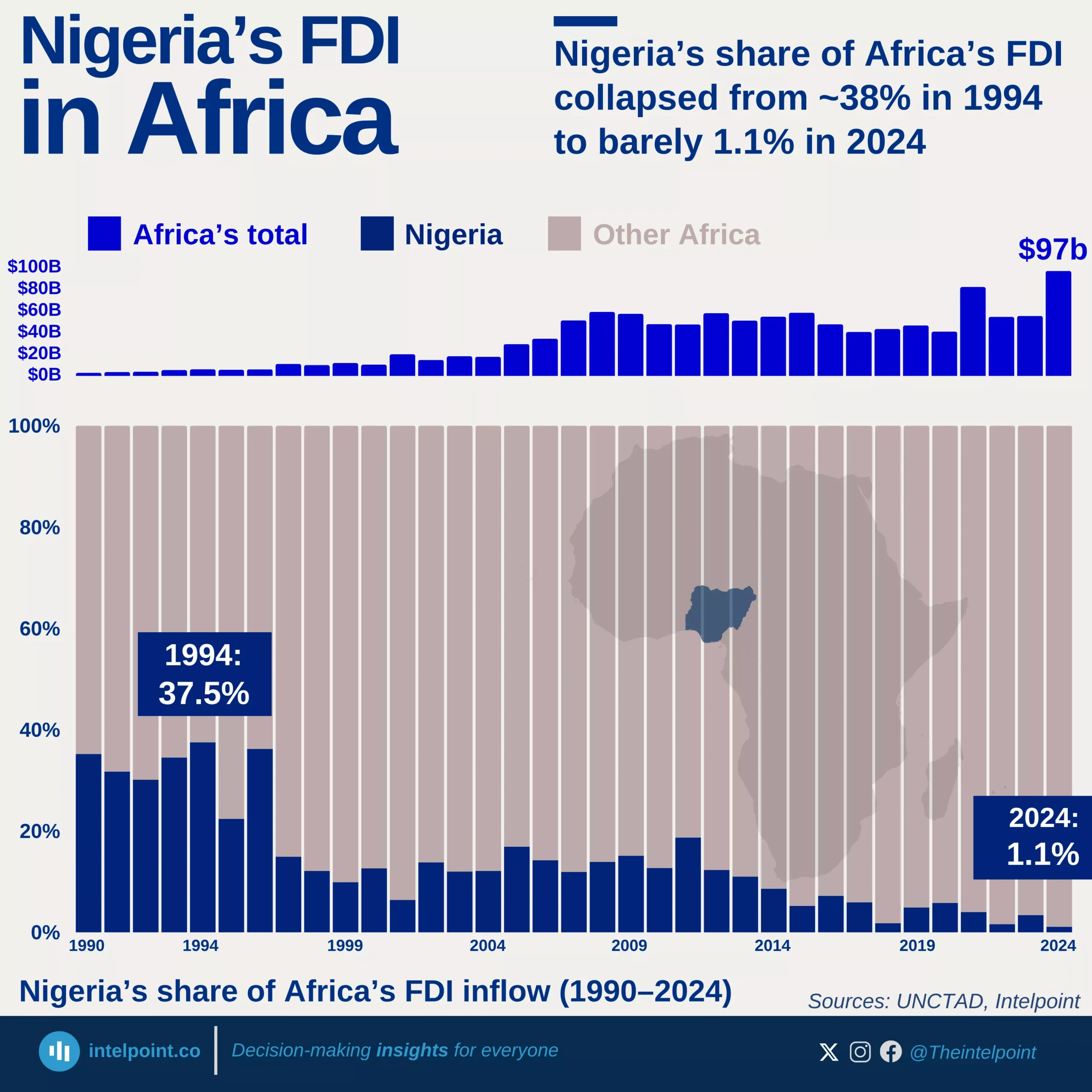

Foreign Direct Investment (FDI) in Nigeria’s Fourth Republic tells a clear story of early promise followed by a prolonged decline. Between 1999 and 2011, the country experienced a strong upward trend in FDI inflows, peaking at $8.8 billion in 2011. This period reflected growing investor confidence, driven by economic reforms, liberalisation policies, and a favourable global commodities market. However, after the 2011 peak, FDI inflows began to fall steadily, dropping to just $1.1 billion in 2024, a level similar to the early days of the Fourth Republic.