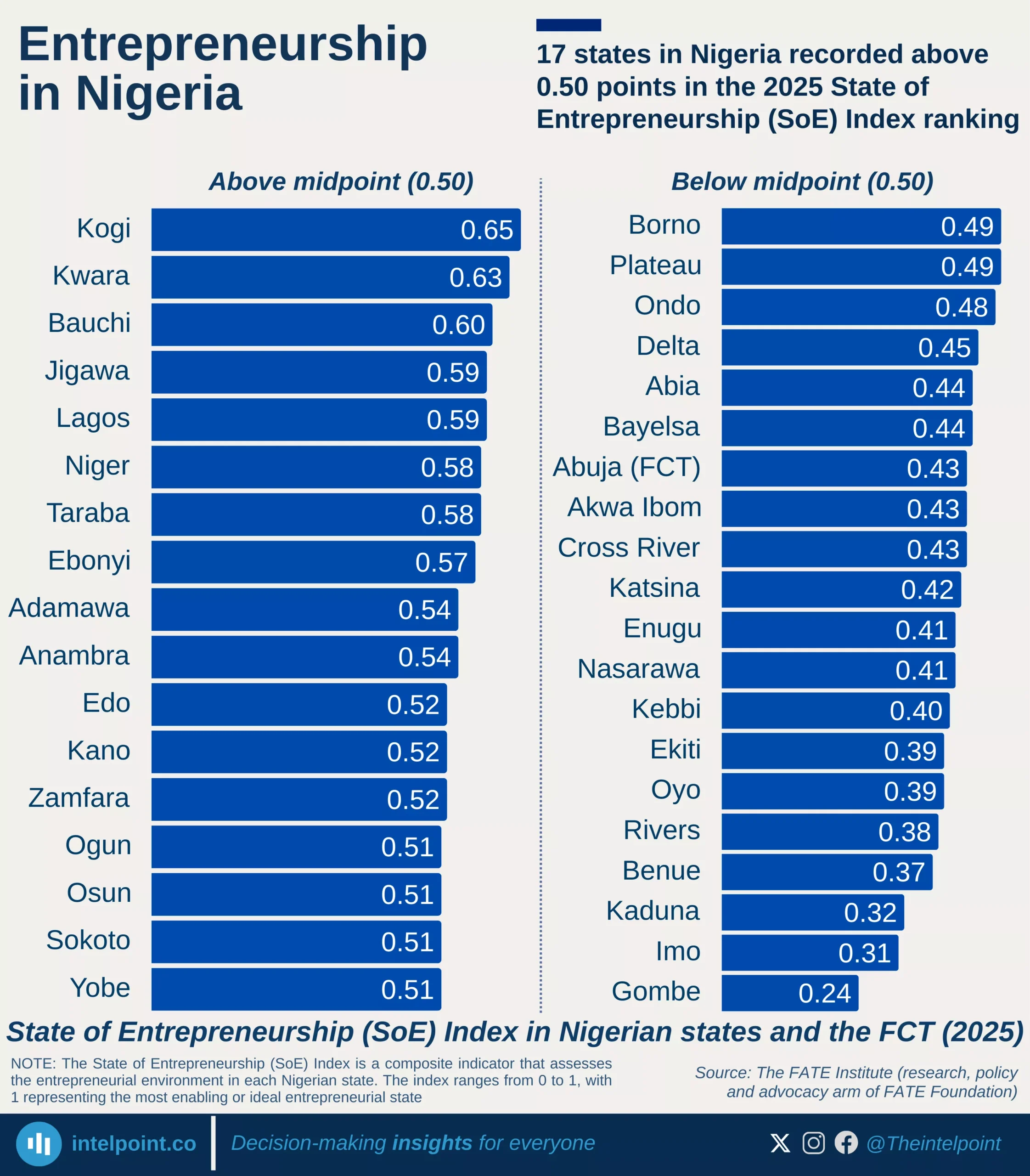

Nigeria’s State of Entrepreneurship (SoE) Index shows a modest but notable turnaround in 2025, rising from 0.46 in 2024 to 0.47.

While the increase is slight, it is significant because it marks the first improvement since 2022, ending a two-year decline. Nigeria’s entrepreneurial environment weakened steadily after 2022, but 2025’s score signals a cautious return to positive momentum rather than continued erosion.

Nigeria started from a relatively stronger position in 2022 (0.58), then slipped to 0.52 in 2023, and fell further in 2024.

These declines reflect growing structural pressures on entrepreneurs, including regulatory bottlenecks and macroeconomic instability. Against this backdrop, the 2025 uptick stands out less as a recovery and more as a pause in deterioration, suggesting that conditions may be stabilising rather than worsening.