Nigeria’s passport mobility has seen notable shifts over the past decade, reflecting changes in global travel dynamics and diplomatic efforts. In 2015, the mobility score stood at 42, experiencing a slight dip to 41 in 2016 before climbing steadily to 50 by 2019. However, the COVID-19 pandemic in 2020 led to a sharp decline, dropping the score back to 44 as global travel restrictions tightened.

Post-pandemic recovery began in 2021, with the score rebounding to 48, followed by a strong surge to 54 in 2022. This upward momentum peaked in 2023 at 56, marking the highest recorded mobility score in the dataset. Despite a slight stabilisation at 55 in 2024 and 2025, the overall trend shows a significant improvement, with Nigerian passport holders gaining access to more destinations over time.

From 2015 to 2025, the mobility score increased by 31%, underscoring enhanced international partnerships and improved visa agreements. While challenges such as global crises can impact travel freedom, Nigeria’s steady recovery highlights progress in global mobility access for its citizens.

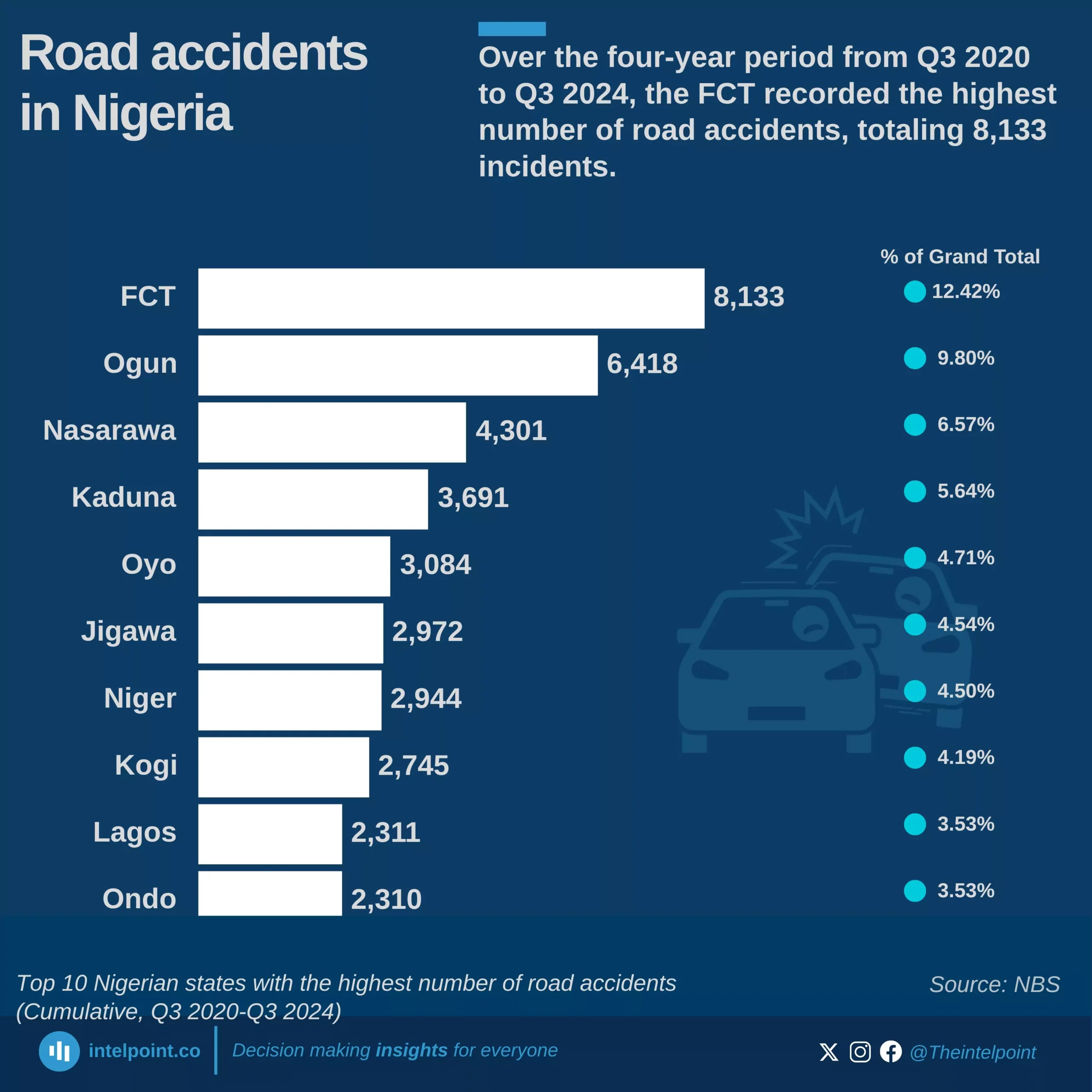

FCT, Ogun, and Nasarawa consistently rank as the top three states with the highest number of road accidents.

The FCT recorded its peak accident figures in 2022, particularly in Q2 (842 cases) and Q4 (864 cases).

In Q2 and Q3 of 2024, Ogun State surpassed the FCT in the number of reported accidents.

Across these three states, there has been a notable decline in accident numbers, with an average decrease of approximately 37.6% between Q2 and Q3 2024.