Key takeaways:

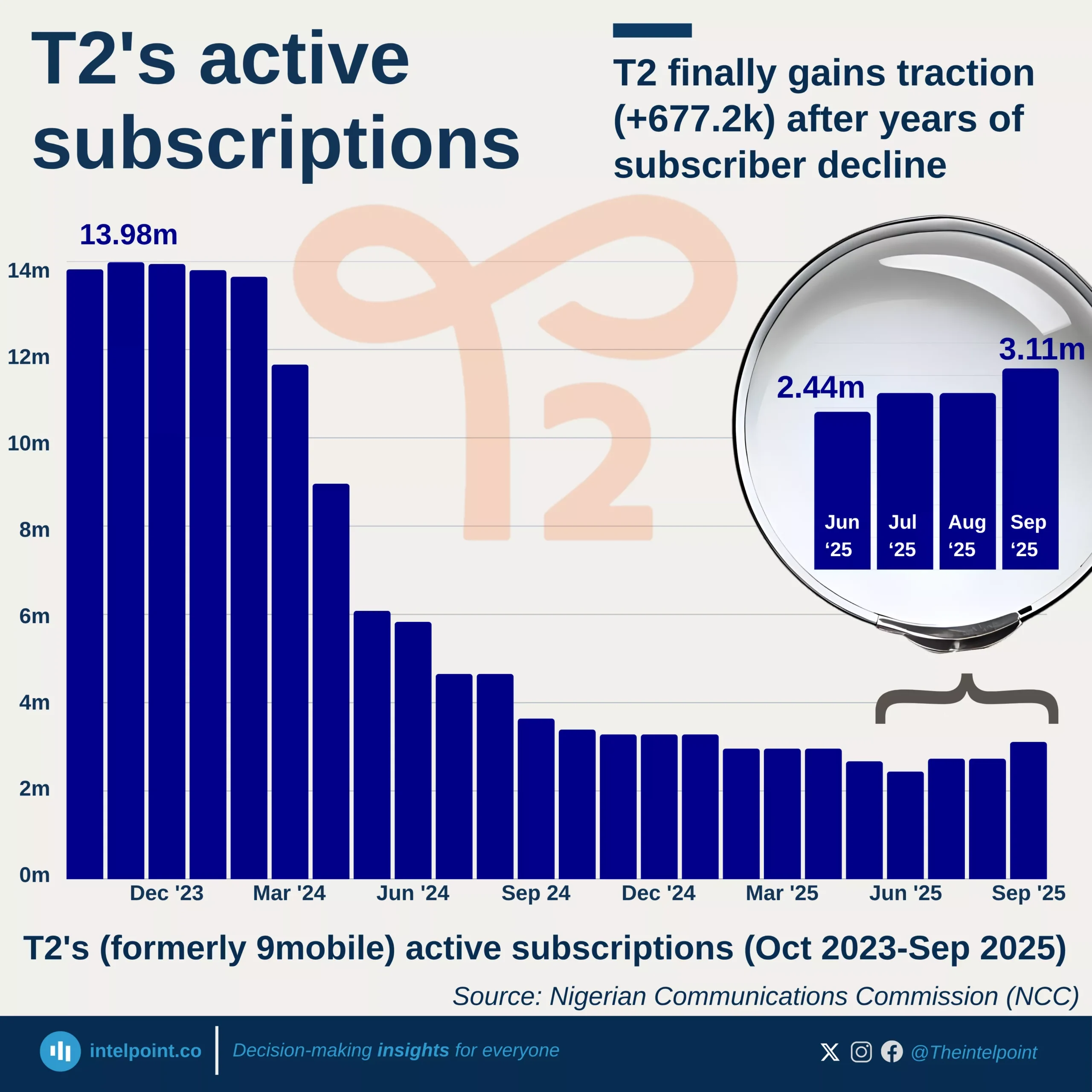

MTN Nigeria led in subscriber port-in traffic between June 2021 and April 2025, attracting most mobile users who switched from other networks. The rising trend began initially but picked up dramatically around mid-2023, most likely due to network upgrades, pricing schemes, or dissatisfaction with competing providers.

Airtel experienced incredible growth, particularly since mid-2024. From 698 users in June 2024, the number rose to 2,414 by January 2025. This growth moved Airtel closer to MTN's inflow levels, indicating successful competitive strategies, service advancements, customer engagement, or market campaigns.

The lowest port-in activity during the entire period was reported by Globacom, indicating a lack of traction among users switching networks. Even its biggest monthly results were modest compared to MTN and Airtel's peaks.