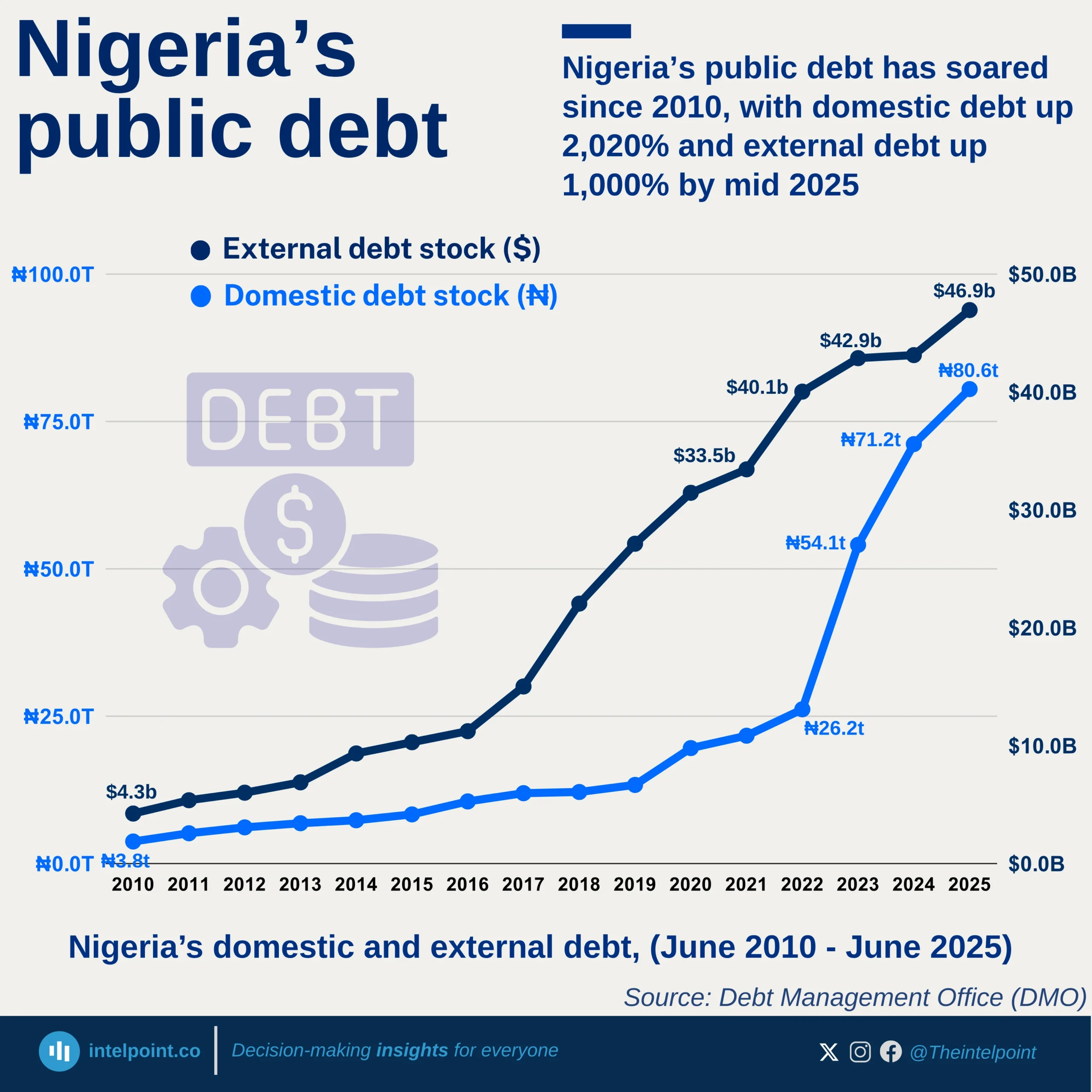

The share of external debt in the country’s total public debt has increased from 26.64% in 2017 to 46.96% in the first half of 2024. This represents a clear trend of rising external borrowing, reducing the dominance of domestic debt in the overall debt structure. External debt has nearly doubled its share within this period, while domestic debt has seen a corresponding decline.

In 2017, domestic debt accounted for over 73% of total public debt, but by 2024, it had dropped to just 53%. This shift highlights a growing reliance on foreign borrowing, which could have implications for debt servicing costs, exchange rate fluctuations, and overall economic stability.