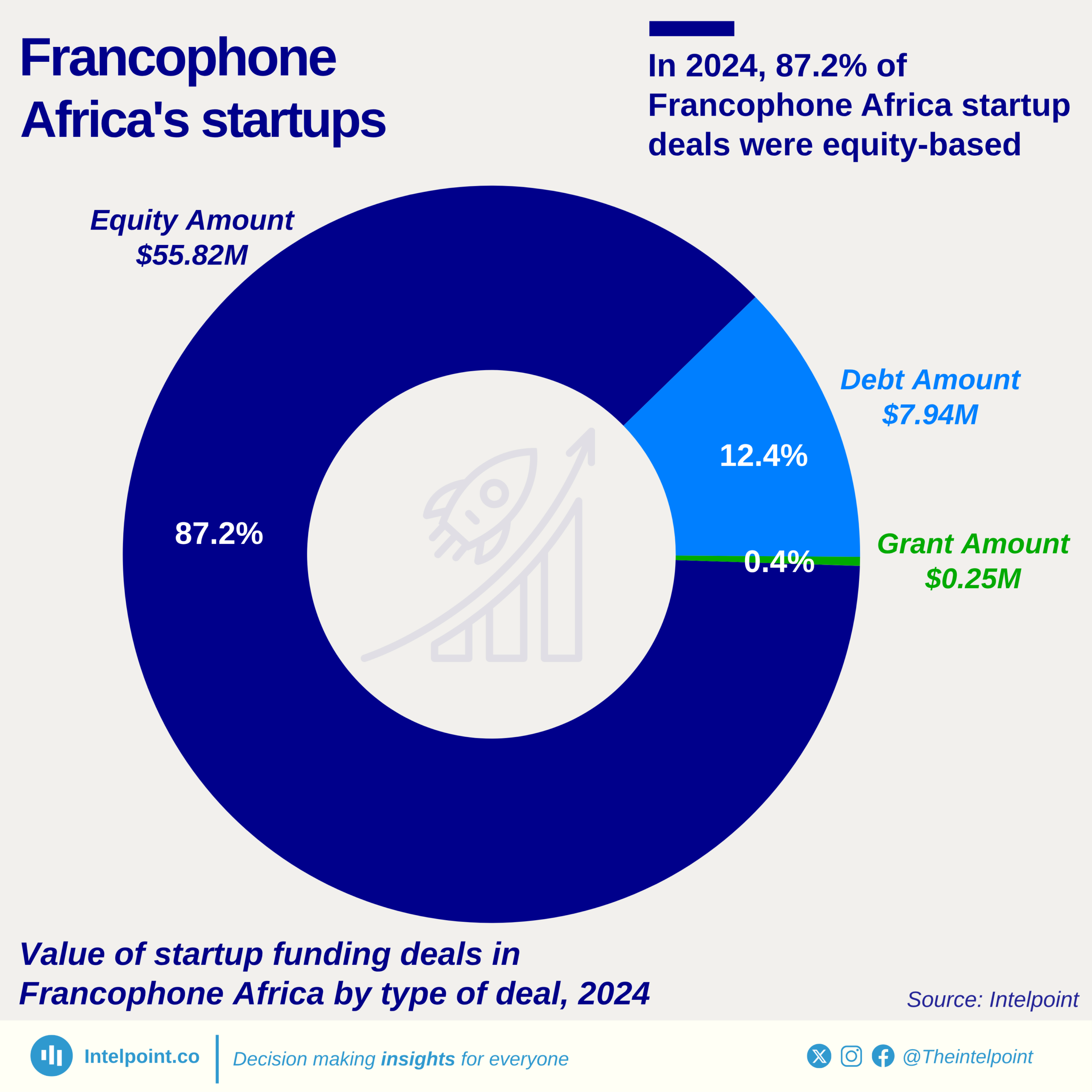

In 2024, African startups' funding was overwhelmingly driven by equity, which made up 74.1% of total capital raised, showing strong investor appetite for ownership and long-term growth potential in the ecosystem. Debt financing accounted for 25.2%, underscoring the growing role of credit and structured loans as alternative funding routes for startups. Meanwhile, grants represented just 0.7%, highlighting the limited availability of non-dilutive funding on the continent. The dominance of equity reflects robust investor confidence in African innovation, while the rise of debt suggests that startups are increasingly diversifying their financing strategies to scale sustainably.