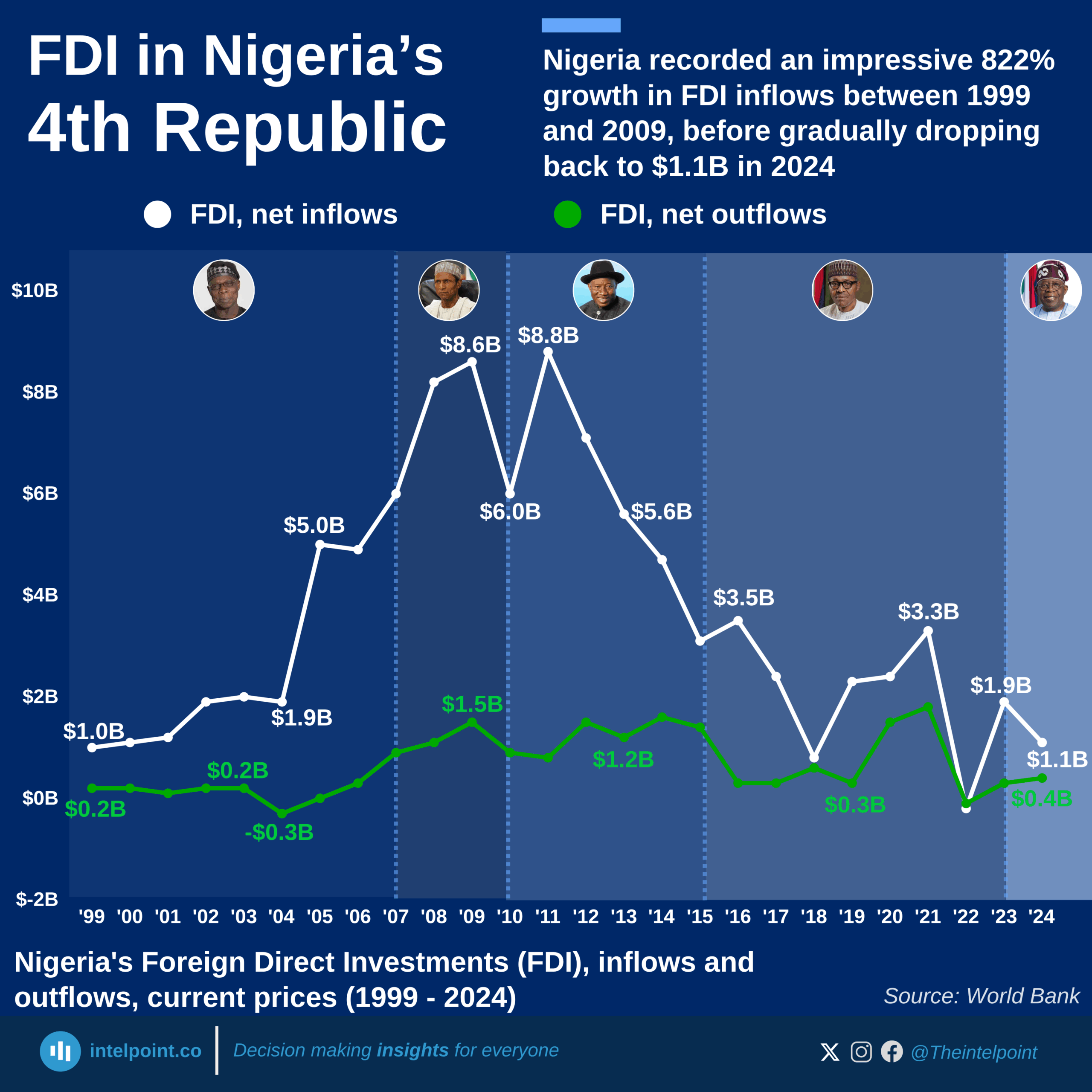

From 1990 through 2024, Egypt has steadily built itself into the top destination for foreign direct investment in Africa, amassing $195.2 billion, thanks to its diversified economy, Suez Canal corridor, and sustained infrastructure spending. South Africa, long seen as a gateway economy, attracted $151.0 billion, while Nigeria, despite its oil wealth and population size, trails with $110.7 billion, likely due to persistent regulatory and security challenges.

Morocco and Mozambique are standout mid-tier performers, drawing nearly $60 billion each, reflecting successful mining, energy, and manufacturing policies. Ghana and Ethiopia, with $48.8 billion and $46.4 billion respectively, reflect growing investor interest in West and East African growth hubs. DR Congo, Algeria, and Congo (Brazzaville) all exceed $30 billion.