In 2013, Lagos State's Internally Generated Revenue (IGR) stood at ₦384.26B, but by 2015, it had dropped to ₦268.22B, reflecting economic challenges. The state rebounded gradually, surpassing ₦300B in 2016 and reaching ₦382.18B in 2018, signalling steady financial recovery.

A major breakthrough came in 2019, when IGR skyrocketed to ₦646.61B, the highest single-year jump, likely fueled by stronger tax enforcement and revenue diversification. By 2021, Lagos hit ₦753.46B, reinforcing its dominance as Nigeria’s economic hub.

However, 2022 saw a dip to ₦651.15B, possibly due to economic slowdowns or policy adjustments. Yet, in 2023, Lagos bounced back stronger, reaching an all-time high of ₦815.86B, marking a 112% growth from 2013.

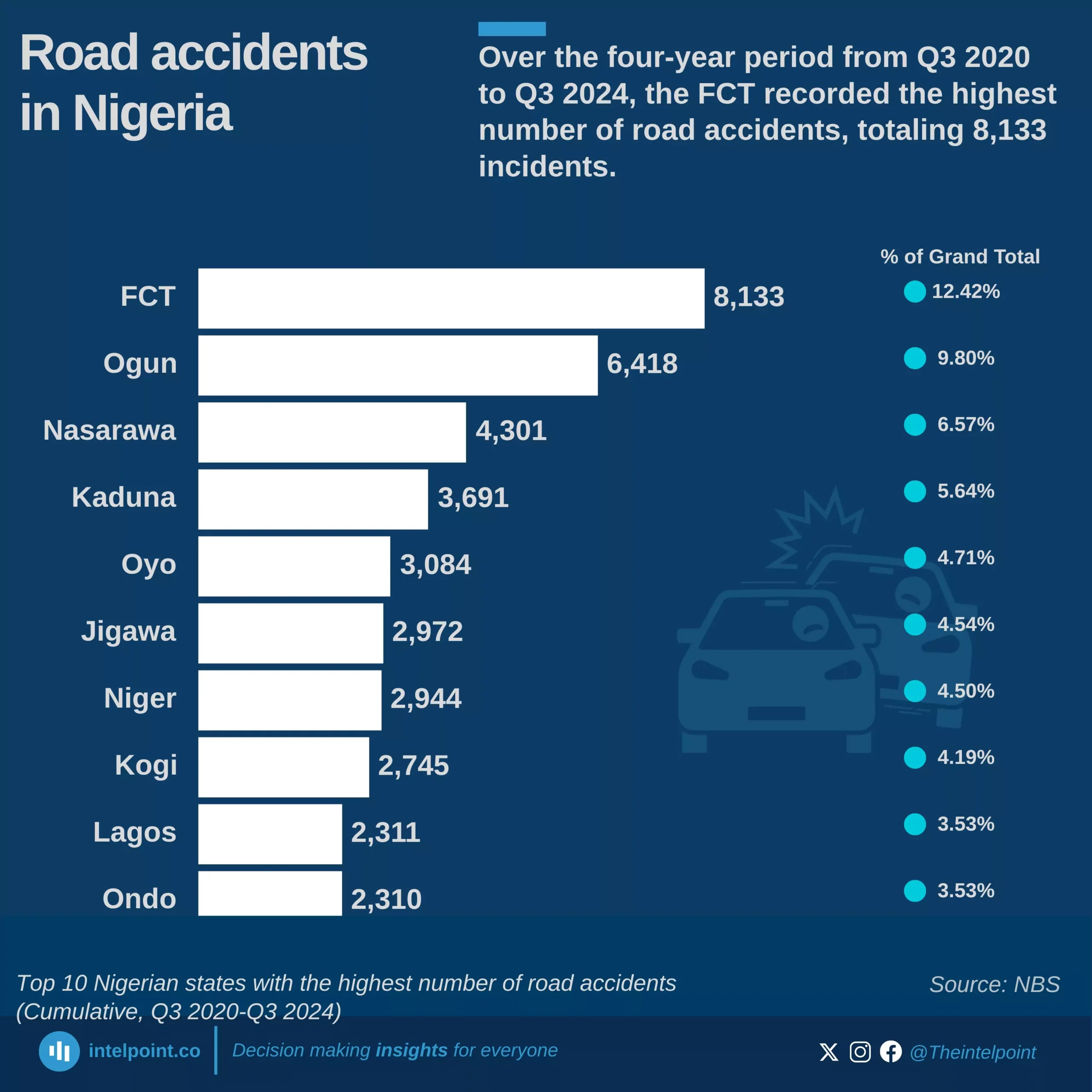

FCT, Ogun, and Nasarawa consistently rank as the top three states with the highest number of road accidents.

The FCT recorded its peak accident figures in 2022, particularly in Q2 (842 cases) and Q4 (864 cases).

In Q2 and Q3 of 2024, Ogun State surpassed the FCT in the number of reported accidents.

Across these three states, there has been a notable decline in accident numbers, with an average decrease of approximately 37.6% between Q2 and Q3 2024.