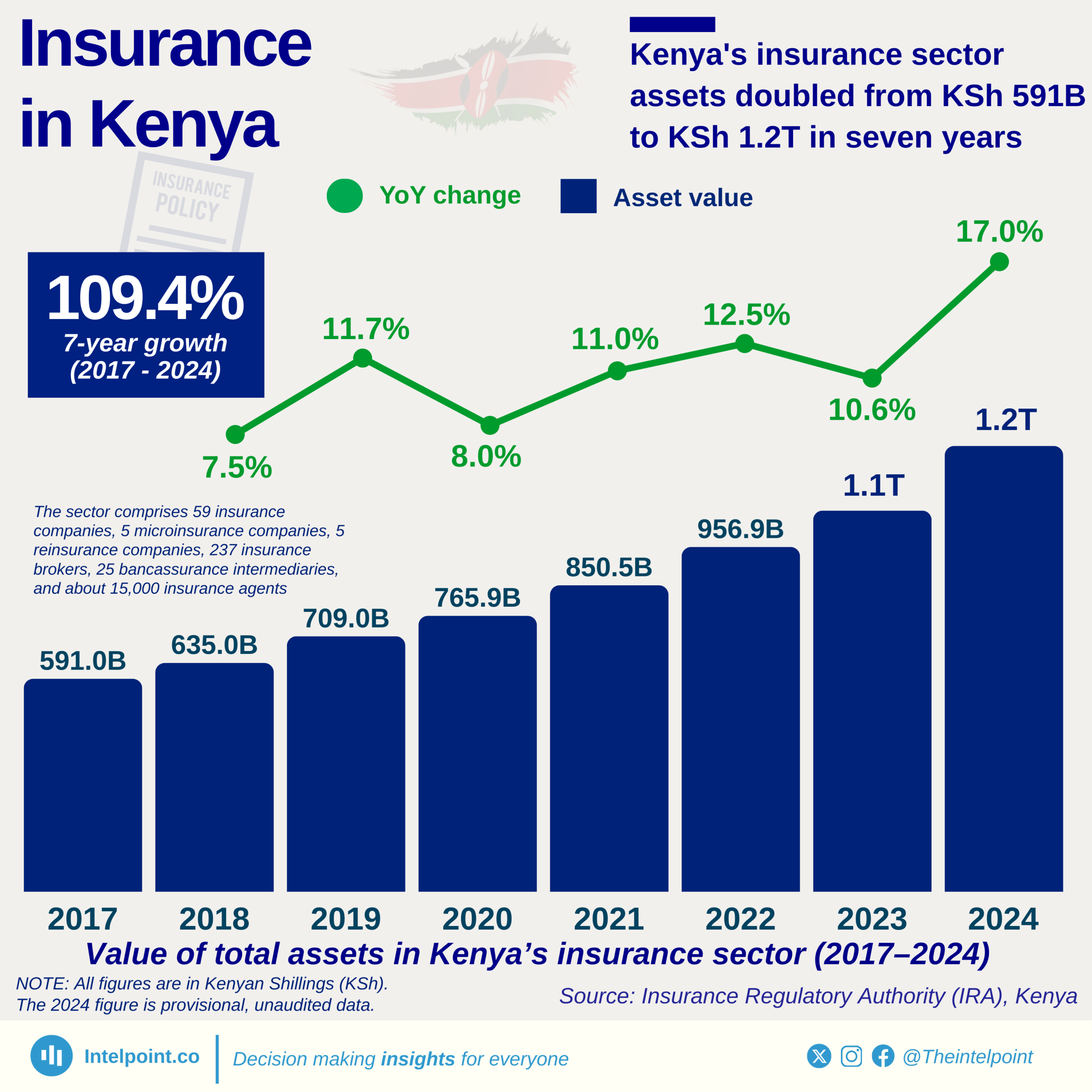

Kenya’s insurance sector has remained heavily reliant on government securities, which consistently make up more than two-thirds of the industry’s total assets between 2021 and 2024. This dominance underscores insurers’ preference for safe and stable investment options, particularly in a market where risk management is paramount. In 2024, government securities accounted for 71.1% of assets, maintaining their stronghold despite fluctuations in other investment classes.

While government securities dominate, other asset classes show shifting dynamics. Investments in subsidiaries, for example, declined from 11.9% in 2021 to 8.4% in 2024, suggesting insurers may be scaling back exposure to company-linked risks. Conversely, investment property and ordinary shares have maintained relatively stable shares, with property investment gradually rising to 9.4% in 2024, indicating diversification efforts. Term deposits, however, fell slightly from 8.6% in 2021 to 6.7% in 2024.