Key Takeaways:

Oando Plc experienced losses before tax in 2015-2016 but achieved profitability in 2017 and 2018. In 2019, profit before tax fell to a startling ₦377 billion loss. The impressive recovery in 2021 was short-lived, as it was followed by losses in 2022.

However, 2023 represented a remarkable turnaround, with the decade's greatest earnings, followed by ongoing strong success in 2024.

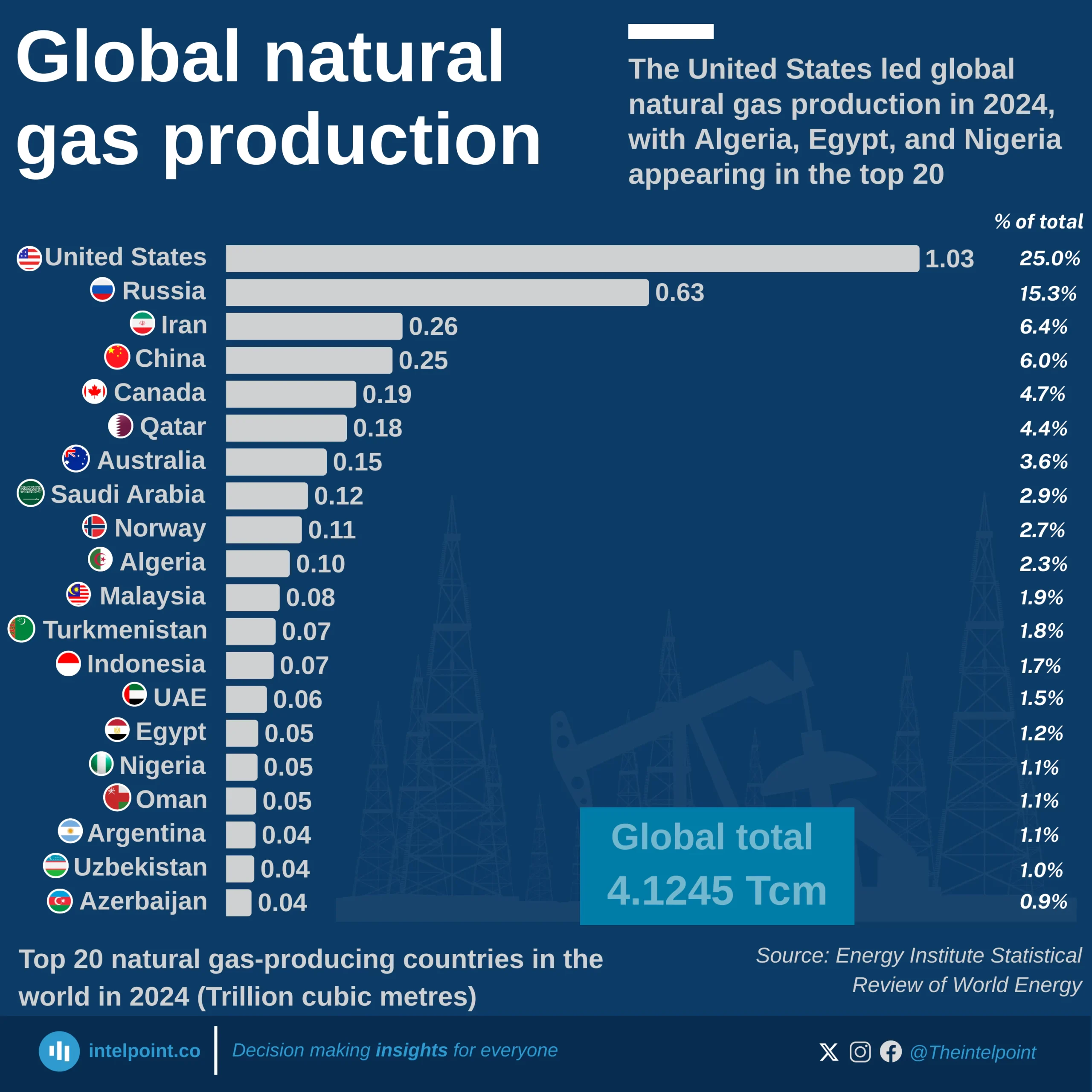

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.