Nigeria’s currency journey began in 1973 with decimalisation, replacing the pound with the naira and kobo at a fixed rate of £1 = ₦2. The Central Bank issued five denominations; 50 kobo, ₦1, ₦5, ₦10, and ₦20, marking the official birth of the naira.

As inflation took hold, the need for higher denominations grew. Between 1999 and 2005, Nigeria introduced ₦100, ₦200, ₦500, and ₦1,000, four new high-value notes that remain the highest today. These changes were not just cosmetic; they reflected real shifts in purchasing power and economic behavior.

Security concerns led to redesigns. In 1984, key notes were revamped to combat counterfeiting. Later, in 2007, the CBN phased out Ajami (Arabic) inscriptions for Roman script, unifying the note language. By 2014, the ₦100 note featured a QR code, signaling a push toward modern tech.

The boldest leap came in 2021 with the eNaira, Africa’s first Central Bank Digital Currency (CBDC). It marked a shift from paper to digital, even before many global counterparts. Then in 2022, the CBN redesigned the ₦200, ₦500, and ₦1,000 notes, Nigeria’s most circulated denominations, embedding enhanced security threads and reasserting control over the cash economy.

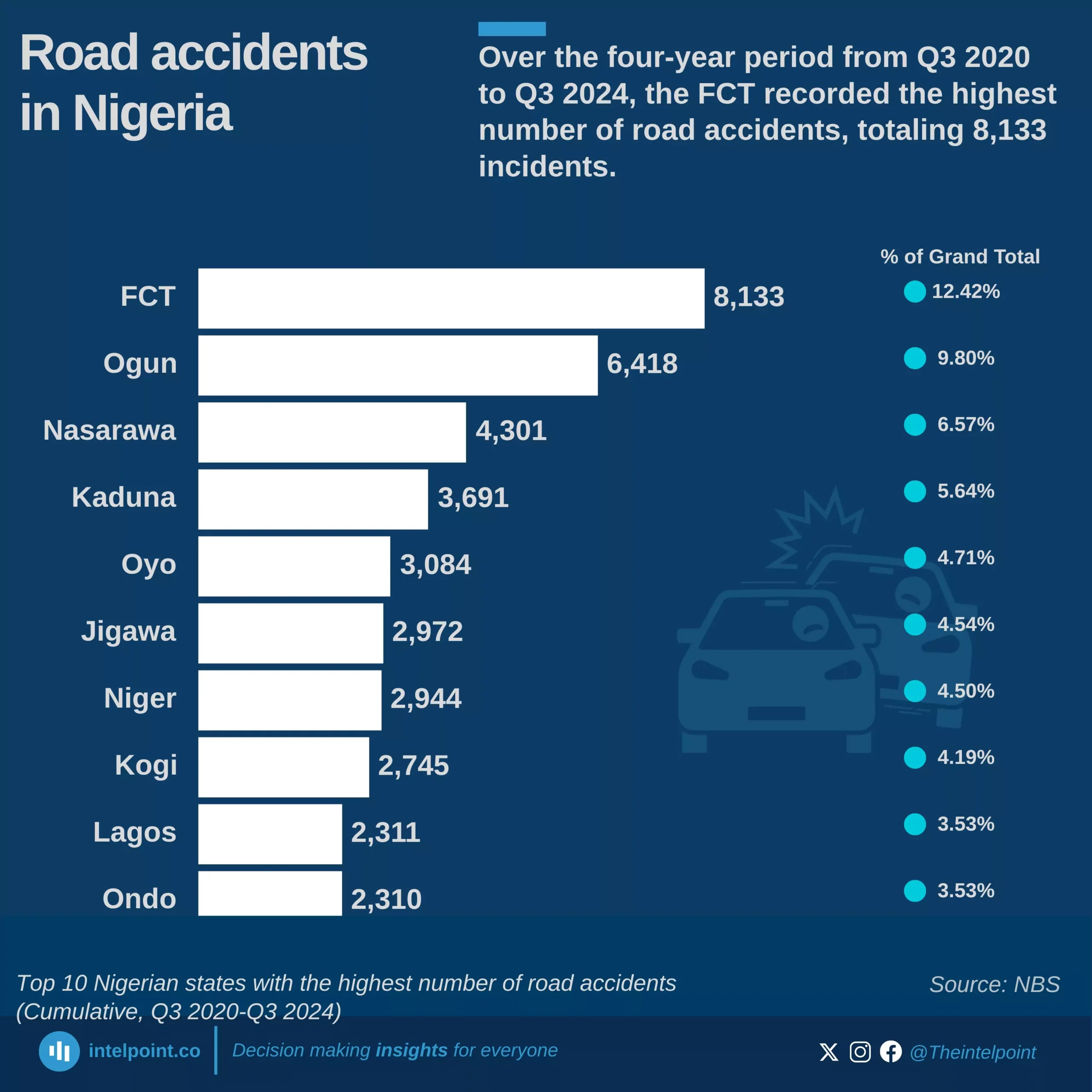

FCT, Ogun, and Nasarawa consistently rank as the top three states with the highest number of road accidents.

The FCT recorded its peak accident figures in 2022, particularly in Q2 (842 cases) and Q4 (864 cases).

In Q2 and Q3 of 2024, Ogun State surpassed the FCT in the number of reported accidents.

Across these three states, there has been a notable decline in accident numbers, with an average decrease of approximately 37.6% between Q2 and Q3 2024.