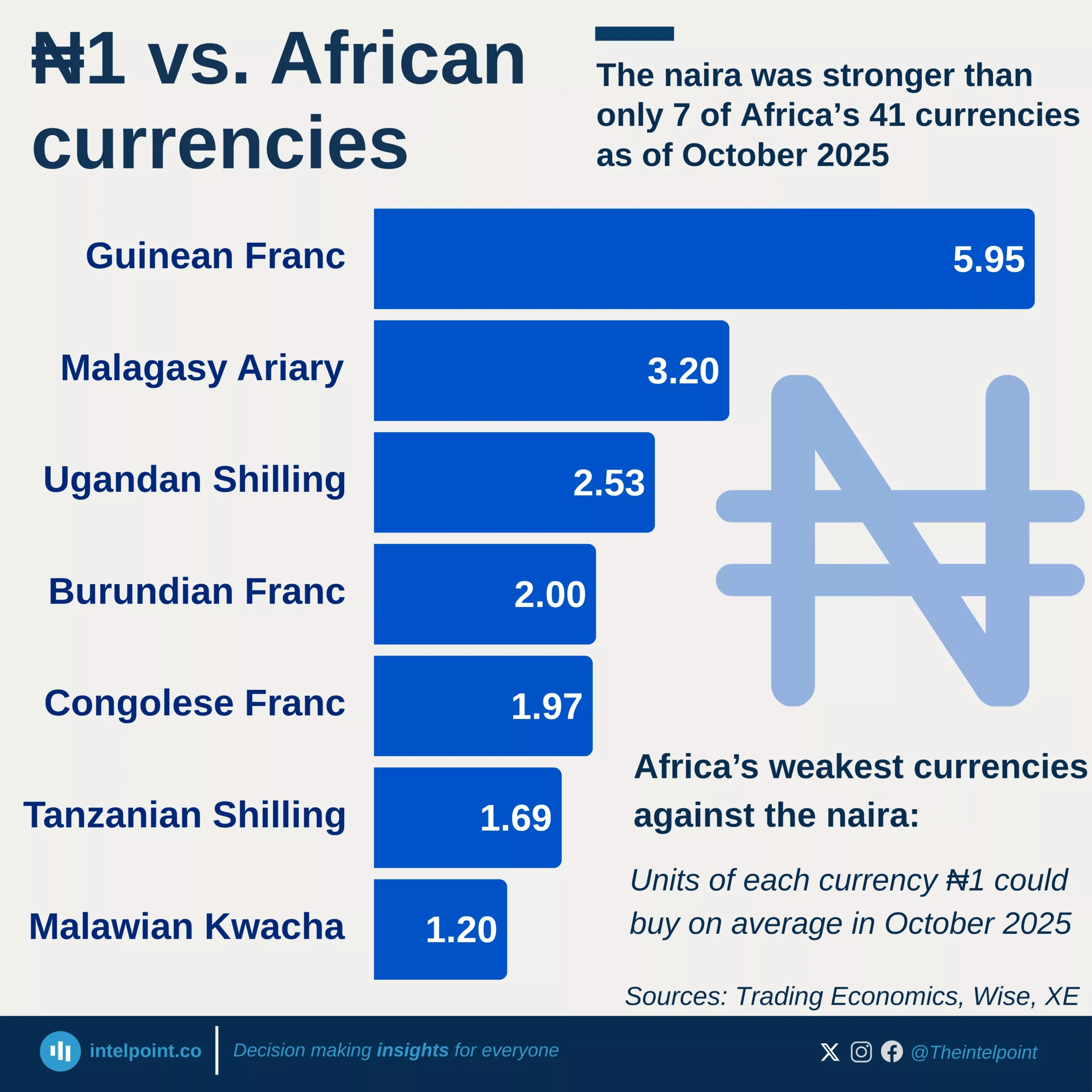

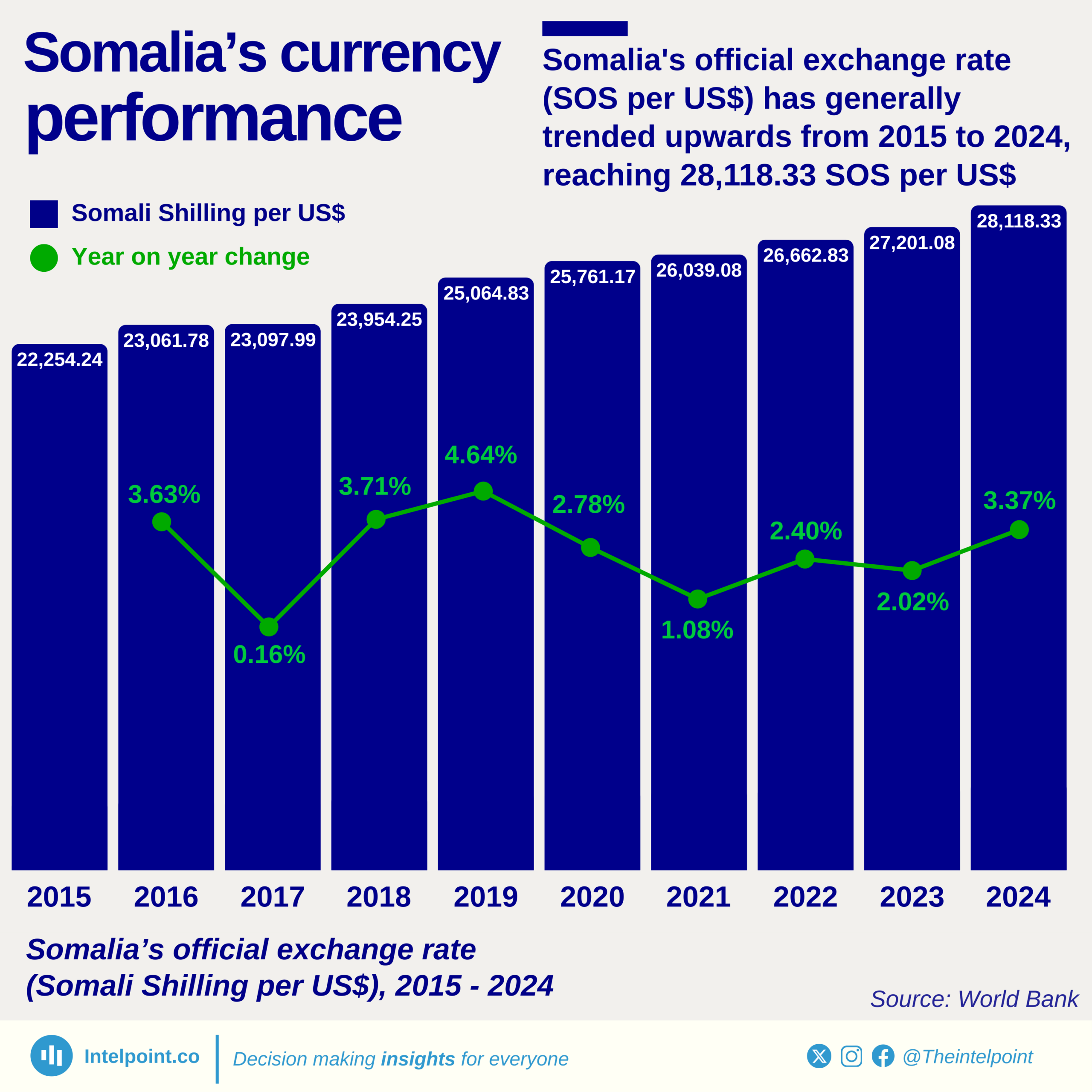

East African nations' currencies showed to be among the weakest in the continent, with eight countries in the region making the list among the top 15 weakest African currencies in 2024. Somalia (an East African country) stood out with the weakest currency in Africa, trading at 28,118.33 Somali Shillings per US Dollar. This is a massive gap compared to other African currencies, highlighting the significant economic challenges the country continues to face. Guinea followed at a distant second with 8,613.26 Guinean Francs per US Dollar, showing a wide disparity between Somalia and the rest of the continent.

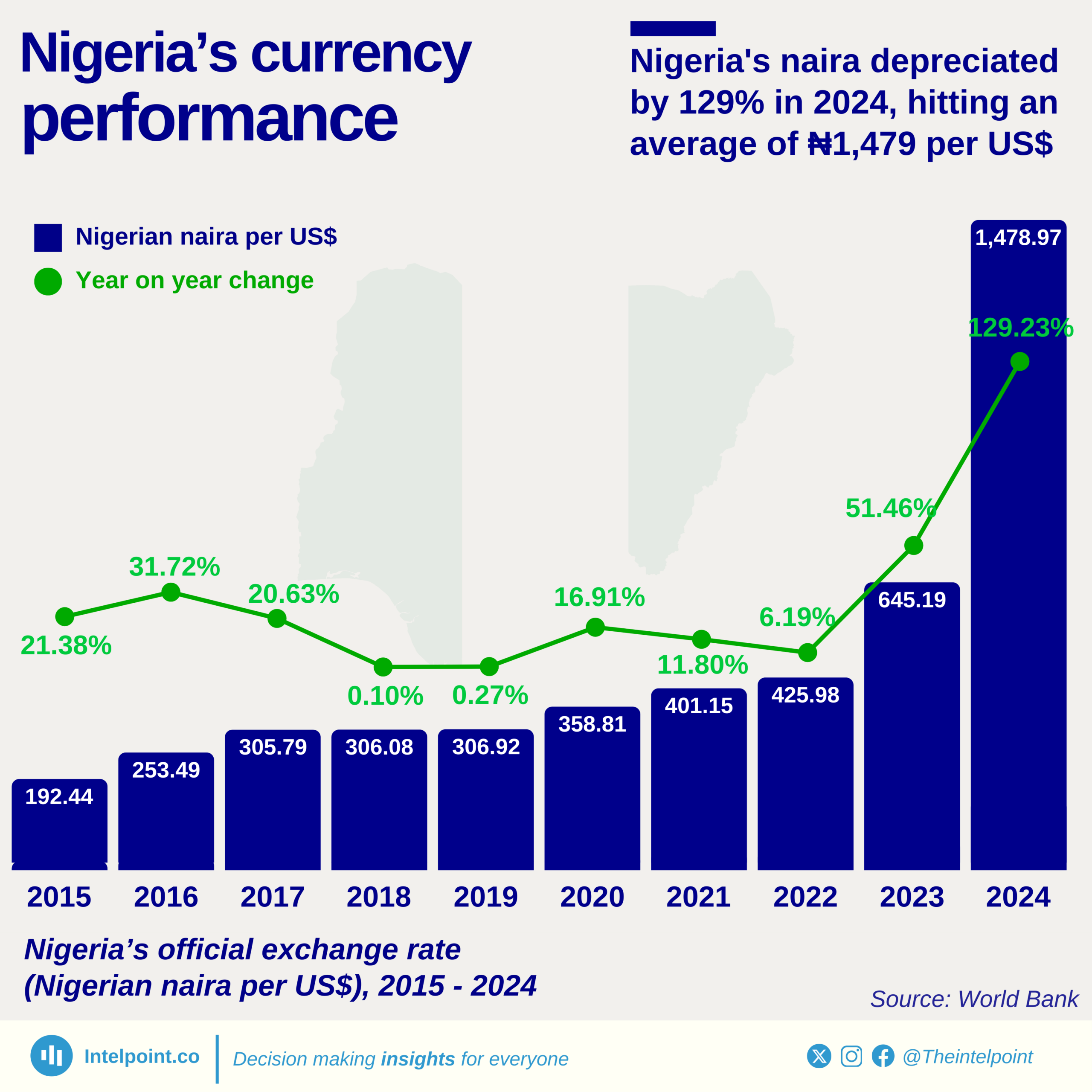

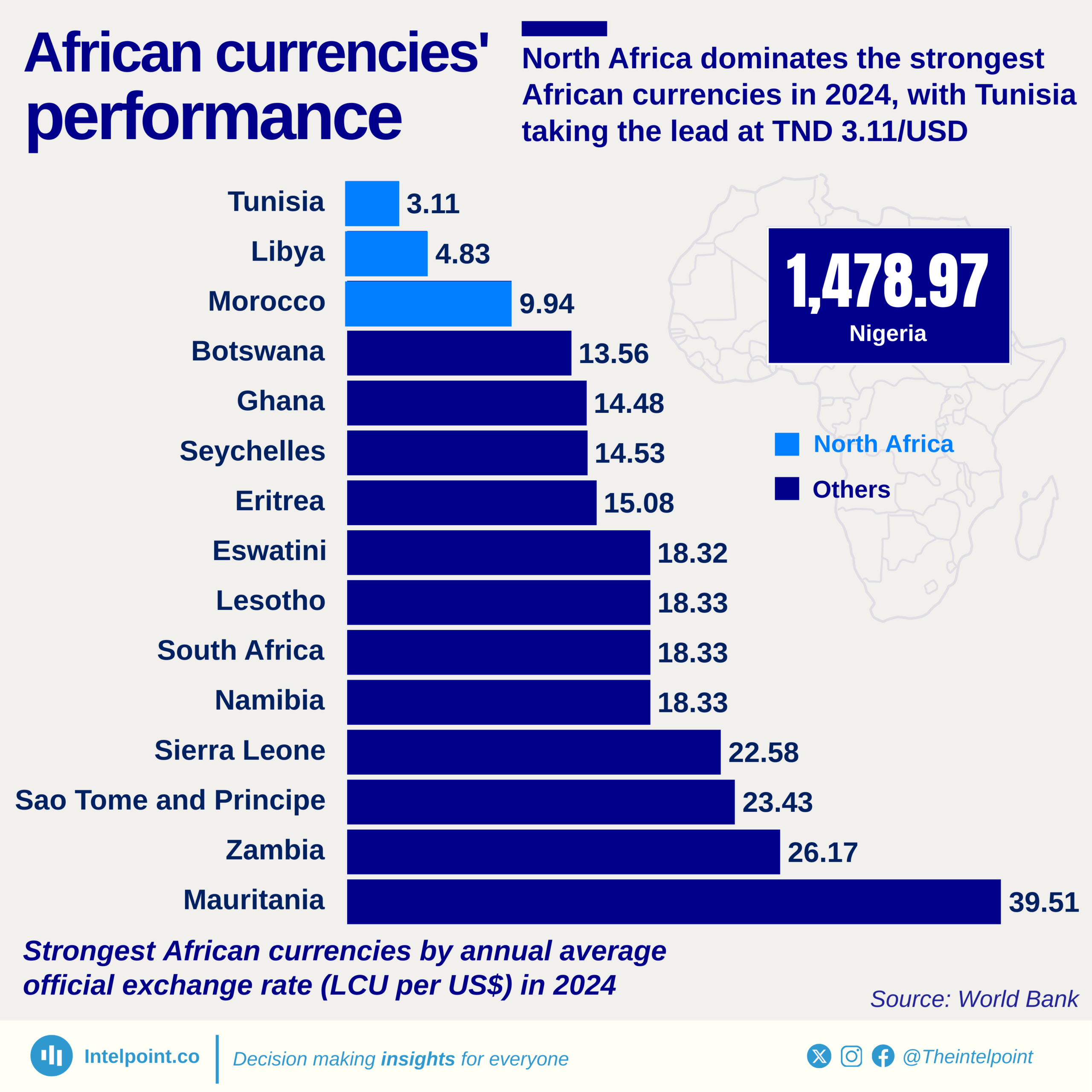

Even countries often discussed for currency instability, like Zimbabwe, Nigeria, and South Sudan, had exchange rates that were considerably lower than Somalia’s. For example, while a Nigerian needed about 1,479 Naira for one dollar in 2024, a Somali citizen needed over 28,000 Shillings—almost 20 times more.