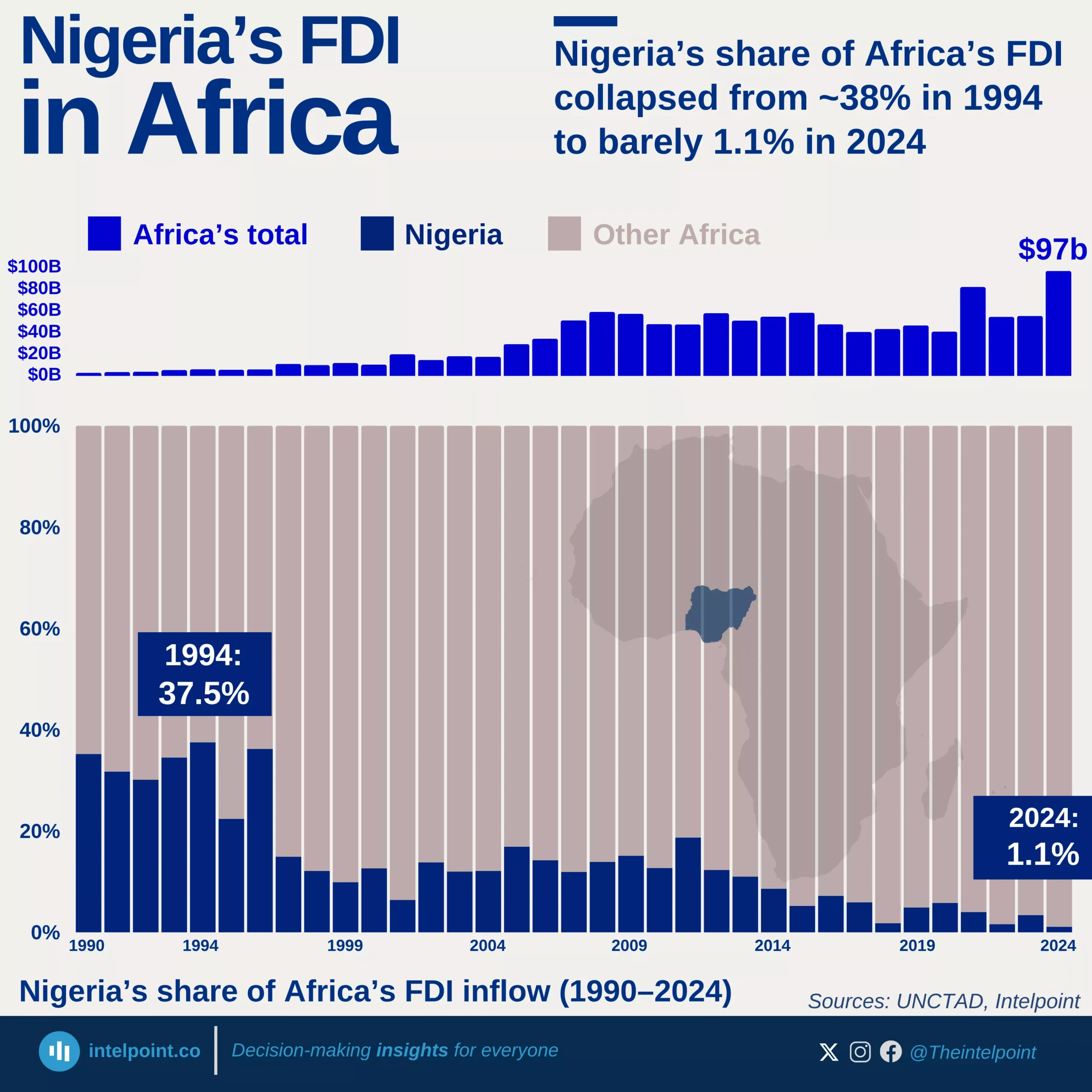

Nigeria's FDI has dropped significantly. From an average of $417m per quarter (2013-2015) to less than $100m (Q1 2022 - Q2 2024), it hit its lowest ($29.8m) in Q2 2024.

The trend shows declines since 2013, with key fluctuations and a shift in investment priorities.

- 2013-2015: FDI was mostly above $200 million per quarter, peaking at $769 million in Q4 2014.

- 2016-2021: FDI mostly stayed under $400 million, with a $531 million spike in Q3 2018.

- 2022-2024: FDI hit new lows, bottoming out at $48 million in Q1 2023 and falling even further to $29.8 million in Q2 2024 — the lowest in 46 quarters.