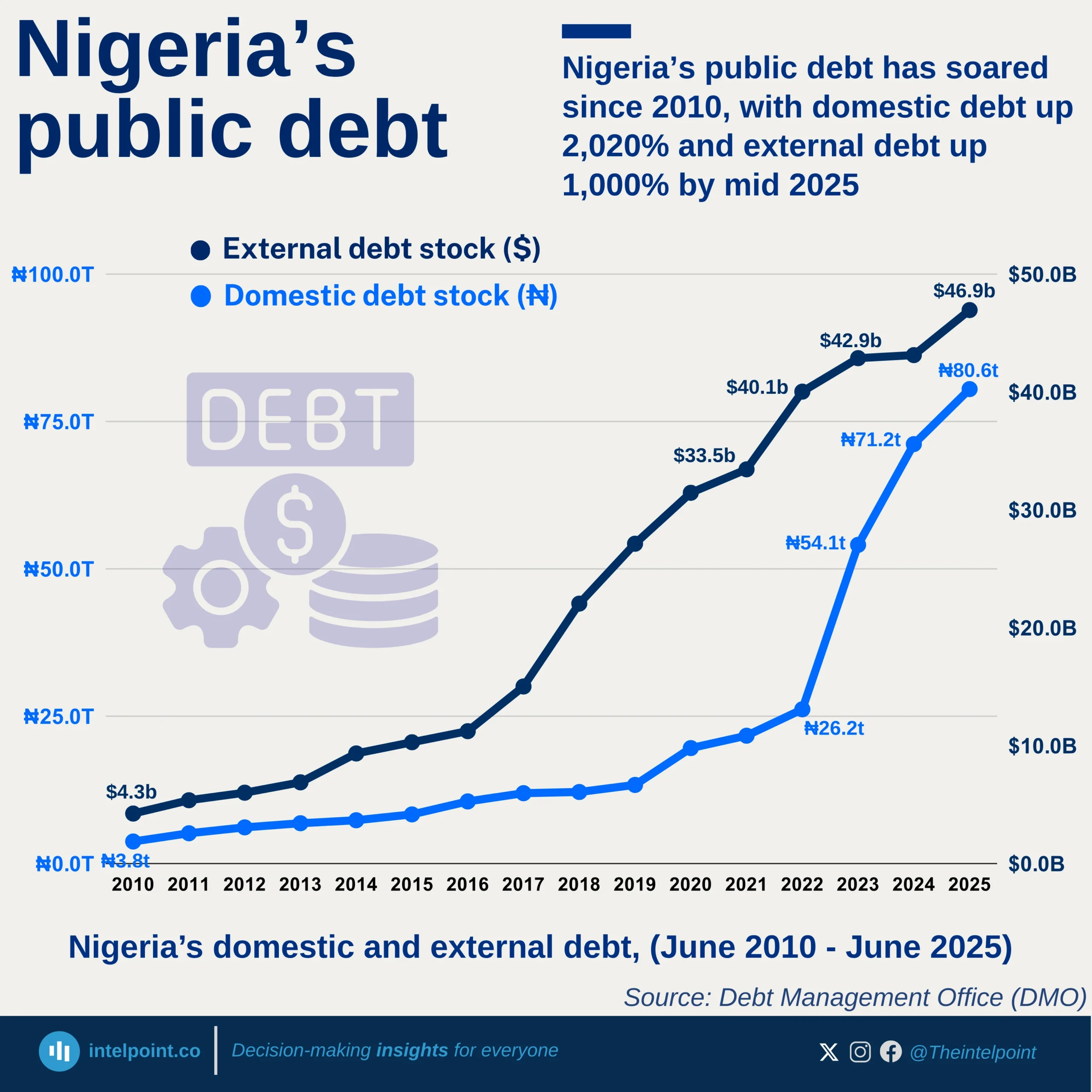

Africa's external debt is highly concentrated, with just 11 countries accounting for 69% of the continent’s total debt stock in the first half of 2024. South Africa, Egypt, and Nigeria hold 14%, 13%, and 8% of Africa’s external debt, respectively.

A closer look at the data shows that North and Southern Africa dominate, with Egypt, Morocco, and South Africa collectively accounting for one-third of the total external debt. Meanwhile, some of Africa’s fastest-growing economies, such as Kenya and Ghana, also hold significant portions, each with 4% of the total debt stock. This raises questions about how these nations are managing their debt obligations amid growing economic challenges.