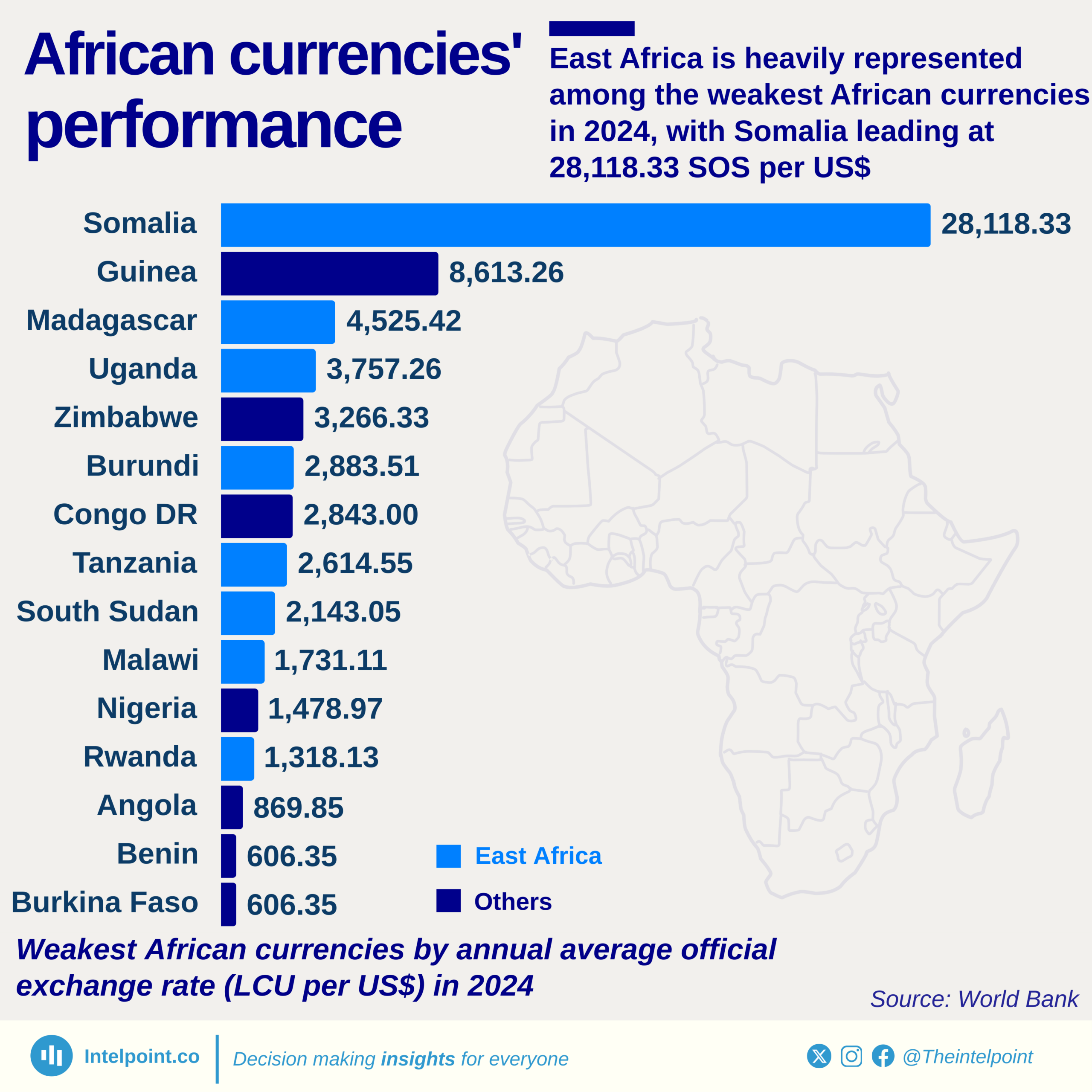

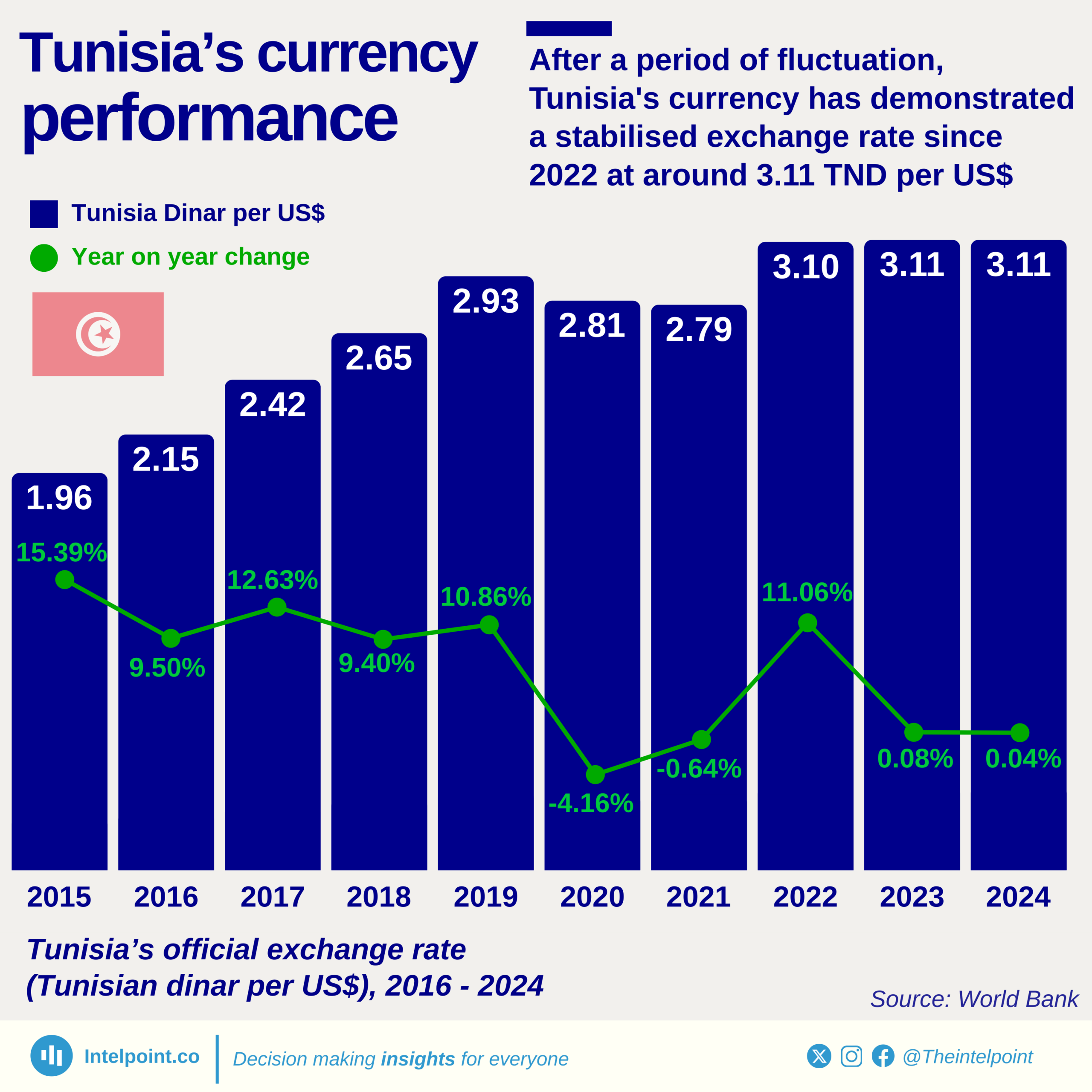

Tunisia’s currency emerged as the strongest in Africa in 2024, with an annual average exchange rate of 3.11 Tunisian dinars per US dollar. This ranking highlights Tunisia’s financial stability and resilience compared to other African nations, many of which have struggled with currency depreciation due to inflation, external debt, and economic instability. Tunisia’s ability to maintain such a strong currency position reflects careful monetary management and relative economic strength amid broader regional challenges.