Key Takeaways:

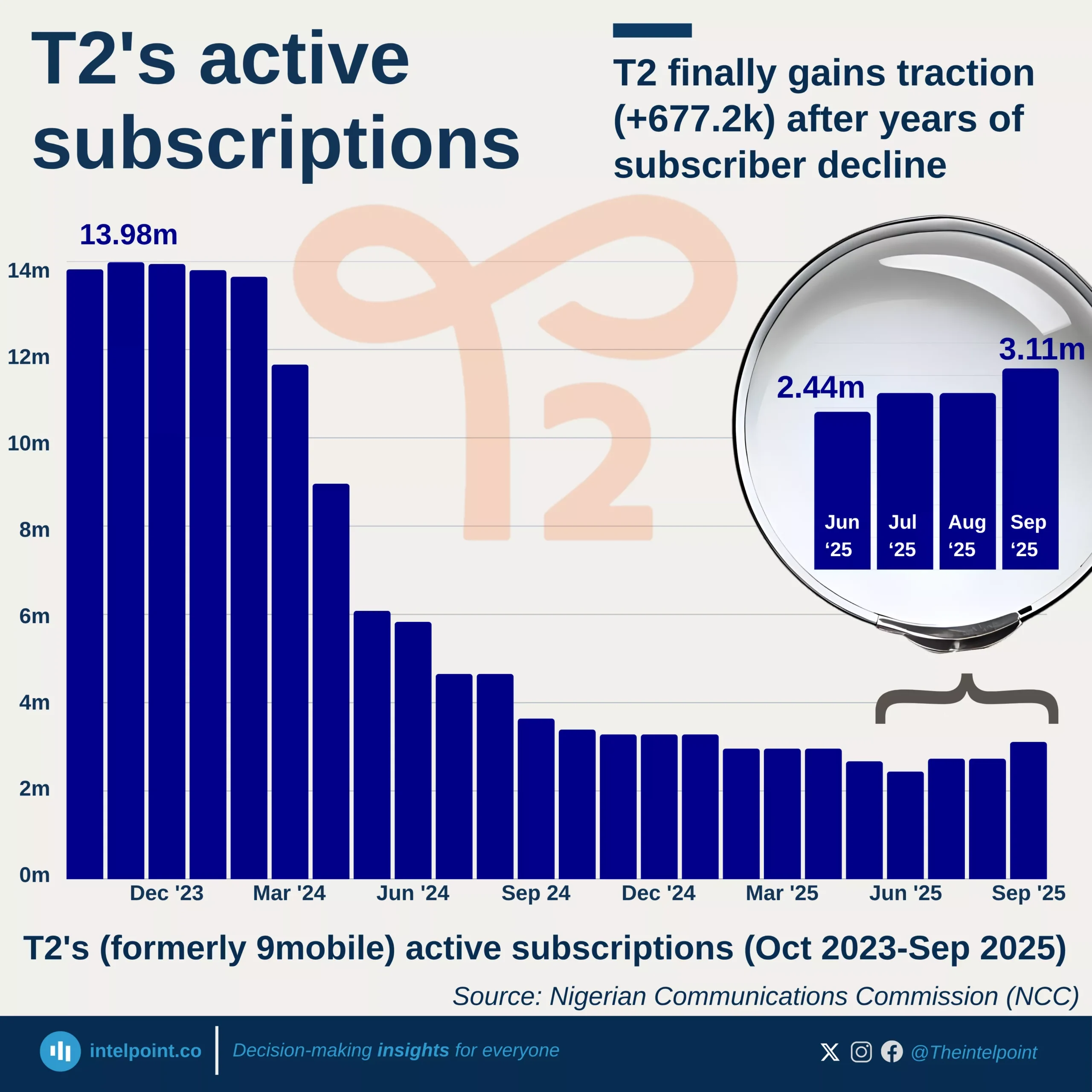

Between May 2023 and April 2025, 9mobile consistently recorded the highest share of customer exits, often accounting for 70% to 90% of total monthly port-outs. This persistent trend suggests ongoing customer dissatisfaction or competitive disadvantages.

Airtel and Globacom maintained modest port-out rates, while MTN displayed strong customer retention. MTN's port-out rates were mostly below 8%, except for a notable jump to 13.64% in January 2025. Globacom reported its highest customer loss rate of 24.1% in June 2023, while Airtel's highest loss share was in October 2023 at 14.6%.