As of 2024, Africa’s oil wealth remains highly concentrated, with just a few countries controlling the bulk of recoverable reserves. Libya tops the list with 48.4 billion barrels, followed closely by Nigeria with 37.3 billion barrels. Together, these two nations alone hold nearly 60% of the total reserves listed among Africa’s top producers. Algeria, with 12.2 billion barrels, sits in third place and reinforces North Africa's dominance in oil endowment.

Beyond the top three, other African producers like Sudan (5.0b), Egypt (3.3b), Angola (2.5b), and Gabon (2.0b) hold more modest shares. Countries like Congo (1.8b) and Equatorial Guinea (1.1b) round out the list, pointing to the broader but thinner spread of reserves across Sub-Saharan Africa.

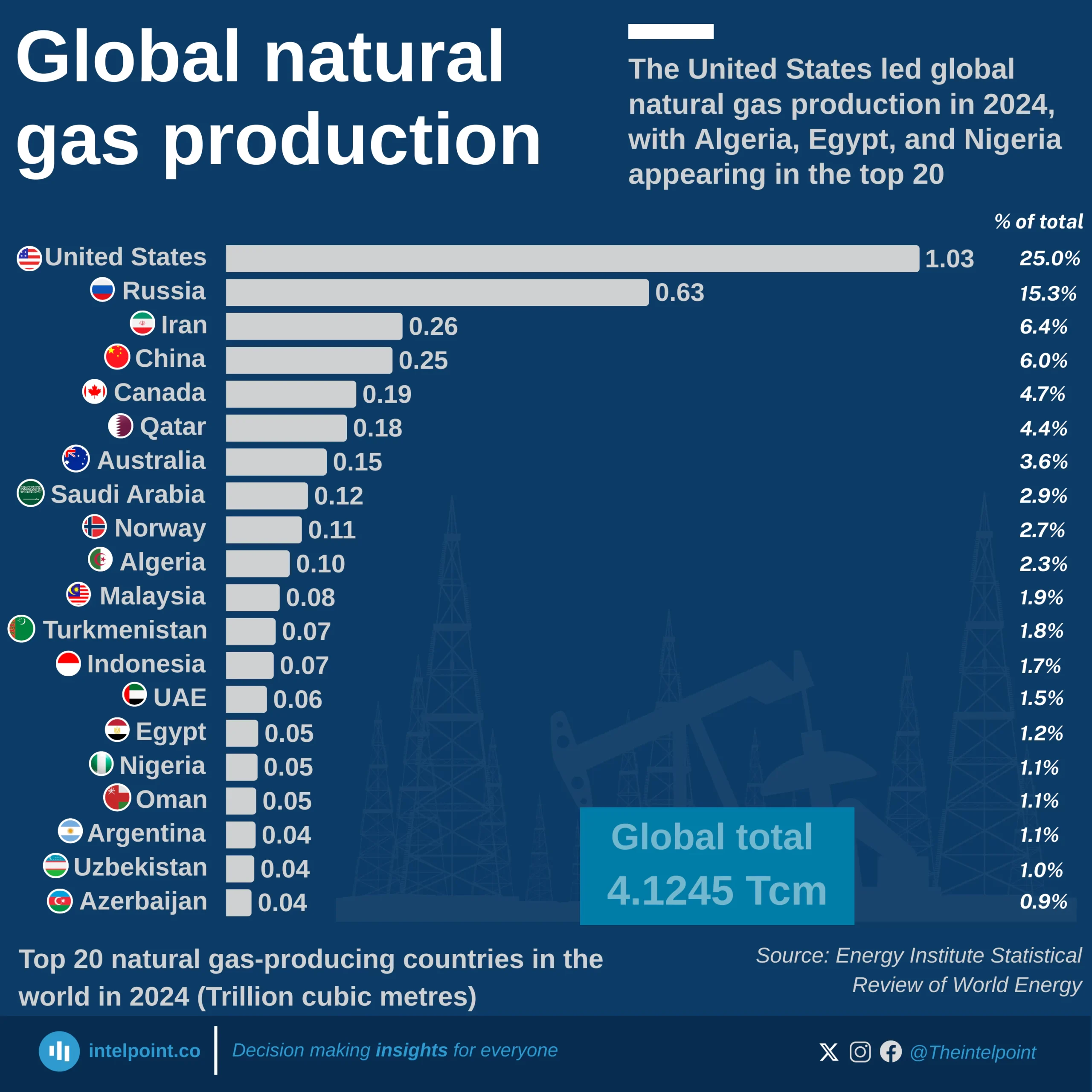

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.