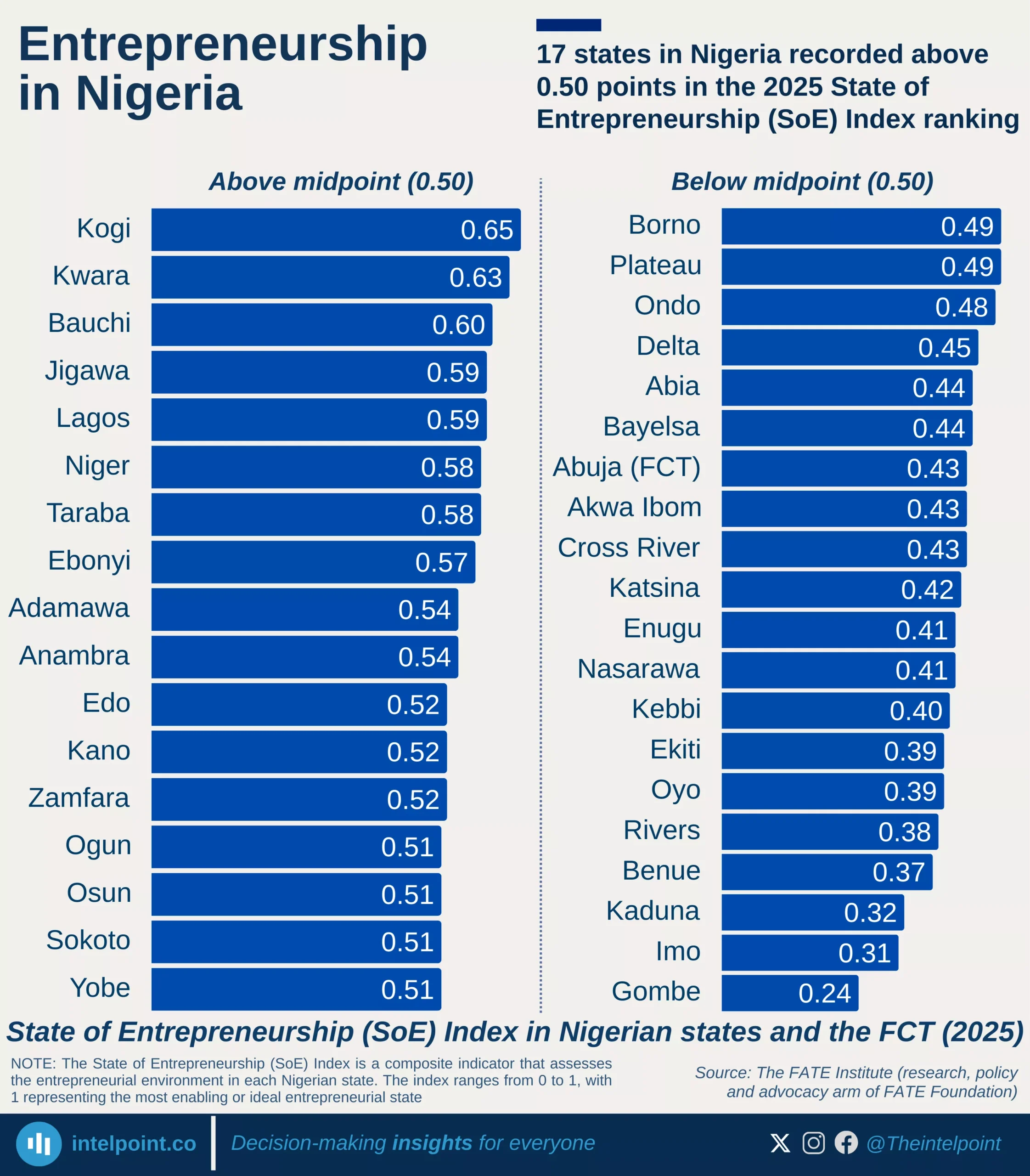

Nigeria’s informal economy remains deeply entrenched. In 2025, most Nigerian states still have a majority of businesses operating without formal registration, with Jigawa standing out sharply: 96.1% of businesses are unregistered, meaning only 3.9% are formally registered. This positions Jigawa as the state with the highest level of informality in the country and highlights how far parts of Nigeria remain from a formalised business environment.

What is striking is how widespread informality is across the country, cutting across regions and economic profiles. Several states, including Gombe, Abia, Imo, Enugu, and Benue, record unregistered business rates above 80%, while even commercial hubs like Lagos (69.8%) and Rivers (75.2%) show that informality dominates over formal enterprise. This suggests that business registration in Nigeria is not just a rural or low-income issue, but a systemic feature of entrepreneurship nationwide.