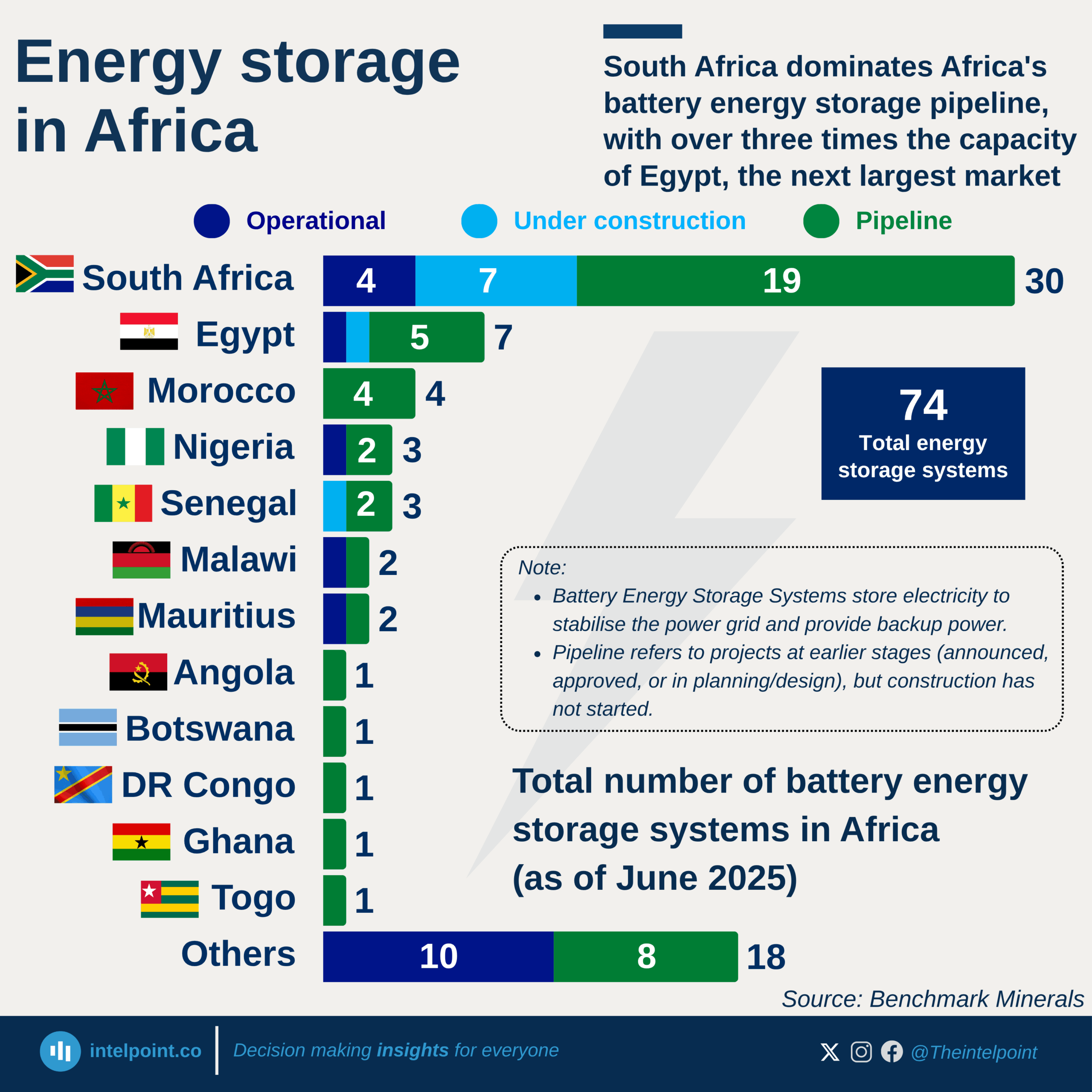

Africa’s renewable energy landscape shows that some countries are making significant strides while others remain far behind. South Africa leads the continent with a renewable capacity of 13.5 GW, followed closely by Egypt at 11.8 GW. These two nations dominate the space, accounting for a large share of Africa’s renewable energy capacity.

The gap between leaders and laggards highlights both opportunities and challenges. For instance, South Africa, Egypt, Ethiopia, Angola, and Morocco have all surpassed 4 GW, showing how focused investments and government policies can drive expansion. On the other end, countries like Guinea-Bissau, Niger, and Liberia are struggling with just 2 MW each.

As Africa positions itself for sustainable growth, the disparity in renewable energy adoption will shape its economic and social trajectory. Countries at the top of the list are already proving how renewables can drive industrial competitiveness, while those at the bottom risk being left behind.