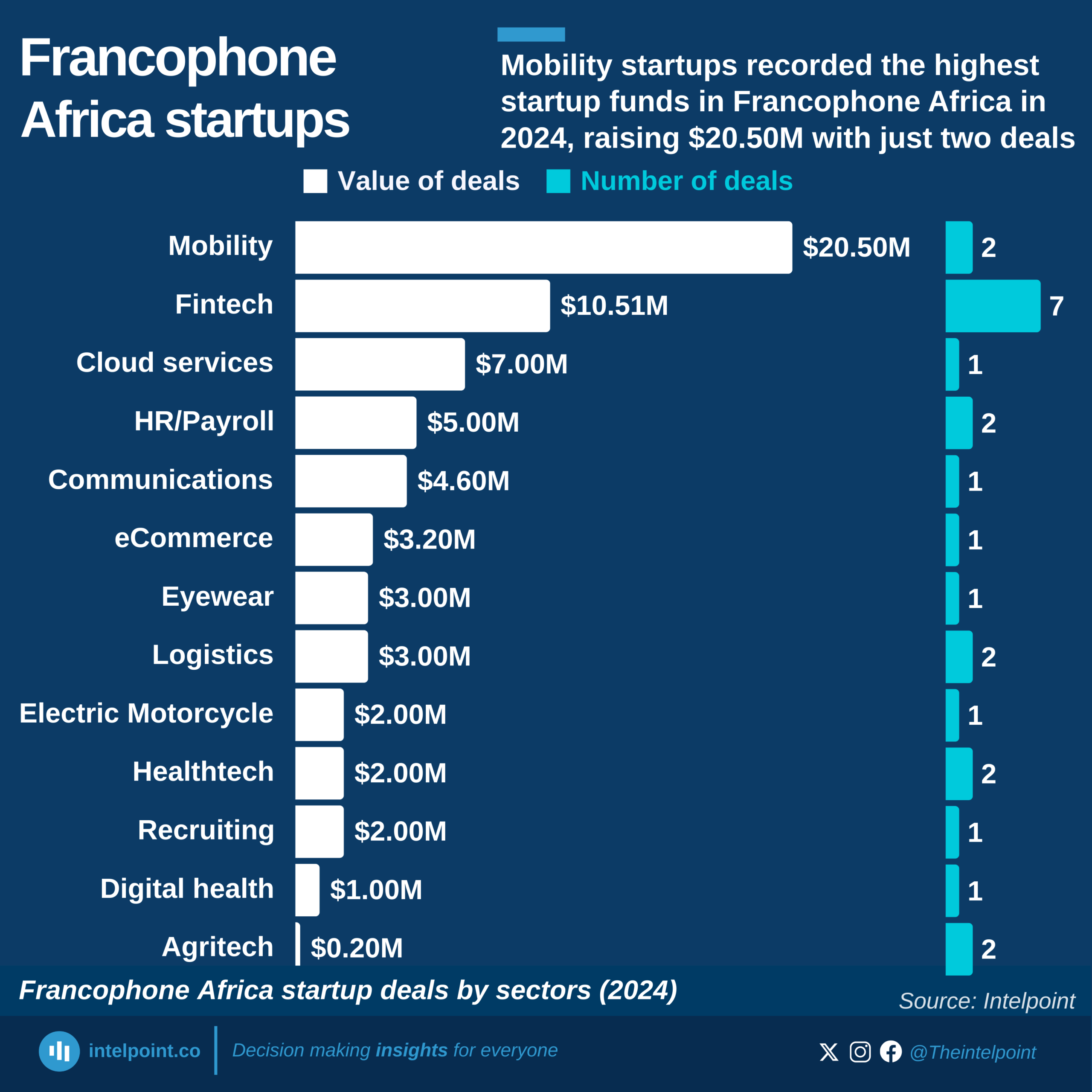

Just five countries account for over 52% of all private capital deal value between 2012 and mid-2024. This signals that investors are doubling down on countries where they perceive political stability, economic dynamism, and scalable markets.

At the top of this list is Côte d’Ivoire, capturing 25% ($1.2B) of the entire region’s deal value. That’s one in every four dollars of private capital flowing into Francophone Africa going to a single country. Senegal follows with 14.5% ($697M), and Madagascar, Rwanda, and DR Congo round out the top five with smaller but meaningful slices of the pie.