Time zones reveal how geography and political reach shape global connectivity. France’s 13 zones make it the world’s most temporally diverse nation, driven less by its European landmass than by territories in the Pacific, Indian Ocean, and Caribbean. The United States and Russia, each with 11 zones, showcase how continental sprawl dictates timekeeping complexity. Other global powers like the UK and Australia (9 zones each) highlight overseas dependencies as drivers of multiplicity.

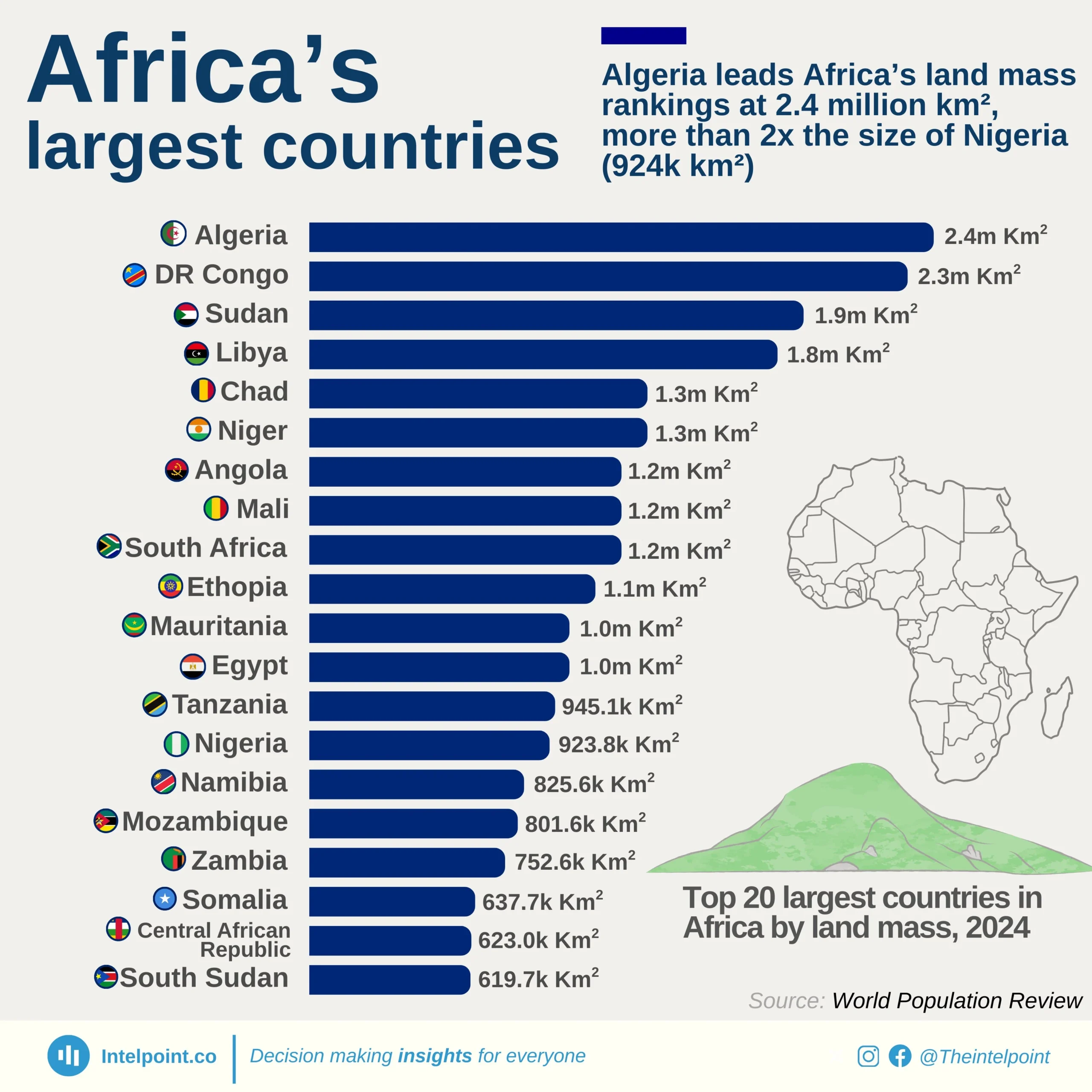

By contrast, Africa presents a strikingly simple picture: despite its vast landmass, nearly all countries observe just a single time zone. The exceptions are DR Congo, whose massive east-west span demands two, and South Africa, which uniquely straddles two zones for practical alignment. This continental cohesion stands in sharp contrast to the fragmented temporal maps of Europe and the Americas.