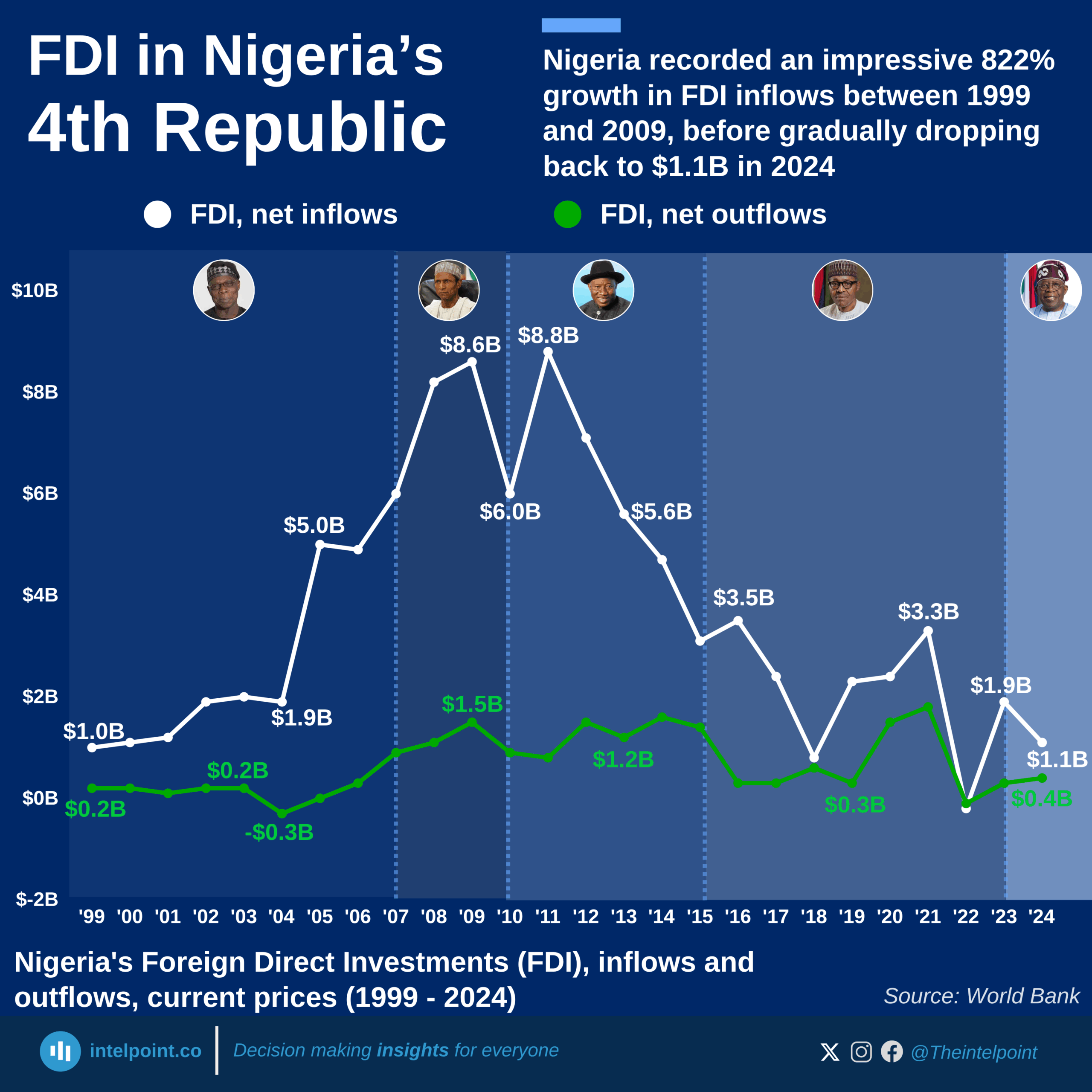

Between 2017 and 2020, Nigeria’s announced Foreign Direct Investment figures were highest in 2018. However, there have been significant differences between investment announcements and FDI inflow over the years. Here are the FDI announcements and FDI inflow from 2017 to 2020. A destination analysis shows that Bayelsa State leads investment destinations with 36% of the total investments.