Key Takeaways:

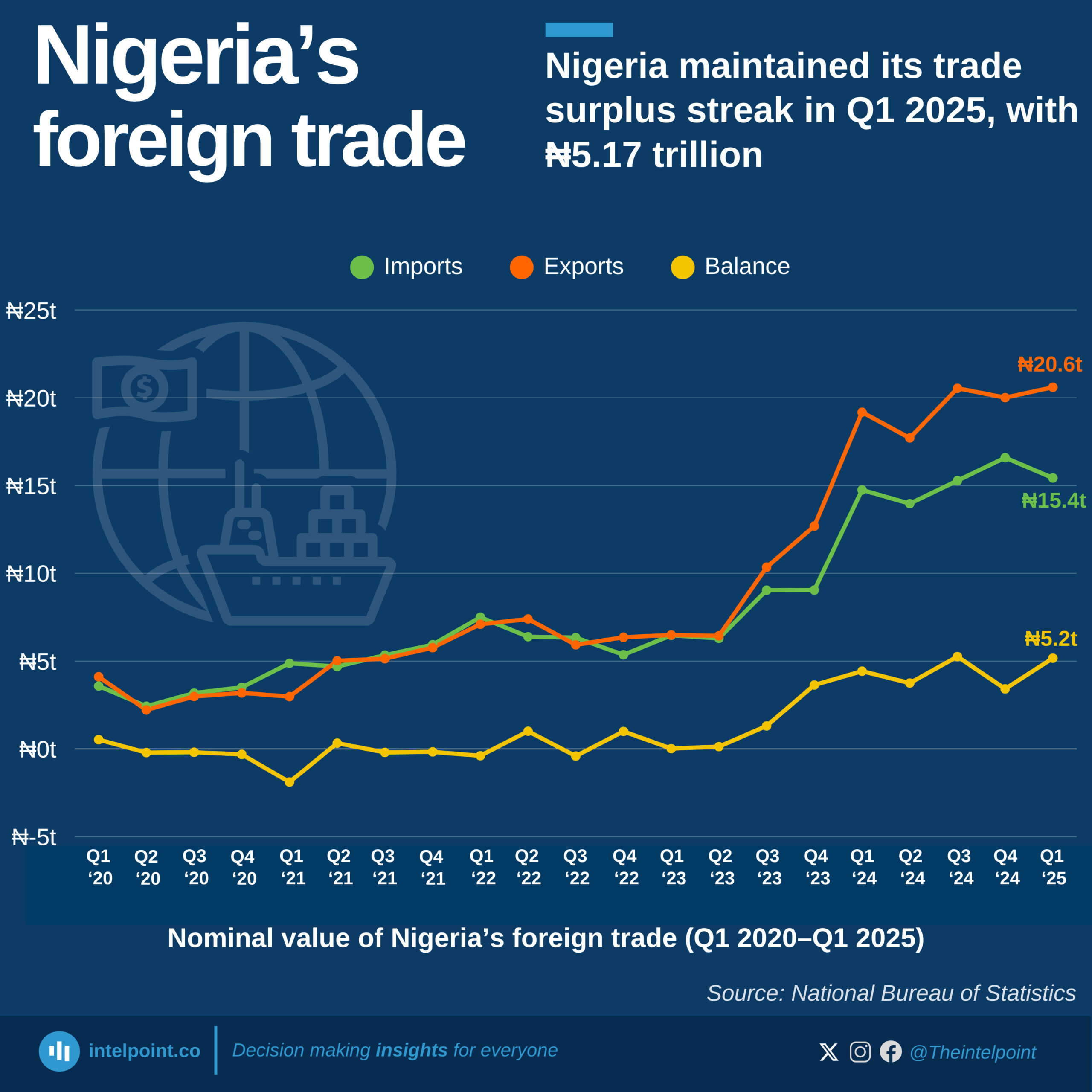

In the fourth quarter of 2024, Nigeria’s international trade depended predominantly on maritime transport. Sea routes facilitated the export of goods valued at ₦19.77 trillion and the import of goods worth ₦14.96 trillion.

Air transport played a more significant role on the import side, handling goods worth ₦1.50 trillion. It accounted for 9.03% of total imports, but contributed just 0.64% of export volume. Road and other forms of transport contributed minimally, with road accounting for less than 1% of both import and export trade.

Overall, Nigeria recorded a total trade value of ₦36.6 trillion across all modes, closing the quarter with a favourable trade balance.