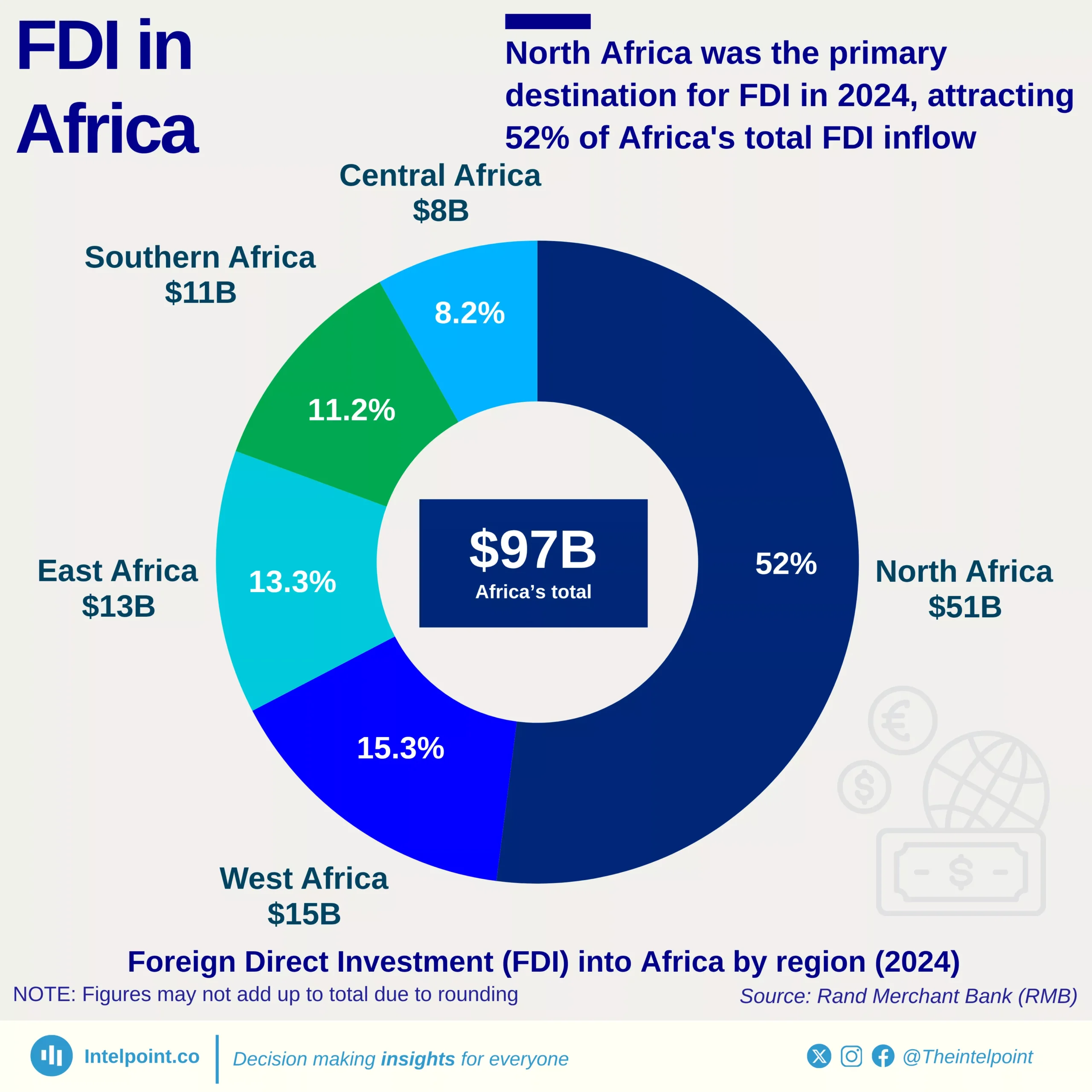

In 2024, global foreign direct investment (FDI) rose modestly to $1.51 trillion, continuing a gradual post-pandemic recovery but still far below the $2.2 trillion peak of 2015, with Egypt’s inflows growing more than 370% year-on-year.

The United States, Singapore, and China remained the top destinations, drawing over $538 billion combined. Capital flows continued to concentrate, with just 10 countries accounting for 63% of global FDI. Among them, the standout was Egypt, which climbed to 8th place globally with $46.6 billion, outperforming larger economies like the United Arab Emirates and Mexico.

This dramatic leap, driven by a $35 billion UAE-backed megaproject in Ras El-Hekma and sweeping domestic reforms, marks a rare moment where an African country disrupts the global investment hierarchy.