About 28,844 TWh of electricity was generated globally in 2022. Driven by industrial growth and large populations in countries like China and India, Asian countries collectively accounted for 56%. North America and Europe followed, with 5,432 TWh and 4,731 TWh, respectively.

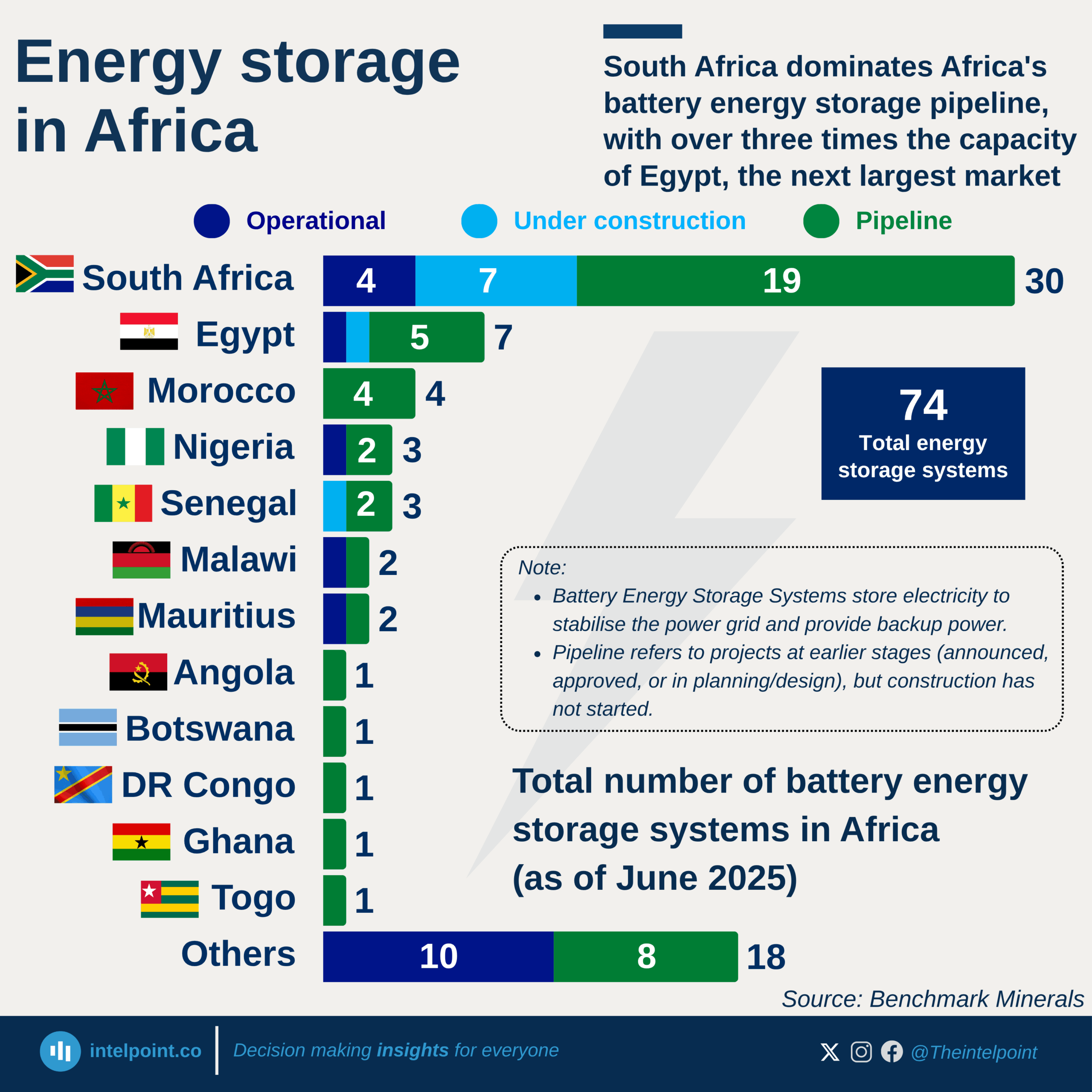

Africa generated less than 900 TWh, with key contributions from South Africa and Egypt. Oceania, primarily led by Australia, produced 330 TWh.