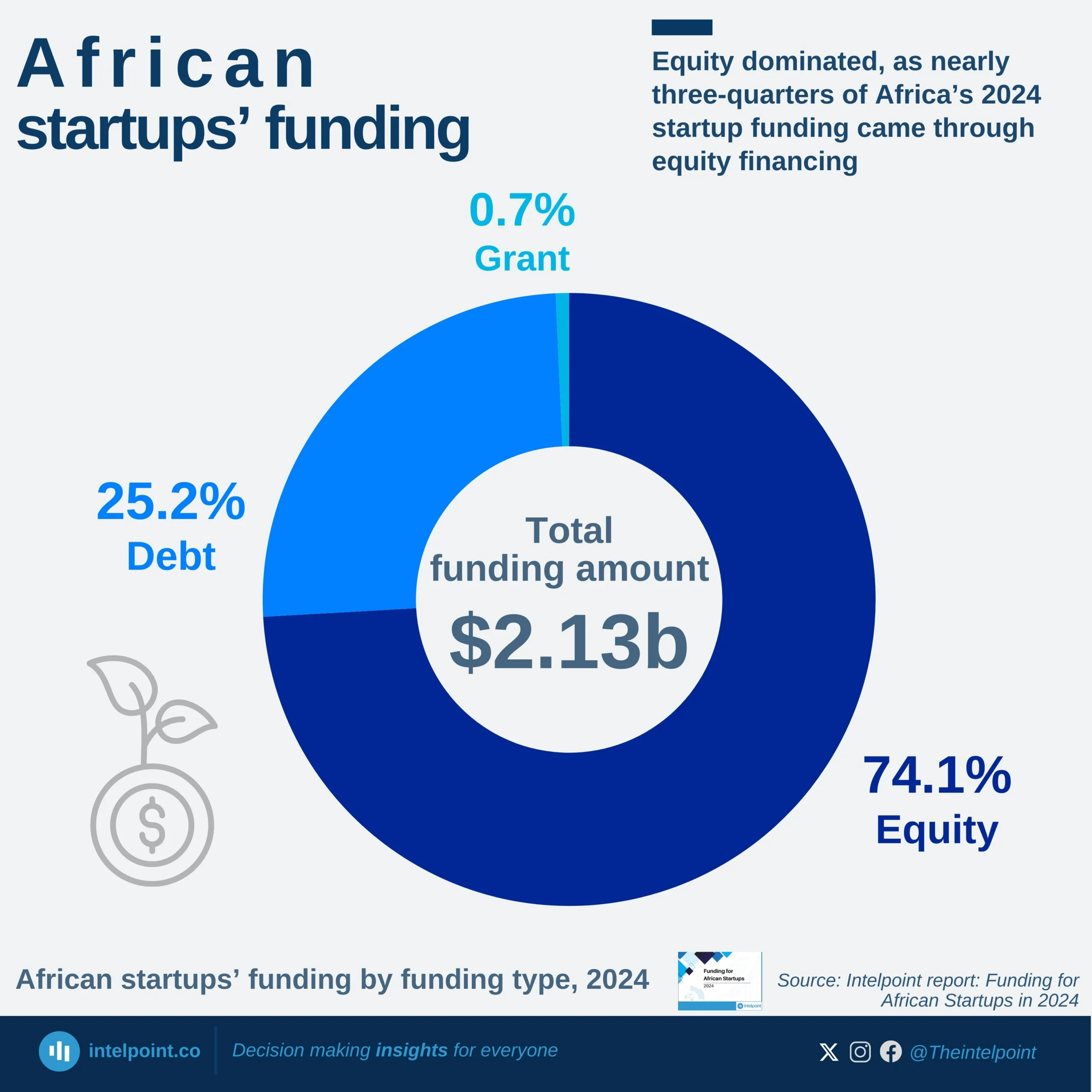

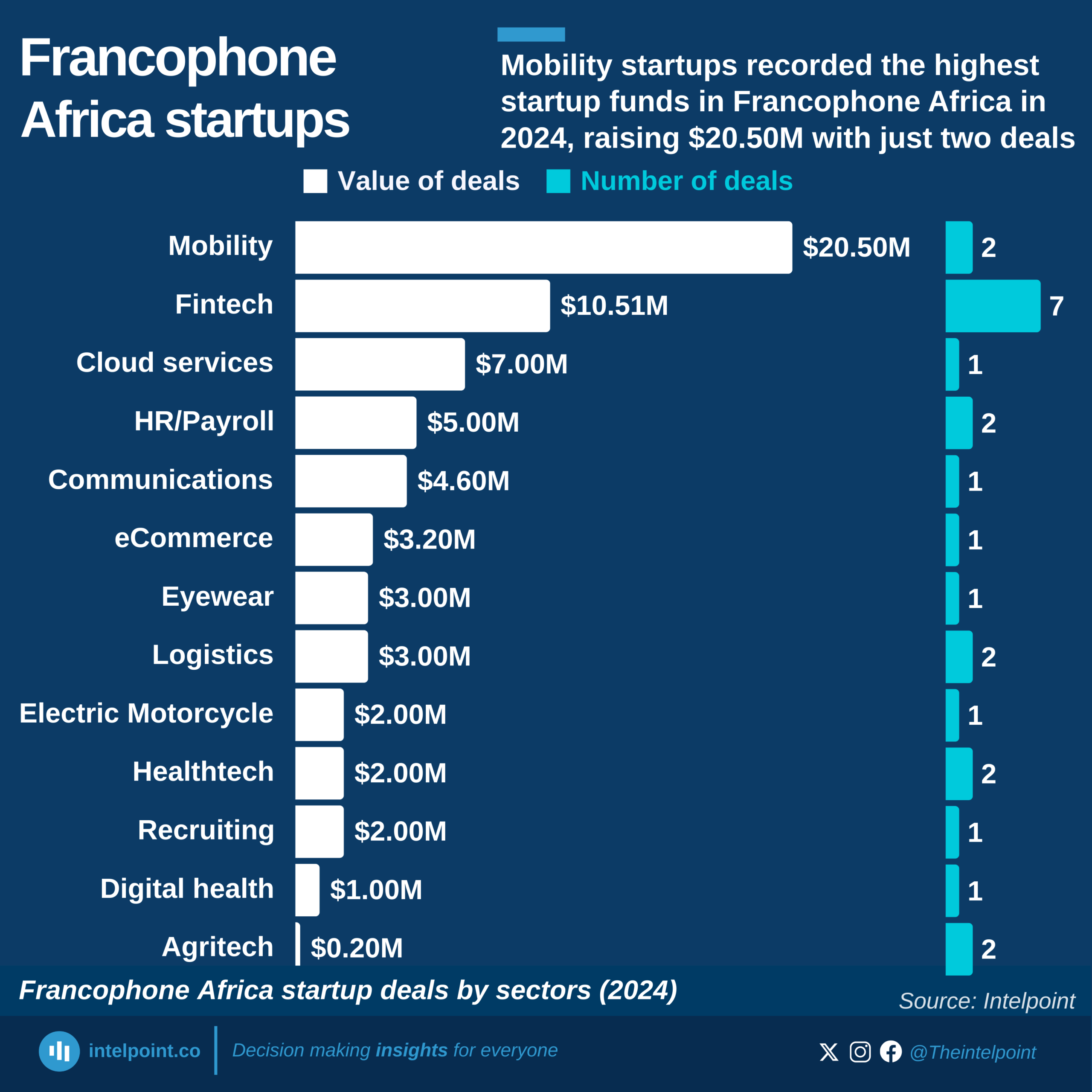

In 2024, 87.2% of startup deals in Francophone Africa were equity-based, totalling $55.82 million in value. This preference for equity financing (common for most startup funding activities worldwide) reiterates investors’ appetite for ownership and long-term commitment to ventures, signalling confidence in the scalability and future returns of these startups. Debt financing, while present, accounted for just 12.4% of deals ($7.94M), and grants were almost negligible at 0.4% ($0.25M), suggesting that most founders are raising funds by trading equity rather than relying on loans or free capital.

This dominance of equity-backed deals paints a picture of a startup ecosystem still heavily reliant on venture capital and angel investment, rather than institutional credit or government-led innovation support. In more developed markets, there's often a healthier mix of equity, debt, and grants, indicating more mature financial ecosystems and risk-sharing structures. But in Francophone Africa, startups seem to be navigating limited funding options by leaning into the type of capital that most aligns with risk-tolerant investors.