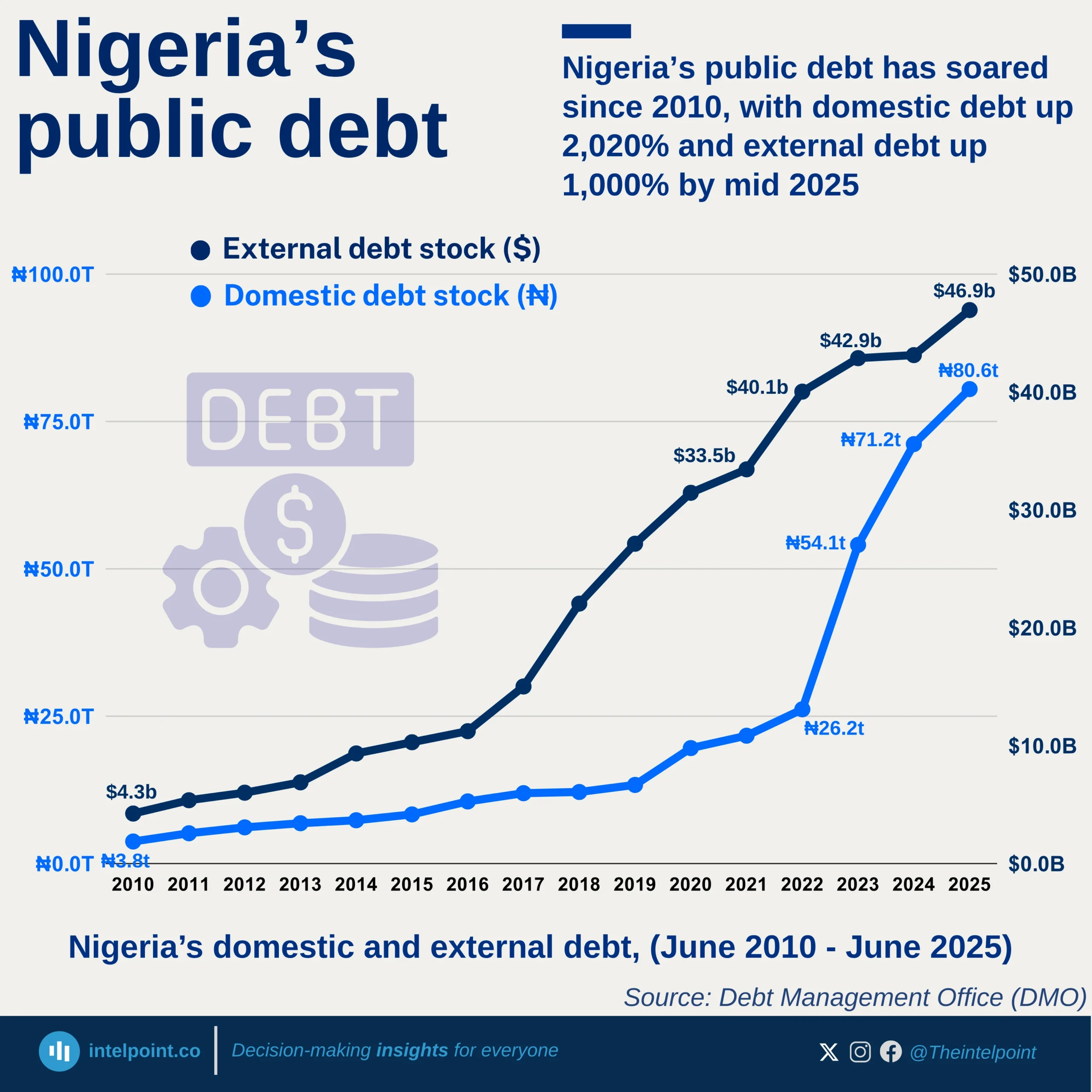

Nigeria paid a total of $57.67 billion in external debt interest from 1970 to 2023. Payments were low in the 1970s, rose steadily in the 1980s, and fluctuated in the 1990s due to debt restructuring.

In 2005, interest spiked to $5.31 billion following a strategic debt buyback that accelerated previously scheduled obligations. Since 2009, annual payments have surged 1,139.6%, climbing from $0.31 billion to $3.79 billion in 2023.

This trend highlights how borrowing patterns, targeted fiscal interventions, and rising commercial debt costs have shaped Nigeria’s external debt service over five decades.