Key takeaways:

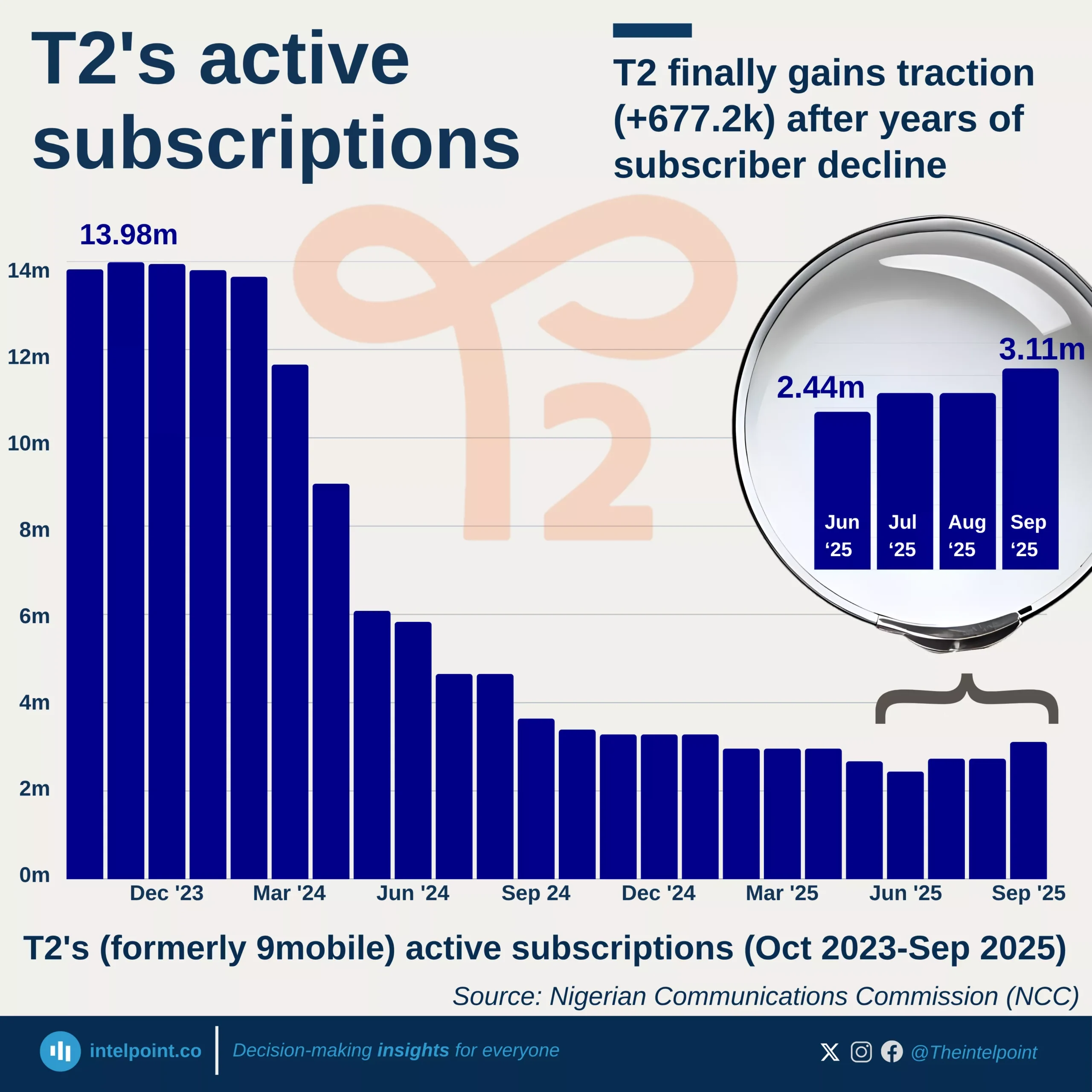

Between 2014 and 2015, 9mobile saw strong subscriber growth, reaching approximately 23.5 million in September 2015. However, its customer base has been on a decreasing trend since late 2015, with a brief and temporary recovery in late 2018 before continuing its downward trend in mid-2019.

From late 2019, the company's customer base stabilised until January 2024, when it began declining drastically from 13.8 million to less than 3 million by April 2025, representing an 87% loss in just over a year.

This massive loss could be attributed to ongoing service issues, poor customer experience, or competitive pressure from its competitors.