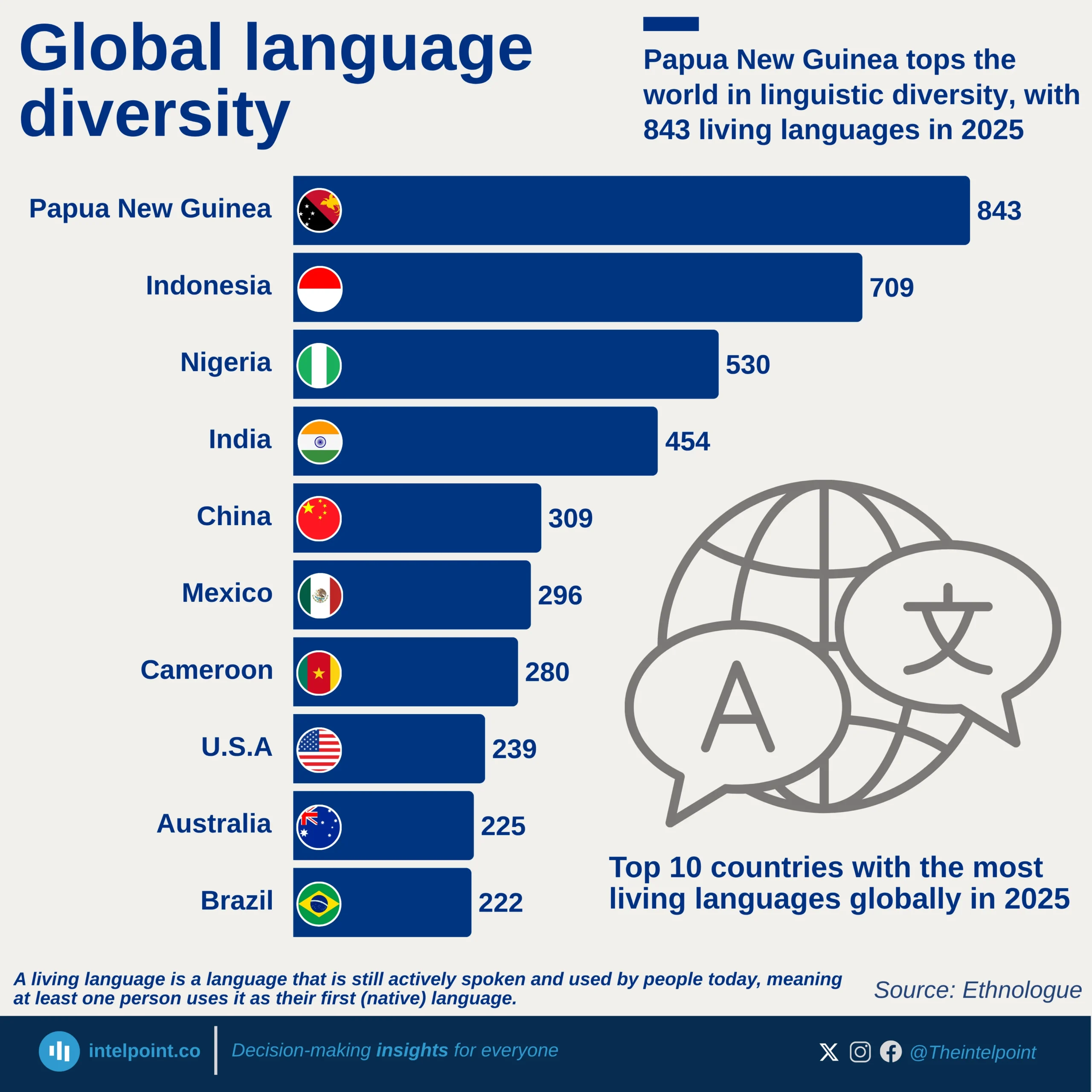

Languages remain one of the strongest indicators of cultural influence and global communication. English, with 1.5 billion speakers, continues to be the global lingua franca, widely spoken across continents for education, business, and diplomacy. Mandarin Chinese follows with 1.2 billion, underscoring China’s demographic and cultural strength, while Hindi, Spanish, and Standard Arabic reflect the combined impact of population size, historical spread, and regional dominance. European colonial legacies remain evident in the prominence of Spanish, French, and Portuguese, which maintain large global communities of speakers far beyond their countries of origin. Notably, African languages are gaining global relevance, with Nigerian Pidgin and Hausa ranking alongside established world languages.

This global linguistic landscape provides context for Nigeria’s recent decision to include Mandarin in its revised secondary school curriculum. By offering Mandarin as an optional subject alongside French and Arabic, Nigeria is not only aligning with global language trends but also positioning its next generation for opportunities in diplomacy, trade, and cultural exchange with one of the world’s most influential economies. The move illustrates how education systems adapt to the realities of global communication, ensuring students are equipped with languages that matter both regionally and internationally.