Key Takeaways:

In the fourth quarter of 2024, crude oil and oil obtained from bituminous minerals accounted for ₦13.78 trillion, representing nearly 70% of Nigeria’s global exports. Natural gas followed, adding ₦1.94 trillion or 9.71% to Nigeria’s global exports.

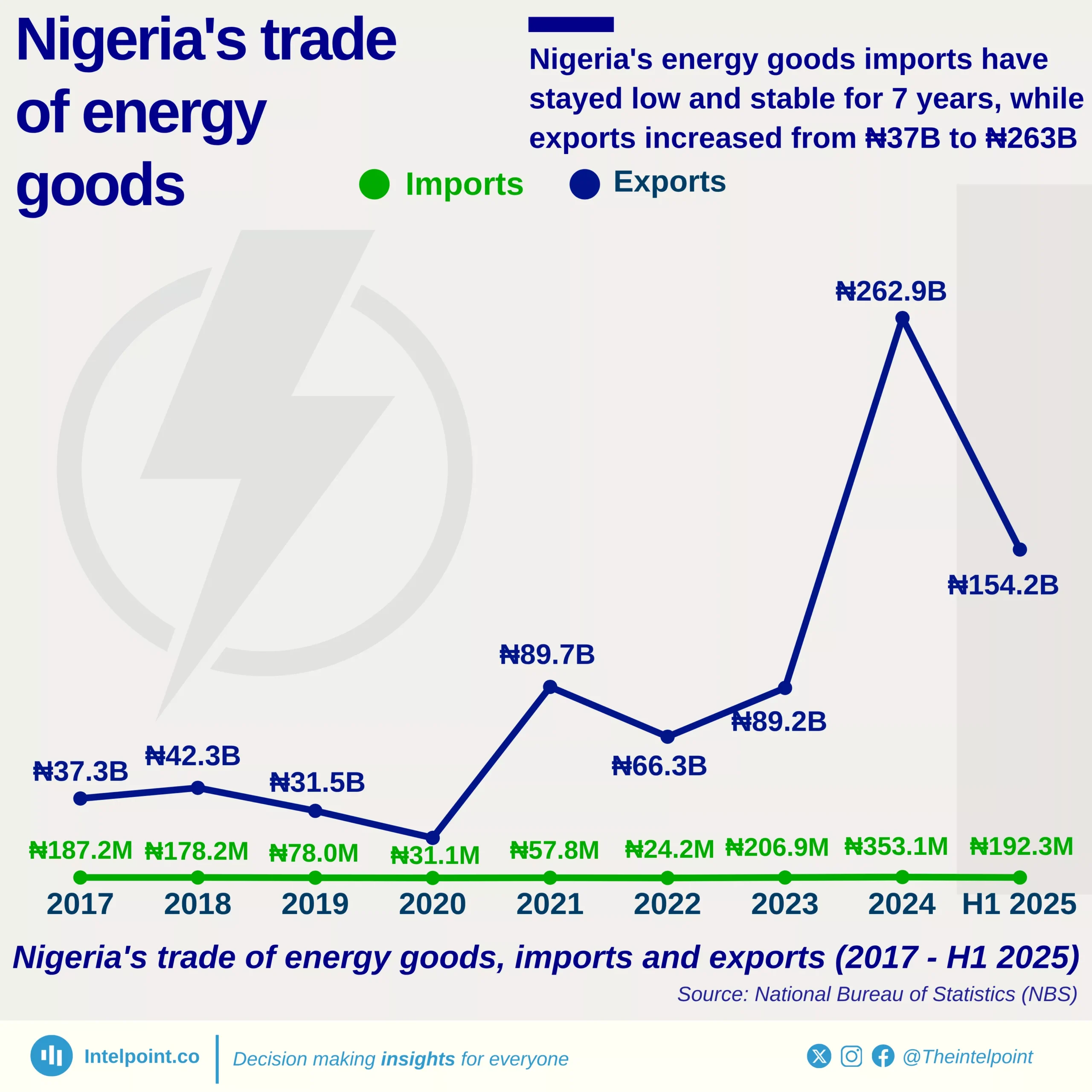

On the import side, refined petroleum products topped the list. Motor spirit (petrol) led with ₦3.3 trillion, while gas oil followed with ₦1.23 trillion. Together, these accounted for over 27% of Nigeria’s global import value.

Though oil dominates the country's export trade landscape, non-oil exports such as cocoa beans, sesame seeds, and natural cocoa butter are emerging as valuable contributors to its export diversification strategy, with individual shares ranging from 0.52% to 4.18%. Meanwhile, Nigeria’s imports reflect a broad range of needs, highlighting the importance of enhancing domestic manufacturing and reducing reliance on foreign goods.