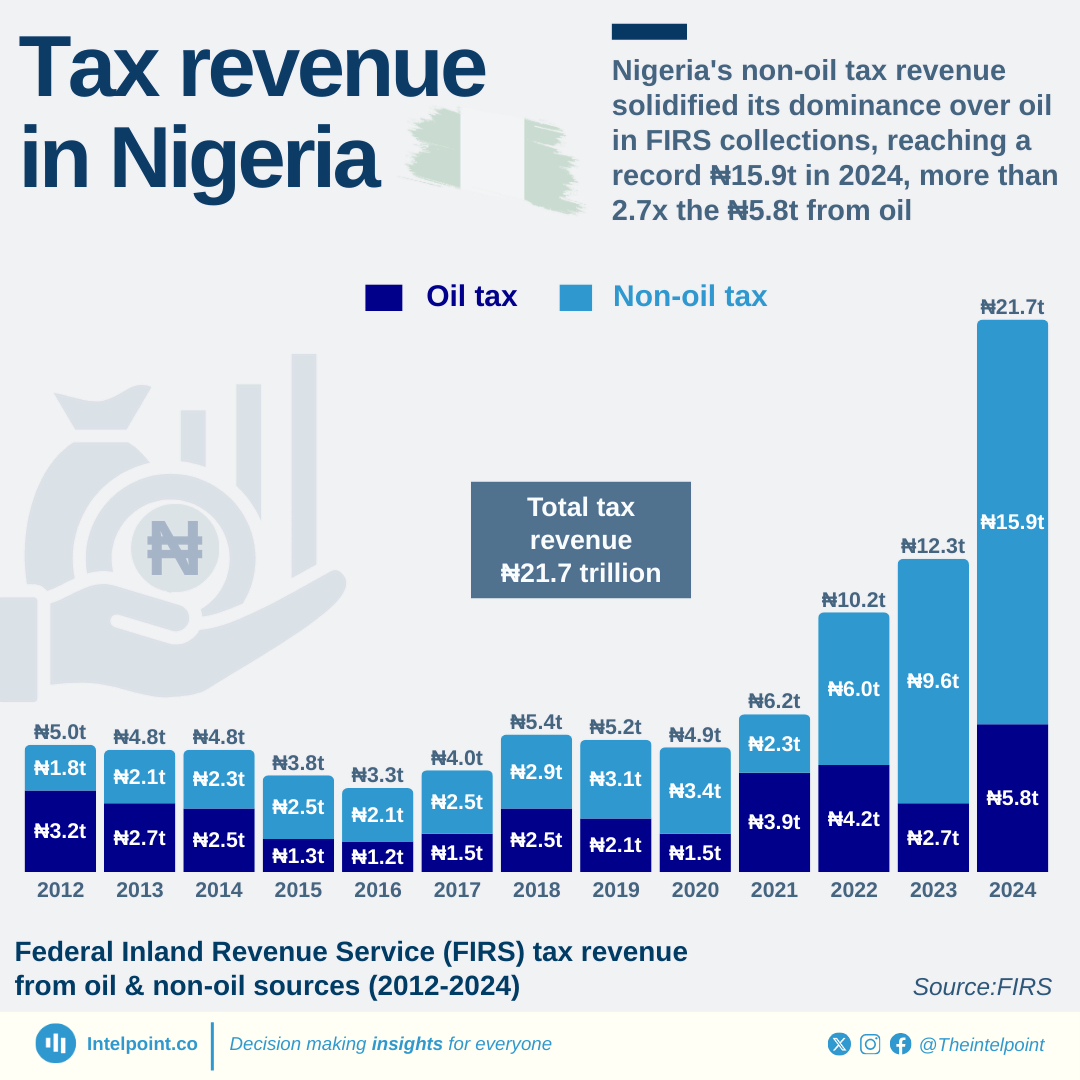

Nigeria’s diversified tax revenue structure now has company income tax (Non-Oil) leading the pack at ₦6.54 trillion, equivalent to 30.15% of total revenue. This suggests that despite Nigeria's historical reliance on oil, private sector and corporate activities outside oil and gas are now the top drivers of tax revenue.

Closely behind is NCS-Import VAT, which contributed ₦5.13 trillion or 23.63%, reaffirming the critical role of trade and customs revenue. With Nigeria being a high-import economy, VAT collections on imports have become a dependable and predictable revenue stream.

Oil-related taxes, notably Petroleum Profit Tax (₦3.92 trillion) and CIT (Oil & Gas) (₦1.84 trillion), together account for over ₦5.7 trillion or roughly 26.5%, which shows that while oil is still important, its dominance has been overtaken by non-oil sources, a trend consistent with fiscal diversification goals.

Smaller tax heads like Stamp Duty, Education Tax, and Non-Import VAT provide moderate revenue contributions, ranging between ₦1.5–1.6 trillion, indicating stable collection mechanisms in those areas.

On the lower end of the spectrum, categories such as Capital Gains Tax, NITDEF (National Information Technology Development Fund), NASENI (National Agency for Science and Engineering Infrastructure), and NPTFL (Nigeria Police Trust Fund) collectively contribute less than 2%, highlighting the potential for policy-driven improvement in enforcement, tax base expansion, or administrative efficiency.

Overall, this chart demonstrates a shifting tax landscape where non-oil sources are becoming more dominant, and import-related collections remain strong, while smaller and newer taxes present opportunities for enhanced growth through reform or enforcement.