Key Takeaways:

Nigeria's data service industry has substantially evolved over the last decade. On average, MTN maintained its dominance, growing from 26 million in 2013 to 75 million data subscribers in 2025. Airtel is nearly quadrupling its subscriber base, positioning itself as a strong second player in the telecom internet industry.

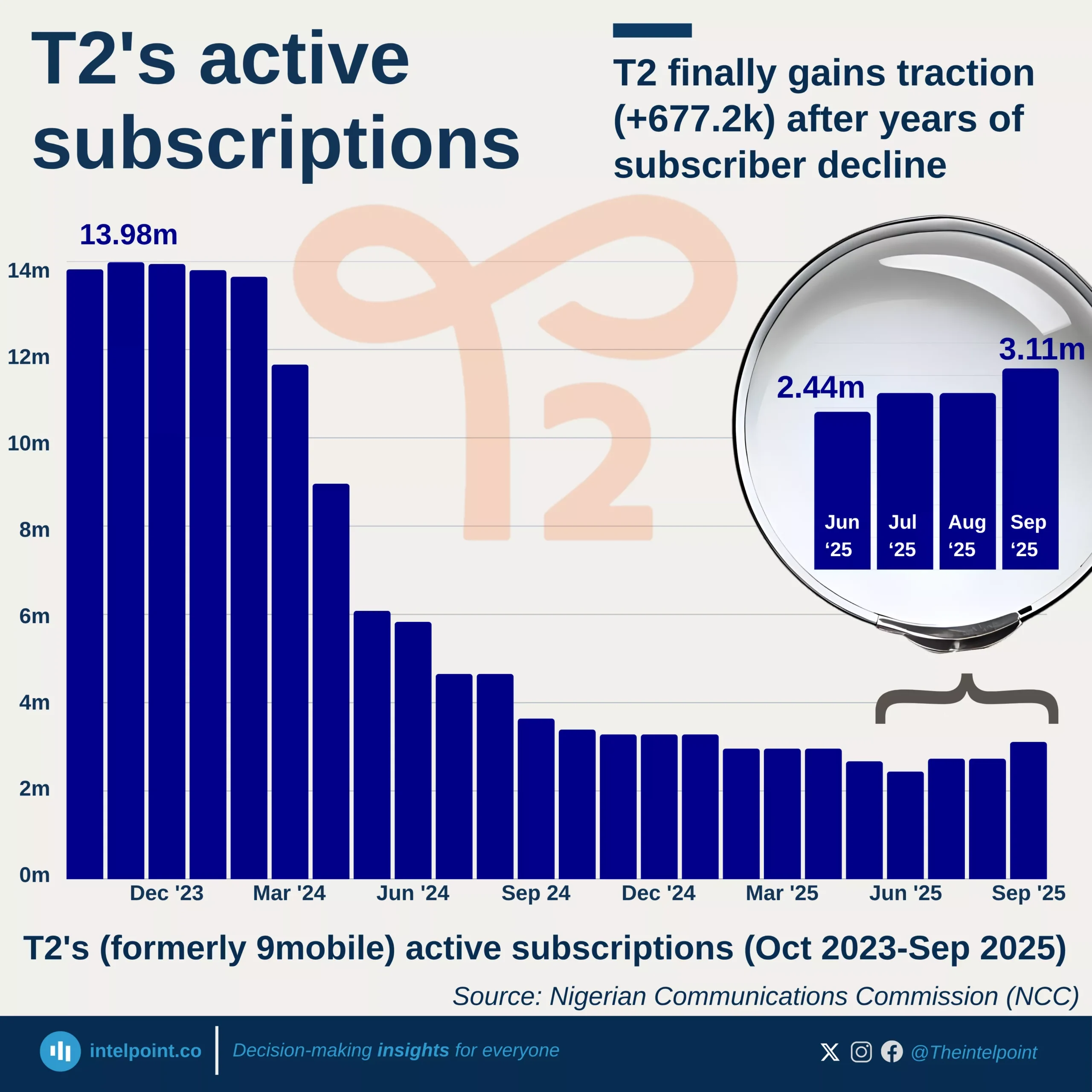

However, Globacom’s average internet subscriber base dropped drastically from 43.7 million in 2023 to just 15.8 million by 2025, signalling major market or operational challenges. In the same vein, 9mobile's average data subscriber base continues its downward trend that started in 2016, falling to less than 2 million users in 2025.

Furthermore, the sharp decline in Globacom's subscriber base since the second quarter of 2024 has significantly affected the year's average. This drop is mainly due to the deactivation of SIM cards not linked to verified NINs and an NCC audit, which found that Globacom had substantially overstated its subscriber numbers before the SIM-NIN linkage exercise, as reported by The Guardian and BusinessDay.