Key takeaways:

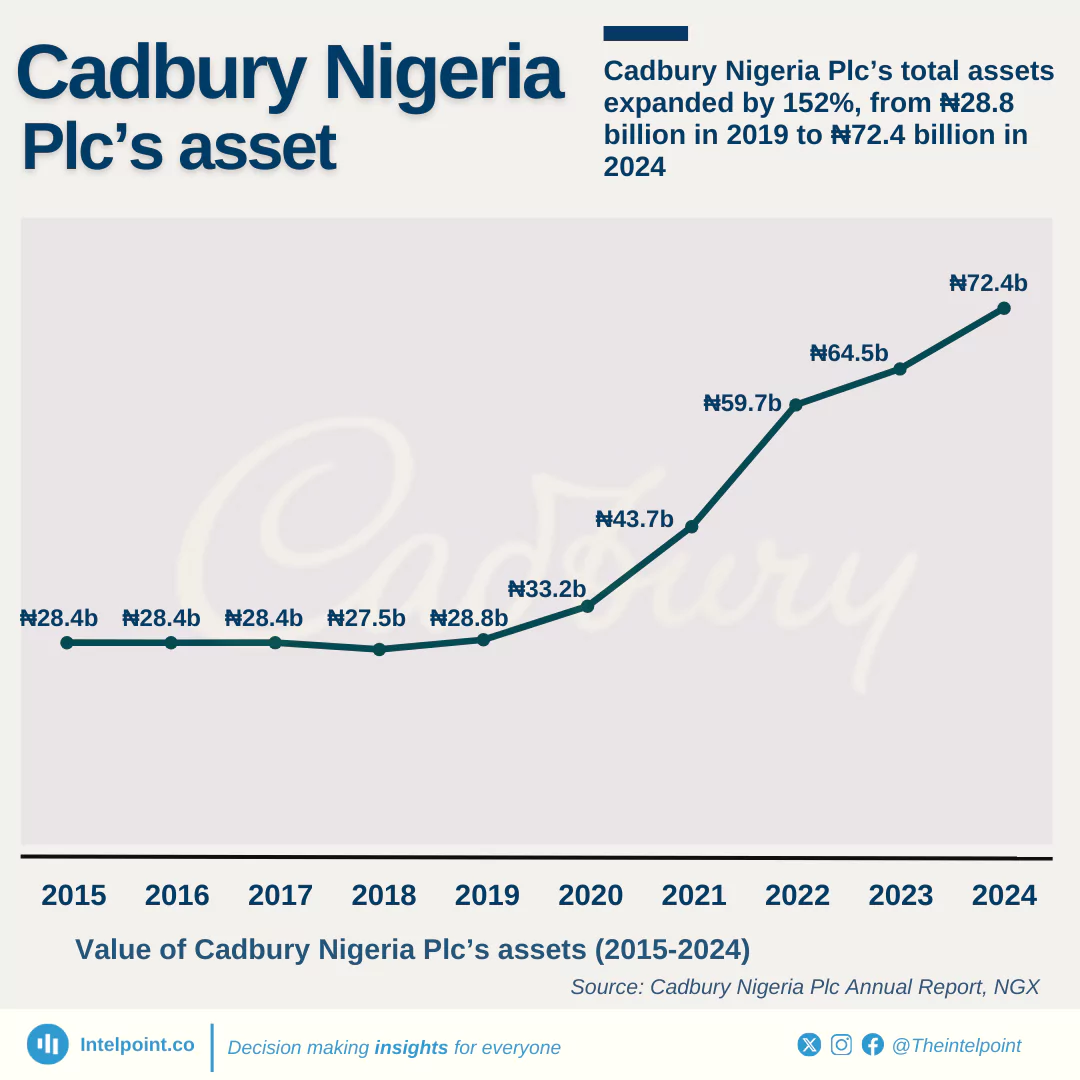

In 2021, the company's tax liabilities were stable, commencing with payments of ₦1.99 billion each in Q1 and Q2 and slightly increasing to ₦2.07 billion by Q4. This upward trend persisted into 2022, with tax payments gradually rising to ₦2.49 billion by Q4 2022.

However, the year 2023 introduced notable shifts. The company's income tax payments surged in the first half of the year, reaching ₦5.48 billion in Q1 and ₦7.09 billion in Q2. Contrarily, Q3 2023 witnessed a dramatic decline, with tax payments dropping to a mere ₦104.9 million.

By Q4 2023, the situation partially stabilised as tax contributions climbed back to ₦2.32 billion. This trend grew further in 2024, with Q1 exhibiting another substantial tax payment of ₦6.54 billion, followed by more varied payments in the next two quarters.